AI Solutions Accelerate Business Outcomes for Midsize Financial Institutions

Midsize financial institutions make better decisions when they utilize AI solutions to discover insights in their data. By combining powerful analytics and intelligence services with an experienced data science team, organizations can gain access to an affordable alternative to HyperCloud-based AI solutions. The Aunalytics® Innovation Lab was established to fulfill the need for deep insights, catering to midsize financial services organizations lacking large AI budgets. This highly specialized team of data scientists produces data-driven analytic insights for companies seeking unique predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

To speed insights for financial services customers, the Innovation Lab has developed AI-powered Smart Features. Smart Features are customized to leverage insights obtained from data-driven machine learning models. By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments.

“Demand for intelligence services by financial services organizations is strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

As the financial services industry is one of the top consumers of business intelligence and analytics, these organizations are on the hunt for cutting-edge technology in their mission to identify customer preferences with regard to financial products as well as the need to better understand operational systems and conditions throughout the business. Data platform and predictive analytics solution providers like Aunalytics are the primary enablers behind many next-generation initiatives and are managing the lion’s share of this work for community banks and credit unions by extracting strategic insights, prioritizing market share, expanding products/services, and monitoring key performance indicators (KPIs) to maintain operational excellence. As a result, this has supported community financial institutions to better compete against national banks by strengthening the level of decision making, while empowering white glove service with powerful data analytics.

Aunalytics Managed IT Services Safeguard Local Government Against Disruptive Weather, Cyber, and Pandemic Events

As a primarily rural area, the county is in short supply of experienced technology professionals available to assist with IT management. As a result, the decision was made to contract with a skilled managed IT services provider with regional operations. This has evolved into what is today a strategic relationship with Aunalytics where the IT services and solution provider is integrated both horizontally and vertically to oversee nearly all aspects of the county’s IT operations. This includes oversight of applications, as well as servers, storage, endpoint devices, security, networking, and data protection to ensure business continuity.

This partnership has been particularly beneficial as Logan County has faced a series of challenging events:

- A powerful storm damaged the county’s courthouse, resulting in a complete closure and relocation of court staff and systems. The IT and business recovery experts at Aunalytics helped to set up transitional offices, upgrade servers, desktops and laptops to enable remote access to all required information stores, allowing the court to proceed with operations. Once repairs to the courthouse were complete, relocation support back to the building began and re-orchestration of all IT infrastructure was completed by the Aunalytics’ IT services and support team.

- In early 2021, the Jobs and Family Services Office was also severely damaged after the weight of ice and snow collapsed the roof, necessitating evacuation to a temporary facility. As with the damaged courthouse, the managed IT services team coordinated with a rented facility prior to occupancy and wired the location for operations, minimizing downtime and facilitating the quick re-opening of the temporary office location in order to return services to the community.

- The past 12 months have also seen a recurring stream of cyberattacks, where Aunalytics has defended the county’s sensitive data and systems from downtime. However, in one instance, a server at the sheriff’s headquarters was struck by an attack, resulting in a printer issue. The attack occurred on a Friday when Aunalytics took immediate action and rectified the printer issue over the weekend, returning it to proper operation by Monday morning.

- Adding to the challenges, the COVID-19 pandemic began in March of 2020, causing a number of IT issues as county employees worked remotely, exposing a large number of computing endpoints in the form of laptops, desktops, printers and other network-connected devices outside of the county walls. Aunalytics assisted by improving virtual private network (VPN) services for much higher traffic volumes than usual and managed these systems so that county employees could re-establish their work environments from home where they would be protected against the contagious and, in some cases, deadly virus.

Measuring Success

The county measures the success of its outsourced IT operations by looking at uptime and risk mitigation. Aunalytics has provided an IT services foundation that reduces the number of internal employee hours allocated to IT management and monitoring. Aunalytics enables Logan County staff to work remotely in a much more efficient and reliable manner than otherwise possible. Furthermore, both the security and disaster recovery capabilities implemented have been exceptional, guarding the county against serious downtime for many years.

According to Jack Reser, Auditor of Logan County, “The causes of downtime in a distributed IT infrastructure can be innumerable and the county has definitely had its share of events putting its services at risk. However, Aunalytics has been a reliable IT services partner, quickly responding to our challenges and with expertise that ensures we are returned to the people’s business without delay. Aunalytics has been a steadfast IT partner that we plan to work with closely in 2022 and beyond.”

Learn more about how Aunalytics Managed IT Services have benefitted the Logan County government by downloading the full case study.

Managed IT Services Drive Value for Mid-Sized Businesses

Increased Reliability

Modern businesses run on technology, making the IT department indispensable to daily operations. Unfortunately, outages can and do happen, and when they do, they can be very costly. Gartner estimates that on average, downtime costs companies $5,600 per minute or somewhere between $140K to $540K per hour. Even after an outage is resolved, it requires effort to restore lost data, make required updates, install necessary hardware upgrades, and ultimately get business back on track.

This worst-case scenario can be avoided by working with a managed IT services provider who works around the clock to manage hardware and software and will proactively address issues before they lead to costly outages and downtime.

Aunalytics offers a Secure Managed Services solution that includes 24/7/365 remote monitoring and management to mitigate the risk of your valuable infrastructure going down or becoming unavailable. Our advanced monitoring tool ecosystem allows us to not only respond to equipment that is reporting down in a timely manner, but also to proactively detect system issues and repair them ahead of downtime. Our remote monitoring agent includes client-based interactive support, performance management, alerting, asset management and reporting, while on-site support ensures issues can be resolved quickly at any time of day.

Reduced Security Risk

Ensuring that systems are up-to-date and constantly monitored is just one piece of the equation. Cyberattacks are an increasingly ubiquitous threat for businesses both large and small. In 2021, ransomware attacks increased by almost 105% worldwide, Fortune reports. And these increases are even higher in certain industries—in 2021, governments worldwide saw a 1,885% increase in ransomware attacks, while the health care industry faced a 755% increase, according to the 2022 Cyber Threat Report. In addition, attacks are becoming increasingly malicious and complex. Statista reports that the average duration of the downtime after a ransomware attack had increased from 15 to 20 days between Q1 2020 and Q4 2021.

Just as outages and disruptions due to technical issues can be avoided with proactive maintenance measures, there are steps organizations can take to avoid cyberattacks. McKinsey cites several tactics that have proven successful at mitigating cyberattacks which include: securing remote workstations, multifactor authentication, patch management, disabling user-level command-line capabilities and blocking TCP port 445, protecting Active Directory, and organization-wide education and training.

The in-house IT department of a mid-sized business could implement many of these tactics on its own, but generally these individuals are not data security experts. Knowing how to effectively monitor, manage, detect, prevent, and respond to cyberattacks is a very specialized skillset. Big enterprises have the bandwidth to take on these divisions. The mid-market does not.

By partnering with a managed IT services provider who is entrenched in the latest security best practices and strategies, mid-market companies avoid making costly mistakes and omissions. They can stay well-protected at all times. At Aunalytics, our security expertise includes proactive security services that your business needs to thrive. As threats evolve, your security solutions must adapt. We meet you where you are and guide you on a journey to mature your overall security posture and manage risk.

Increased Operational Efficiency

One of the biggest benefits to partnering with a managed IT services provider is increased operational efficiency. The IT team of a mid-sized business spends most of its time dealing with day-to-day challenges, and they don’t have time to think too far ahead. It can also be difficult for businesses to hire and retain IT talent. Mid-sized businesses increase operational efficiency when they utilize the talents of a managed IT services partner to advise, build, and maintain solutions on the forefront of technological advances. This partnership gives the organization’s internal team the freedom to focus on what they do best.

At Aunalytics, we strongly believe that innovation through technology makes teams more efficient. We are committed to helping organizations digitally transform by guiding and assisting them along every step of the journey. ultimately, allowing them to thrive by working side-by-side with existing teams to drive positive business outcomes through the use of Aunalytics’ technology and solutions.

Aunalytics Managed IT Services

To achieve our mission of helping mid-market businesses thrive, Aunalytics offers a wide range of managed IT and security services. It Aunalytics, we believe security is so vital that our Secure Managed Services solution includes embedded security. We offer everything needed to support the IT needs of mid-sized businesses, including:

- 24/7/365 Remote Monitoring & Management

- Synchronized Network Security Platform

- Internet Protection

- Workstation & Server Patching

- Office 365 Management & Security

- Email Filtering & Security

- Multi-Factor Authentication

- Data & Device Encryption Management

- Security Awareness Training

But at the core of all of our offerings is the team of experts that work side-by-side with clients to meet both their everyday needs and make improvements that will benefit them long-term. For urgent day-to-day issues, the Aunalytics Service Desk is available 24/7/365. Our Service Desk is comprised of knowledgeable technicians and engineers working in tandem to tackle technical issues—both simple and complex—that impact our clients. To keep your business moving forward for the future, we work with your team make improvements to your existing tech stack. With years of experience working with the mid-market, we are confident recommending new technologies and procedures your team may not even realize you need.

The technology and security experts at Aunalytics reduce your risk and increase your efficiency. Gain peace of mind by knowing that our team is there to support your tech initiatives and keep your business up and running and secure.

Why Mid-Market Organizations Need Digital Transformation Solutions that Combine the Right Technology and Talent to Achieve Business Value

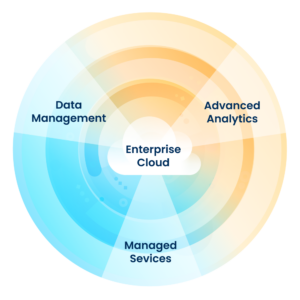

At Aunalytics, we know that an organization’s everyday data holds value, yet is a resource that often remains untapped. This is especially true for the mid-market—this market segment has been underserved and often lacks access to data management and analytics technologies and expertise. Our mission is to empower the mid-market with solutions that enable digital transformation so they can compete and stay relevant.

Digital transformation calls for mid-market companies to shift away from operational silos and work across the company to harness the power of data. This requires the integration of diverse technology across all functional business areas to enable convergence, promote a positive cultural change, drive customer value, and facilitate operational agility. Gartner’s report “Over 100 Data and Analytics Predictions Through 2025” asserts that by 2024, 75% of organizations will have established a centralized data and analytics center of excellence to support federated data and analytics initiatives and prevent enterprise failure. By 2023, organizations with shared companywide data management goals, including stewardship, governance, and semantics to enable inter-enterprise data sharing, will outperform those that don’t.

There is a recipe for successfully transforming massive amounts of corporate and third-party data created and used daily in your lines of business into a valuable asset. But to achieve business outcomes, organizations need to implement digital transformation solutions that include the right technologies/tools combined with the right talent.

The Right Tools and Technology

Mid-market companies generally do not currently have the tools needed to find value in their data through advanced analytics and AI. An enterprise data warehouse is only one piece of the puzzle. Successful mid-market digital transformation requires the appropriate storage and compute infrastructure, data management platform, and analytics software. It can be difficult to piece together each of these components into a single, unified system—it is expensive, time-consuming, and inefficient.

To solve this challenge, Aunalytics has developed a robust, cloud-native data platform built for universal data access, powerful analytics, and AI. Mid-market businesses benefit from using an end-to-end, cloud-based platform as it moves the burden of infrastructure procurement and maintenance to a third-party vendor in the data industry. An end-to-end platform is secure, reliable, and scalable while including the added benefit of being deployed and managed as a service. This is especially important for mid-market businesses because finding the right talent to execute digital transformation initiatives is extremely challenging in the current market.

The Right Talent and Expertise

Most IT departments do not currently have the skill sets needed for getting business value out of data. At the same time, for most mid-market companies, it does not make business sense to hire an entire division of highly compensated data experts to achieve digital transformation goals. Even if a mid-market company can find and hire these scarce resources—they were hard to come by even before the Talent War of 2022.

Aunalytics provides a team of experts who assist every step of the way. Mid-market businesses will have access to the right tools, resources, and support throughout our end-to-end process. Our team also includes industry experts who help businesses identify areas in which data can provide the most value, and guidance on how to work toward achieving these goals.

Aunalytics’ Digital Transformation Solution Gives Mid-Sized Businesses Answers

With Aunalytics, you get the technology and expertise required to complete the journey from data to actionable business results. This combination accelerates digital transformation, which allows businesses to realize the value of their investment quickly. By taking advantage of the experienced data professionals at Aunalytics, organizations can save time and avoid making costly mistakes while also maximizing the value currently hidden in their data.

Daybreak is a Customer Data Platform Encompassing Ingestion to AI for an End-to-End Analytics Solution

Daybreak is an end-to-end data and analytics solution, providing daily insights powered by a robust data platform, financial industry intelligence, and AI-powered insights. In the current market, it can be difficult for midsized financial institutions to hire the technical talent for complex data management and advanced analytics. Aunalytics provides clients with the right tools, resources, and support throughout our end-to-end process. The right foundation is essential for a successful AI, machine learning, and predictive analytics journey.

Watch the video below to see why an end-to-end customer data platform is the ideal solution for community banks and credit unions:

Daybreak allows community banks and credit unions to compete with large financial institutions by…

- Understanding customers,

- Optimizing processes, and

- Revealing actionable insights.

See how Daybreak Customer Intelligence for Financial Institutions is the customer data platform that makes it easier for community banks and credit unions to gain actionable insights and achieve positive business outcomes.

Proactive Security Measures Prevent and Mitigate Cybersecurity Attacks

Does your enterprise’s security stand up to today’s threats? Cyberattacks have increased to higher than ever levels and bad actors are attacking with increasing sophistication. It has been reported that ransomware attacks increased over 90% in 2021, with demands for payment skyrocketing into tens of millions of dollars. In addition, with remote work more prevalent than ever, most businesses now hold some form of sensitive data in the cloud and workers access company data from remote locations. Securing many different locations can be a challenge. Because of these factors, your security infrastructure in place today may still have gaps. Fortunately, proactive security prevents cyberattacks. Therefore, a security operations center (SOC) is the most essential element of modern security. But SOCs are expensive, complicated, and far beyond the reach of most small to midsize enterprises. Plus, security expertise is not easy to recruit and retain internally.

At Aunalytics, we constantly enhance our knowledge to keep up with progressively complex attacks. Aunalytics provides proactive measures for prevention, detection & response by identifying vulnerabilities and threats through a single, unified service. Our data platform examines intel from different sources with the goal of providing insight to your organization needed to best protect your technology environment. Pairing our data platform with the top cybersecurity solutions in the industry gives our clients peace of mind with our complete, holistic approach.

Watch the video below to learn more about Aunalytics Security solutions:

Since proactive security prevents cyberattacks, businesses need access to expert skills in cloud security and data security, which is not standard in mid-market IT departments. That is why our Aunalytics Advanced Security solution includes everything mid-market businesses need to manage risk, including:

- Comprehensive security operations solutions

- Customized security alerting and vulnerability prioritization

- Proprietary, cloud-based security platform

- Continuous vulnerability scanning

- Predictable, consistent pricing

- Threat intelligence and other security data

- Dedicated security engineers X 24×7 detection and response

When your business requires the highest level of security, Aunalytics has you covered. Our security experts stay up to date, so you can focus on your business.

Integrate & Wrangle Siloed Data into a Single Source of Truth with Aunsight Golden Record

With Aunsight Golden Record, you don’t need dedicated resources with deep technical knowledge of code writing, data mapping, and building data models to perform months of mapping projects or build custom APIs. Pre-built smart API plugins easily profile your data and connect your sources to the platform in minutes. With a large library of available plugins, Aunsight Golden Record integrates all of your data sources and third party sources. From data silos to clean, integrated data to golden records of accurate business information.

Watch the video below to learn more about Aunsight Golden Record:

Aunsight Golden Record includes features that automate tasks required to the integrate and wrangle siloed data:

- Data Integration: No custom code or glue code required to use our platform. We’ve done the heavy lifting—just configure and go. Powerful pre-built connectors enable seamless integrations in minutes.

- Data Mapping: Auto-map to all your data sources. No more gruesome mapping projects to move your data. Find the data you are looking for quickly and easily with automatic schema discovery.

- Data Quality: Automated data quality checks, cross system comparisons and data quality notifications help you set and enforce data quality standards. Use data profiling results to set quality checks based upon expected values, ranges and anomalies.

- Data Matching & Merging: Automate de-duplication and relationship discovery of data across all your systems using fuzzy matching algorithms and ML on individual data fields. Combine data in motion in real-time from multiple sources to build and maintain a Golden Record that can be trusted.

- Data Governance: Data flow events are automatically retained and captured to show you where data came from and where it goes—changes made to your data over time are tracked in our audit trail timeline. Build a data catalog or dictionary as a foundation for governance.

- Data Delivery: Replicate your Golden Records of accurate business information forward to data warehouses, data lakes, dashboards or reporting applications. Our bidirectional sync allows you to write the accurate information back to source systems so that your entire organization operates off of the same information.

Our solution provides technology and automation of data integration and wrangling, so you can focus on achieving business outcomes. Click here to learn more about Aunsight Golden Record.

Predictive Customer Insights Drive Positive Business Outcomes for Community Banks and Credit Unions

Daybreak™ Customer Intelligence for Financial Institutions uses data from across your enterprise to reveal actionable, predictive customer insights. As a community bank or credit union, you know that providing white glove service is your competitive differentiator. The ability to anticipate needs not only leads to happy customers and members, but also leads to increases in revenue and reduced costs. But in order to make accurate predictions, you need access to the right data.

We know that transactional data tells a story…if you can interpret it. Reports from banking cores only show you the past. You need to be proactive—predictive customer insights enhance your white glove services so you can compete with larger financial institutions. We also know that smaller financial institutions usually don’t have the technical talent for advanced analytics, machine learning, and AI, or don’t know where to start to become data-driven. As a result, they do not achieve value from technology investments.

At Aunalytics, we believe that it takes the right combination of people and technology to achieve value. Daybreak gives you access to a team of technical experts paired with an end-to-end data platform. Instead of trying to piece together tools and technologies, we build and maintain the solution for you.

Watch the video below to learn more about the benefits of Daybreak’s predictive customer insights:

With Daybreak’s customer intelligence insights, you can:

- anticipate customer and member needs by offering the best product at the right time,

- grow relationships by winning business when your customers have products with competitors,

- reduce risk by predicting likelihood of loan default at the time of application, and recognize who is at risk for crypto-fraud, and more.

Daybreak provides an end-to-end solution, including both technology and expertise, so you can focus on business outcomes. Click here to learn more about the Daybreak solution.

Credit Union Realizes Immediate High Value Impact with Daybreak Advanced Data Analytics Platform

Having experienced an unsuccessful partnership, CFCU now had concrete goals and a higher set of expectations for what it required of a data analytics provider. After researching and vetting many vendors, CFCU choose Aunalytics and its Daybreak™ Advanced Data Analytics Platform. Aunalytics offered a side-by-side partnership model that integrates technology and expertise in one end-to-end solution built for non-technical business users. Aunalytics was also flexible, open, agile, and offered an unmatched level of support.

By implementing Daybreak for Financial Services, the credit union realized immediate high value impact in centralized automated data cleansing, organizing, structuring, consolidating, and aggregating. The credit union was able to gain and leverage daily cleansed data, delivered seamlessly in a dynamic environment without the investment in required cloud infrastructure, software, and people such as data engineers, data scientists, and day to day support. To learn more about how CFCU leverages this data to accomplish high effort projects at greater speed and efficiency download the full case study.

Ransomware Attacks Now Target Community Businesses

If you think that your business will not be a target for ransomware attackers, think again. This is no longer a problem only for large enterprises—now, ransomware attacks target community businesses as well.

The Battle Creek, Michigan community woke up to a May Day attack that forced its Kellogg Community College (KCC) to close all operations. In the middle of preparations for final exams, all five campuses serving approximately 6900 students closed and all operations came to a screaming halt.

The community college posted alerts on its website and social media:

Eric Greene, the Vice President for Strategy, Relations, and Communications at KCC said: “We are still working to understand the full extent of this incident, but as soon as we became aware of it, we immediately assembled a multi-disciplinary team and engaged independent legal counsel and external forensic experts.”

Greene continued, “KCC had backups in place, and we are working systematically with our IT experts to restore our operations.” But even though KCC had backups, “As a precautionary measure, all campuses have been disconnected and our systems will remain offline until they are deemed secure by our IT experts. As a result, our students and staff might experience delays accessing our services, including campus emails, online classes, and resources,” Greene said.

Back-ups alone are not sufficient to prevent business disruption when a ransomware attack hits. Preventing the attack, rather than having to respond to it, is key. KCC remained closed for three days while IT scrambled. All computer access to university systems had to be shut down in an attempt to stop further damage. The response and mitigation included a forced password reset for all students, faculty and staff, and adding multi-factor authentication (MFA) for all users.

Enable Multi-factor Authentication

MFA is an important security measure when people access systems remotely. It provides an extra level of verification to make sure that the user attempting to access the system is really an authorized user and not a bad actor trying to get in. Modern business regularly includes employees logging in from home, travel and mobile devices to access data and systems from their organization. As such, the old firewall security perimeter around your place of business does not protect you. Modern security requires focus on users and access. MFA is something that is easy to add to your security stack. The protection benefit from MFA far outweighs the resource cost of installing and using the technology. Really, there is no excuse for not having MFA in today’s threat landscape. It is standard.

So if you do nothing else this year to improve your security posture, add MFA. But considering that community businesses are becoming targets for cybercrimes, unless you can afford a complete shut-down of your business, it is becoming a must to have modern security technologies (including robust monitoring so that you are equipped to prevent attacks and are better positioned to respond and mitigate), in addition to back-up and disaster recovery plans.

Shift Applications to the Cloud

Mid-market businesses are shifting security and data center responsibilities from on premise servers and security maintained by their IT department, to partnering with cloud experts who run data centers, keeping client systems stable and secure as their full time business. The trend with line of business applications used by your team for daily operations is cloud. As more and more community businesses use cloud based apps for functions like accounting, customer portals, ERP, CRM and HR, having cloud experts with the tools and the skills to be able to secure your organization’s data (from multiple sources) for safe use by remote users makes more sense than trying to build a security fortress yourself at your place of business.

Partner with Experts

If cybersecurity is not your main line of business, partner with security experts unless you want cybersecurity to become your main line of business. It will consume your resources to stay current with emerging threats, protective means, 24/7/365 monitoring, best practices and constantly evolving security measures. The ever increasing sophistication and volume of attacks has shifted the answer to the “buy it or build it” question for this critical business service from the solution being your in-house IT department to the solution requiring managed security services to supplement your in-house IT team.

Don’t become the next ransomware attack headline. Community businesses can take steps to avoid ransomware attacks. An ounce of prevention, after all, is less costly than the cost of operational shut-down, PR scramble, customer service disruption, brand reputation tarnishment, and emergency security consultant fees paid when you are in the middle of an attack that succeeded.