Microsoft will be ending patch support for Windows 10—what does that mean for you?

Preparations to end patch support for Windows 10, and eventually end of support entirely, have been in process for quite some time on Microsoft’s part. As far back as 2021, in an article by The Verge which talks about the then upcoming Windows 11, the author commented on the end of support date for Windows 10. The current version of Windows 10, 22H2, will be the final version of Windows 10, and all editions will continue to receive monthly security update releases through the end of support on October 14, 2025. This information applies to all of the following editions of Windows 10: Home, Pro, Pro Education, and Pro for Workstations

With the end of patch support for Windows 10, vulnerabilities will begin to appear, leaving your network more exposed than ever. The number of bad actors encrypting and stealing data can be overwhelming on the best of days and can cause massive issues and downtime for your company. Any hole in your cyber security could spell disaster for your company.

While it may seem like you have plenty of time to prepare, deadlines can quietly slip by, leaving your network and machines suddenly vulnerable because they are no longer receiving support or security patches. The rate of ransomware attacks remains high, with 66% of respondents across all industries indicating they had been hacked within the last year, says Sophos in their State of Ransomware 2023 report.

With a total of 36% respondents, Sophos also reported exploited vulnerabilities as the number one root cause of ransomware attacks within the last year. Knowing that 66% of companies surveyed in the last year were attacked by malicious actors, the number of ransomware attacks with the root cause of exploited vulnerabilities is quite large.

It’s hard to admit that your network may become unsafe at any point in time, but it’s necessary if you want to be prepared for when your Windows 10 network will no longer be supported. If you can keep track of those important dates, your cyber security should be on the right track. However, it can be a huge undertaking to efficiently manage patching or replace workstations in a timely manner.

With the right partner, you can stop worrying about missing important updates, especially as the end of patch support for Windows 10 is nearing. Aunalytics has a team of security experts, as well as technical support, with the ability to act as your Network Operations Center (NOC). Aunalytics also offers Co-Managed Patching-as-a-Service and many other ways to support the technology that keeps your business up and running. With the support of an experienced Managed IT Services partner, you can rest easy knowing that your cyber security is working hard to keep your data and network safe.

2023 IBA/OBL Annual Convention

2023 IBA/OBL Annual Convention

Fairmont Chicago - Millennium Park, Chicago, IL

Ryan Wilson of Aunalytics Speaking at 2023 IBA/OBL Annual Convention

Aunalytics is pleased to announce that Ryan Wilson, VP, Client Relationships at Aunalytics, was chosen to present at the 2023 IBA/OBL Annual Convention in Chicago, IL. His presentation is entitled, “How to Win Wallet Share while Cutting Costs in Operations”. This presentation will examine how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. He will also share how Aunalytics empowers banks through our Daybreak™ for Financial Services solution, which enables community banks to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

Why You Should Include an Analytics Platform in your Banking Software Arsenal

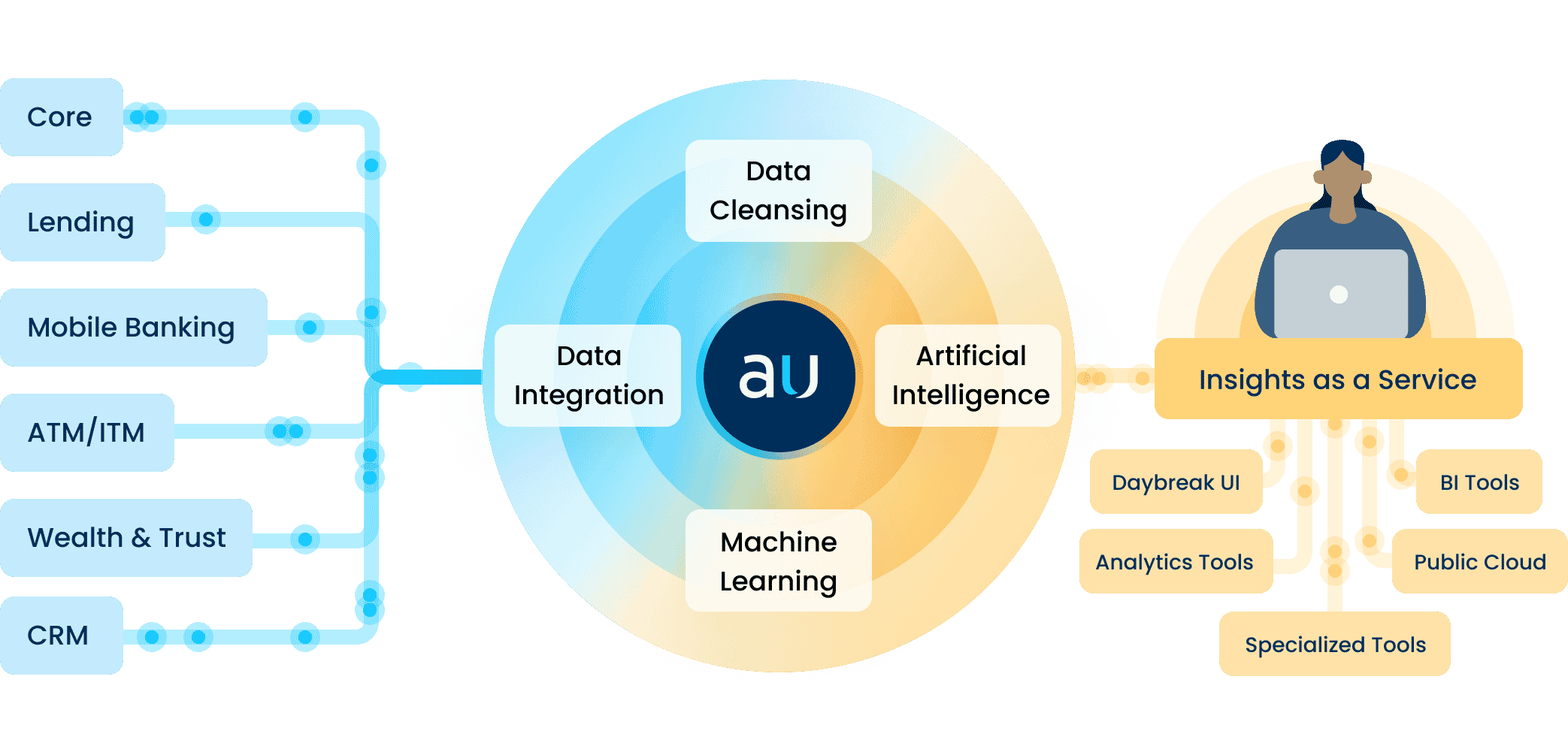

Banking software is vital to the success of all financial institutions. With an increasing focus on digital transformation, banks and credit unions amass a collection of platforms and software systems. Financial institutions not only rely on their banking core, but also CRM systems, online and mobile banking applications, loan management software, payment processing systems, and wealth management, risk, and compliance software, to name a few. Not only do these systems make banking more efficient, but they are collecting data that can be used to improve the business itself.

How can financial institutions best utilize their existing data? Thanks to their existing banking software, every institution holds valuable information about each customer or member that can be used to increase their lifetime value. PWC estimates that banks can generate a 70% return on initiatives targeting existing customers versus 10% when targeting new customers. Therefore, one of the best ways to use data to achieve better returns and higher margins is to focus on improving the customer or member experience.

Having access to an abundance of data points across various systems presents a tremendous opportunity to strengthen existing relationships—but it also poses a challenge. While each banking software system includes valuable information, it does not give the whole story. The problem for many institutions is that they have no way of getting a complete, 360-degree view of each individual from disparate software systems.

The Importance of an Analytics Platform

That is why a data and analytics platform is essential. An analytics platform can aggregate data from multiple systems, cleanse and organize that data into a 360-degree customer view, then apply artificial intelligence (AI) and machine learning algorithms to gain data-driven insights.

Once an analytics platform has been implemented, there are many customer intelligence use cases that can help banks and credit unions target the right customers, with the right offer, at the right time, including:

- Gaining transaction insights – Gaining access to transaction data, paired with AI and machine learning, gives great insights into consumer spending habits and preferences.

- Identifying competitor payments – By mining transactional data, financial institutions can discover customer payments going to competitors, then use that information to reach out to customers or members and win back business with a more attractive offer.

- Generating product recommendations – With access to data points from several software systems, machine learning and AI models can make predictions such as the next best product to offer for each customer.

- Predicting churn – AI algorithms identify trends in transactional data, and determine which customers are most likely to churn—so financial institutions can take actions to prevent it.

- Calculating Customer Lifetime Value – An analytics platform can calculate customer value scores based on a large number of relevant data points using AI and machine learning. Banks and credit unions can use this information to allocate resources toward targeting customers with higher customer lifetime value scores.

These are just a few of the ways banks and credit unions can implement insights from a data and analytics platform that mines data from across their organization’s many software systems. Once the platform is implemented, any number of use cases can be developed using AI and machine learning—getting the data collected, aggregated, updated, cleansed, and organized for analytics is one of the largest obstacles for organizations.

Thankfully, Aunalytics has developed a robust data and analytics platform called Daybreak for Financial Services. Daybreak provides all of these services and more to make sure your bank or credit union is making the most of its banking software data to reduce risk, optimize processes, increase revenue, and most importantly, improve the customer or member experience.