Aunalytics Selected as Nominee for Tech Company of the Year at the 2024 Mira Awards, Presented by TechPoint of Indiana

South Bend, IN (February 26, 2024) – Aunalytics, a South Bend based technology company announced today that it has been selected as one of four nominees for Indiana Tech Company of the Year at the 2024 Mira Awards.

“Aunalytics is proud of this nomination and the work by our team to be recognized in this way. We believe the fusion of artificial intelligence and advanced IT are bringing about a seismic transformation within the business landscape, and those traditional businesses like banks, healthcare providers and manufacturers located in secondary markets where technological resources are scarce face a disproportionate challenge” stated Rich Carlton, President of Aunalytics.

“This recognition of the execution of our mission—to be the advanced computing infrastructure and primary advisors, powering analytics and IT innovation to traditional businesses—is greatly appreciated” concluded Carlton.

The Mira Awards, hosted by TechPoint, an organization headquartered in Indianapolis, annually recognizes outstanding achievements in the technology sector in Indiana. Over the span of 25 years, these awards have served as a platform to celebrate the advancements made by the tech community, offering a valuable opportunity for innovators statewide to convene, network, and recognize excellence in digital innovation.

“We look forward to celebrating the 25th anniversary of Indiana’s most prestigious tech and innovation awards at a new venue,” said TechPoint President and CEO Ting Gootee. “Even more exciting is the level of excellence, innovation and resilience outlined in each entry and even more so by those whose efforts elevated them to status as a Mira Award nominee. It is truly Indiana’s biggest night for innovation.”

Next month, Aunalytics, along with the other nominees, will be interviewed by panels consisting of founders, executives, community leaders, and subject matter experts. The winners will be announced at the TechPoint Mira Awards gala Friday, April 26, 2024, at the Old National Centre in Indianapolis.

The other nominees for Tech Company of the Year include Authenticx, an Indianapolis-based AI company in the healthcare space, Baker Hill, a financial services software provider based out of Carmel, IN, and Republic Airways, a Carmel-based regional airline.

About Aunalytics

Aunalytics revolutionizes the way businesses harness the power of data and IT to mold their strategic and operational decisions. Aunalytics offers services across the entire spectrum of transformation from cloud infrastructure and IT services to advanced analytics and AI. Understanding that businesses in traditional industries don’t just need tools, Aunalytics stands apart by going beyond software and hardware—providing the guidance and expertise to navigate the complexities of adopting innovation.

Each business is unique—Aunalytics offers a holistic solution that empowers legacy organizations to embrace innovation with confidence by seamlessly integrating technology with strategic analysis, counsel, and hands-on management rooted in years of experience. Aunalytics provides the tools to not only survive but to thrive in the data-driven future, enabling businesses to pioneer innovation while retaining their essence.

How State and Local Governments Can Use Technology to Overcome Economic Challenges

How State and Local Governments Can Use Technology to Overcome Economic Challenges

At present, state and local governments are confronted with significant challenges stemming from the current state of the economy. This includes a decrease in tax revenues, sustained high inflation, and a shortage of proficient IT personnel, who are vital to their day-to-day operations. Industry experts consider technology as an effective solution to address inadequacies during challenging economic periods.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Aunalytics Dashboards Deliver Insights and Actionable Business Opportunities to Mid-Market Banks and Credit Unions to Achieve Greater Visibility into Data, Strengthen Regional Market Position, and Compete More Effectively

Dashboards Augment Capabilities of Aunalytics Daybreak for Financial Services Cloud-Native Data Platform to Drive Customer Intelligence and Higher Strategic Value

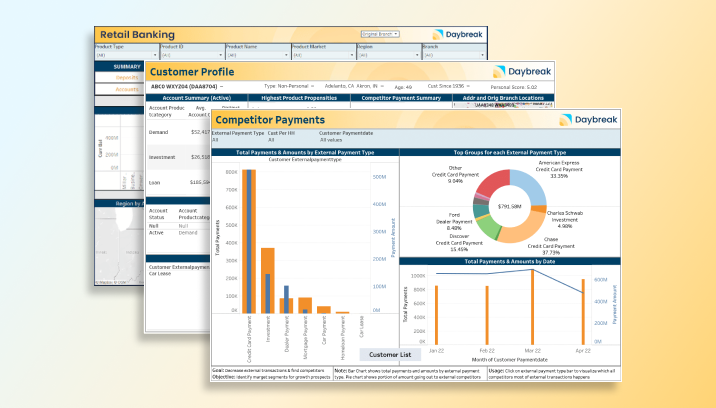

South Bend, IN (July 12, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today a new set of pre-built dashboards that augment the value delivered by the company’s DaybreakTM for Financial Services solution. The Daybreak dashboards are designed to deliver insights and actionable business results by revealing opportunities associated with customer, competitive, marketing, lending, and branch data and automatically presenting the data in a way that is easily understood, without any manual processes required.

Customer intelligence and personalized marketing in a digital world matters more than ever before, especially for mid-market banks that have traditionally relied on hometown, white glove service to win customers. With Aunalytics Daybreak for Financial Services, midsize financial institutions can target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. With the new Daybreak dashboards, mid-market banks and credit unions can achieve greater visibility into their data and identify more opportunities to strengthen their position in regional markets and compete more effectively.

The Daybreak for Financial Services cloud-native data platform integrates and cleanses data for accuracy and mines transactional data daily with AI-powered algorithms for customer intelligence and timely actionable insights that drive strategic value.

New Daybreak Dashboards include:

Customer Profile - This dashboard delivers an enriched profile of individual customers, powered by AI- insights that deliver intelligence on future customer growth beyond mere aggregations and reports of the past. The Customer Profile offers a 360-view of each customer including analysis of data integrated from multiple sources across the organization, and mined daily for timely fresh insights that can be acted upon. Banks can identify accounts that a customer has with competitors in order to make a more attractive offer to win their business and grow customer value. They can also determine the next best product offering for customers today, based upon their transactional behavior, and gain a deeper understanding of customers and the branches they use, beyond the origination branch.

Competitor Payments - Competitor Payments reveals insights for each customer, each competitor, and type of financial product. The dashboard tracks competitor payments by amount and how long they have been taking place so that a banker or credit union can determine when customers or members are likely to look for a new product, then create better offers as a result. Competitor Payments can drill down on credit cards, mortgages, auto loans, and investment products to identify a more competitive offer and use the segmented Customer List dashboard to target them. By using targeted competitive offers made to the right customers at the right time, banks can efficiently grow value from customers to increase net deposits.

Retail KPI - Retail KPI (key performance indicators) help banks to increase total deposits and accounts, and identify growth opportunities and potential. The dashboard delivers key performance metrics to retail leaders to understand the drivers of their account and deposit growth. It enables them to analyze deposits and balances over time and understand growth trends. It also provides data for overall institution performance, as well as detailed performance for each region, branch, market, product type and individual product to identify opportunities for growth and understand which branches are driving change.

Lending KPI - The Lending KPI dashboard delivers key performance metrics to lending leaders to understand the drivers of their loan and loan balance growth. It enables them to view trends over time for original loan amounts and outstanding loan balances. The dashboard provides data for overall institution lending performance and detailed performance of lending by branch, region, market, product type, and each product to uncover opportunities for growth and understand which products, team members, and branches are driving growth. The accompanying Lending Officer dashboard reveals performance insights by team member and shows loans closed and principle amounts over time.

Marketing KPI - This dashboard delivers key performance metrics to marketing leaders on campaign effectiveness to improve targeting and reduce account acquisition cost. It enables banks to target their institution’s marketing to reach the right customer at the right time with the right offer, making marketing operations more efficient and successful by using a data driven approach. Capabilities include:

- Track campaign performance by resulting deposits and new accounts

- Understand customer acquisition cost by region, branch and product type

- Assess account and balance growth by region, branch, and product type

- Understand new account demographics

Branch Reassignment - The Branch Reassignment dashboard delivers key information to business leaders to understand branch utilization and change over time based on where a customer originates and performs business. They can identify branch growth opportunities and areas where efficiencies can be improved, and view branch utilization to see customer banking patterns. With this, banks can determine which products to market at a particular branch and more precisely target those customers who are likely to need that product.

“Daybreak dashboards offer more than just reporting on the past. They connect the dots of relevant data and use predictive analytics to create a picture revealing intelligent insights that help financial institutions build smarter business strategies,” said Kyle Davis, Vice President of Daybreak, Aunalytics. “Designed to accelerate the value derived from AI-powered insights, Daybreak dashboards enable mid-market banks and credit unions to more clearly see the opportunities presented by their data and take action to increase net income and advance their competitive position.”

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Aunalytics Powers Data Insights and Positive Outcomes for Horizon Bank Customers

Aunalytics Powers Data Insights and Positive Outcomes for Horizon Bank Customers

Community Bank Takes Strategy-First Approach to Streamline Customer Intelligence and Business Operations

Fill out the form below to receive an email with a link to the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Communication Federal Credit Union Leverages Data to Drive Higher Business Value with Aunalytics Daybreak for Financial Services

Communication Federal Credit Union Leverages Data to Drive Higher Business Value with Aunalytics Daybreak for Financial Services

Advanced Data Analytics Platform, Coupled with a Dedicated Side by Side Model, Accelerates Member-centric Decision Making

Fill out the form below to receive an email with a link to the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Citizens Federal Simplifies IT with Managed Services by Aunalytics

Citizens Federal Simplifies IT with Managed Services by Aunalytics

Ohio Savings & Loan Automates and Improves IT Efficiency with

Comprehensive Managed Services Suite by Regional Technology Leader

Fill out the form below to receive the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Cybersecurity Controls Checklist

Cybersecurity Controls Checklist

Cybersecurity standards are constantly evolving as cyberattacks get increasingly complex. The following checklist from the Center for Internet Security (CIS) will allow your organization to evaluate whether the correct controls and safeguards are in place to meet global cybersecurity standards.

Fill out the form below to receive the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Managed Services is an IT Workforce Multiplier for Paulding Putnam Electric Cooperative (PPEC)

Managed Services is an IT Workforce Multiplier for Paulding Putnam Electric Cooperative (PPEC)

Aunalytics Brings Professional IT Infrastructure Services Team

to Support Operations Throughout Electric Utility

Fill out the form below to receive the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Cybersecurity Drives Insurance Crack Down

Cybersecurity Drives Insurance Crack Down: Be Prepared to Document Your Security Posture

A common question for cyber insurance brokers in the last few years has been “If I implement this cyber security control, will I get a discount on my insurance premium?” The answer has been typically “no.” But these days, the answer has changed to “no, you won’t get a premium discount. And if you don’t implement that security control, you might not even get insurance.”