Blog

October 4, 2024

As increasingly sophisticated cyber threats pose risks to companies of all sizes, understanding how to prevent cyberattacks and implement good safety practices is important for any organization...

September 5, 2024

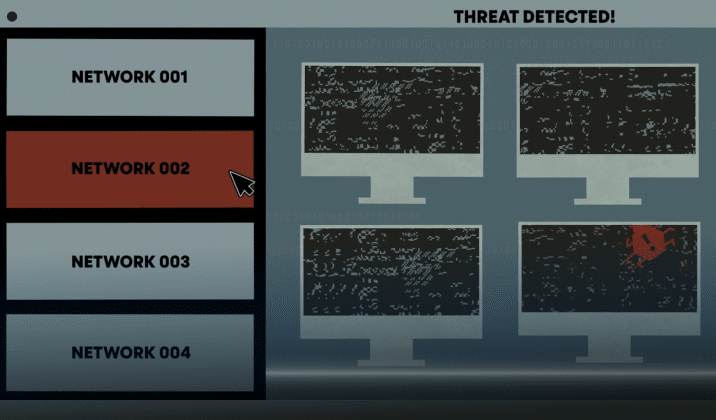

The increasing reliance on digital technologies has led to the increased frequency of security breaches. Recent incidents have highlighted vulnerabilities across several industries, emphasizing the importance of robust cybersecurity measures. Here, we examine some notable security breaches that have recently made headlines, detailing the “how” and the responses taken to mitigate future risks.

August 7, 2024

In the world of financial services, staying ahead of competition means embracing analytics trends that enhance customer experiences and operational efficiency. As technology continues to reshape the industry, financial institutions are turning to advanced analytics solutions to gain insights on customer behaviors.

July 16, 2024

In today’s digital landscape, where cyberthreats pose a significant threat and unforeseen disasters can strike at any moment, ensuring the security and integrity of your data is crucial. But what exactly is an immutable backup, and why is it so important?

September 29, 2023

Personal, white glove service has always been a competitive advantage for community banks and credit unions. Therefore, a customer-centric mindset is vital. While a customer may be just another number...

August 22, 2023

Cybercrime is no longer an inconvenience for an unlucky few—rather, it has far-reaching implications for the global economy, as well as national security...

August 4, 2023

Ransomware attacks are not simply a nuisance—a single attack can affect thousands of computers and servers, cost companies huge sums of money, or prevent businesses from operating altogether. And it's not just large corporations that are at risk. Governments, universities, police forces, healthcare organizations, and even small businesses are brought to their knees by cybercrime. Anyone can be a victim—it can be as simple as one person clicking on a malicious link in an email...

July 21, 2023

How well do you know ransomware? Security hacks and ransomware attacks are constantly in the news. In fact, in June 2023, a zero-day vulnerability in Progress Software’s MOVEit Transfer managed file transfer (MFT) product affected over 130 organizations and millions of individuals. And that is only the latest in a constant stream of cybercrime...

July 7, 2023

The growth rates of cloud-based IT solutions in the areas of analytics and artificial intelligence have been substantial in recent years. The increasing volume of data and the need for faster, more accurate insights have driven organizations to adopt cloud-based analytics solutions at a rapid pace...

June 21, 2023

With recent uncertainty in the economy and bank closures hitting the news this year, you may be scrambling to find ways to increase deposits to protect your institution. But a larger, more urgent risk has always been lurking. With over half of financial institutions reporting cyber attacks in a single year, your organization may be next...