VMUG Indianapolis UserCon 2023

VMUG Indianapolis UserCon 2023

The Westin Indianapolis, Indianapolis, IN

Aunalytics to Attend VMUG User Group Indianapolis as a Bronze Sponsor

Aunalytics is excited to attend the VMWare User Group’s 2023 UserCon – Indianapolis. Aunalytics is participating as a Bronze sponsor and our team is excited to connect with fellow IT professionals to discuss digital transformation and innovation in the technology field.

Financial Institution Cyber Attacks Are on the Rise—Your Institution Is Not Immune

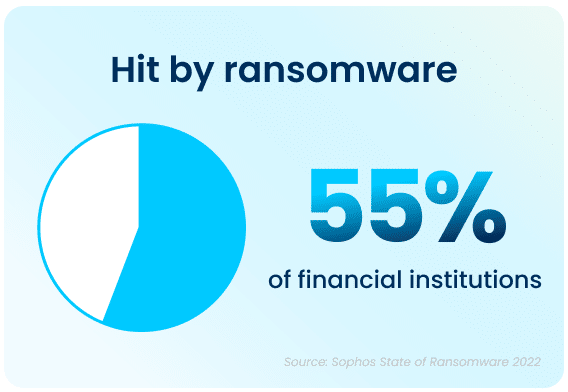

With recent uncertainty in the economy and bank closures hitting the news this year, you may be scrambling to find ways to increase deposits to protect your institution. But a larger, more urgent risk has always been lurking. With over half of financial institutions reporting cyber attacks in a single year, your organization may be next.

Nearly every day we learn of new horror stories from financial institutions who were the victims of elaborate attacks—in fact, 55% reported being a victim of a cyber-attack in a single year.

Bad actors are becoming more sophisticated in their methods. These prevalent attacks have high costs to your business uptime and productivity. A bad attack can also damage your reputation due to closure and data loss, while still costing your bank or credit union large sums of money to pay off ransoms—and you may not even get all of your data back.

Financial institutions hit by cyber-attacks pay, on average, $272,655 in ransom payments. And the average overall cost to remediate the ransomware attack in this sector is $1.59 million.

Do you know where your data lives?

Where you store your data matters, and your storage location may not be optimal for disaster recovery. Storing your backups locally, even if located at another of your facilities, may not protect your data from unknown risks.

In-house servers require large capital expenditures, and you miss out on economies of scale for regular upkeep and maintenance. Giant vendors may seem convenient, but you won’t know exactly where your data resides, and you lose control over the environment.

There’s a better way—Aunalytics backup and disaster recovery solutions can help you avoid losing data or paying large ransoms. We offer concierge solutions tailored to community banks and credit unions—helping you stay steps ahead of increasingly malicious attackers.

Backup and disaster recovery solutions enable the continuous operations of an organization during a disaster event, whether it involves a set of networks or servers, or when all primary IT services have become unavailable. Our solutions leverage the power of data, analytics, and Machine Learning. Disaster Recovery Services, coupled with a comprehensive backup and archival strategy, allow you to remain confident that you are prepared should your business encounter a disaster event.

Study Reveals that Aunalytics Banking and Credit Union Clients Achieve Nearly 400% ROI Opportunity in One Year

Study Reveals that Aunalytics Banking and Credit Union Clients Achieve Nearly 400% ROI Opportunity in One Year

The Aunalytics Daybreak™ for Financial Services data analytics solution provides customer intelligence to financial institutions. It delivers insights-as-a-service, including AI-powered predictive analytics models that can be applied to transactional data for fresh insights delivered daily. Early study results reveal that using Daybreak, Aunalytics’ clients achieved nearly 400% ROI in one year to grow new business from existing customers.

Investment in Artificial Intelligence is Vital for Banks and Credit Unions

Has your bank or credit union made investments in artificial intelligence yet?

Advances in artificial intelligence (AI), and the promise it holds for the future, have been making news all year. And it’s no wonder that financial institutions are taking notice—a recent survey from the Economist Intelligence Unit found that 77% of bankers believe that unlocking value from AI will be the differentiator between winning and losing banks. Yet, many institutions are falling behind in AI maturity.

Despite its promise, making a large investment in artificial intelligence may seem risky to many midsized financial institutions. Hiring talent, developing a data management and analytics strategy, building a data platform, and creating AI models can be both time- and resource-intensive. Banks and credit unions want to ensure that the efforts spent to get an AI program off the ground will yield a high ROI, especially in times of economic uncertainty. Yet, failure to innovate and make progress toward digital transformation is not always an option in the highly competitive landscape.

Financial institutions find many uses for AI technologies

Thankfully, an investment in artificial intelligence can improve many processes across an institution. AI can optimize both time- and resource-intensive tasks, decrease risk, and increase revenue by improving the customer experience. For instance, by applying AI and machine learning algorithms to transactional data, banks and credit unions can gain insights into customers or members’ habits and preferences. Some use cases include:

- Detecting and preventing fraud

- Identifying loan default risk at the time of application

- Predicting customer churn

- Winning back business by discovering customer payments going to competitors, and subsequently making a more attractive offer

- Predicting the next best product for each customer then targeting them with the right product at the right time

- Calculating customer value scores in order to better allocate resources to target more valuable customers

Don’t get left behind

Large banks are already utilizing artificial intelligence use cases at scale. In a recent letter to shareholders, Jamie Dimon, Chief Executive Officer of JPMorgan Chase wrote, “Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success—the importance of implementing new technologies simply cannot be overstated.”

Because of this focus, his company has made tremendous investments in AI. They currently have over 300 AI use cases in production, and employ almost 3,000 people in data management, data science, and AI-research-related roles. This underscores how vital these new technologies are to success in the future.

Unfortunately, not every institution has access to talent and technology at the scale of JPMorgan Chase. That’s why Aunaytics has developed a cloud-based data and analytics platform to provide data management, advanced reporting, and predictive AI and machine learning solutions for midsized community banks and credit unions.

Daybreak for Financial Services allows institutions to learn more about their customers and members in order to provide a better overall experience—which in turn reduces risk, increases wallet share, and reduces expenses.