How State and Local Governments Can Use Technology to Overcome Economic Challenges

How State and Local Governments Can Use Technology to Overcome Economic Challenges

At present, state and local governments are confronted with significant challenges stemming from the current state of the economy. This includes a decrease in tax revenues, sustained high inflation, and a shortage of proficient IT personnel, who are vital to their day-to-day operations. Industry experts consider technology as an effective solution to address inadequacies during challenging economic periods.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Security Maturity Improvement is Imperative as Cyberattack Risks Remain High

Security Maturity Improvement is Imperative as Cyberattack Risks Remain High

While advancing technology offers significant benefits, it has also made it easier for those who seek to gain an advantage by exploiting others. An attack can be devastating for any business and impact it for many years to come—today’s organizations need to move toward security maturity by utilizing multiple lines of defense against cybercrime.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Overcome Hiring and Talent Challenges to Get Ahead of the Competition in 2023

Overcome Hiring and Talent Challenges to Get Ahead of the Competition in 2023

Hiring and retaining staff is going to be the most difficult task facing CFOs for much of 2023. This is particularly true for IT departments. In today’s economy, highly skilled IT and data experts are a scarce and expensive resource. The mid-market organization requires another option that provides access to the right tools, resources, and support.

Fill out the form below to receive a link to the article.

Learn More

Banking Institutions Are Behind in AI Maturity—Catch Up or Others Will Eat Your Lunch

Banking Institutions Are Behind in AI Maturity—Catch Up or Others Will Eat Your Lunch

Financial institutions must embrace the use of data analytics powered by artificial intelligence for operational efficiency, risk reduction, revenue growth, and improved customer experience. Yet, it’s clear that financial companies that fail to pick up the pace, moving ahead to the next phase of AI deployment, are in danger of falling far behind. Luckily, there is a clear-cut solution to reaching AI maturity and achieving sustained, long-term success.

Fill out the form below to receive a link to the article.

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Fill out the form below to receive a link to the article.

Cyber Insurance Continues to Skyrocket—Do You Have a Security Strategy in Place?

Cyber Insurance Continues to Skyrocket—Do You Have a Documentable Security Strategy in Place to Show You’re Prepared?

Cyber risk is a growing critical concern for organizations of all sizes and public entities globally, as we continue to rely on information technology and digital devices. But in the wake of steadily rising digital threats, cyber insurance is getting increasingly expensive—and difficult—for companies to procure.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

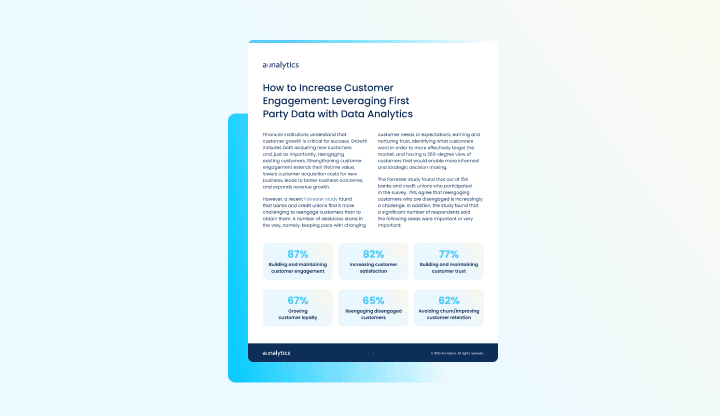

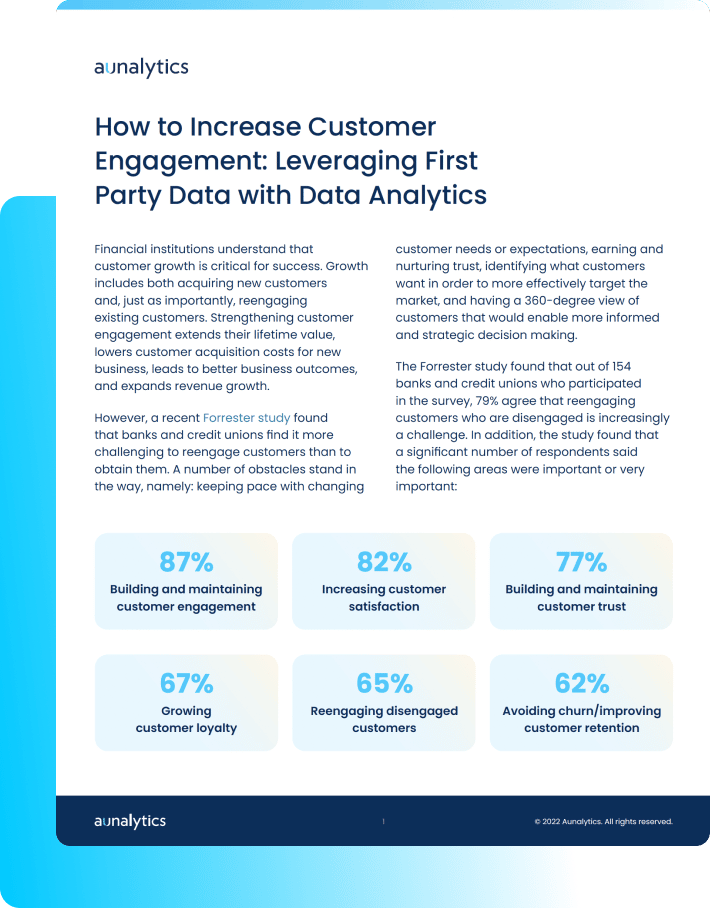

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Does Your Mid-Market Firm Have the Right Talent to Maximize Its Data Tech Investments?

Does Your Mid-Market Firm Have the Right Talent to Maximize Its Data Tech Investments?

Investing in digital transformation technologies can be a waste of money if your company forgets one important point. That point is, no matter how cutting edge the tech or tool may be, people are needed with specific technical expertise in order to derive true business value from these investments.

Unlike large enterprises, mid-market companies often try to find this expertise in their IT manager, hoping a jack-of-all-trades approach will take care of it. This is an unfortunate mistake, since it would require the IT manager to have unusual command over a long laundry list of duties, from data integration, ingestion, and preparation to data security, regulatory compliance, data science, and building pipelines of data ready for executive reporting from multiple cloud and on-premises environments. This is not just a tall order for a mid-market IT manager to pull off, but likely an impossible one.

To read more, please fill out the form below:

Featured Content

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

In a recession economy, it is imperative to cut costs and employ efficient strategies to grow operating income. Here’s what banking institutions can do to make marketing and sales teams more efficient, and achieve better returns.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Bridging the Mid-Market Talent Gap for Digital Transformation

Bridging the Mid-Market Talent Gap for Digital Transformation

To achieve business value from data technology investments, mid-market companies need the right technical expertise and talent. Yet many mid-market firms push this onto their IT manager, assuming that since it is technology related, IT has it. This is a mistake because most IT departments do not have time for data analytics. They are busy full time keeping company systems stable and secure, and providing support to your team members. This by necessity results in IT deprioritizing data queries over crucial cybersecurity attack prevention. Business analysts and executives get frustrated waiting for data query results, and the data is stale or the business opportunity has passed by the time query results are in.

But even if your IT team had time for it, it still is a mistake to rely on traditional technology administrators for data analytics success. This is unless your IT department has expertise across a wide range of skill sets, from cloud architecture, database engineering, master data management, data quality, data profiling, and data cleansing. What’s more, your IT manager would need to have command over data integration, data ingestion, data preparation, data security, regulatory compliance, data science, and building pipelines of data ready for executive reporting from multiple cloud and on premises environments.

When you read this laundry list of needs, it becomes clear that most mid-market IT departments lack the specialized experts needed to derive business value from their data. Unlike larger enterprises that have the resources to hire skilled staff for these roles, the mid midsize organization requires another option that provides access to the right tools, resources, and support. One that integrates, enriches and is trained in utilizing AI, machine learning, and predictive analytics to achieve more useful results.