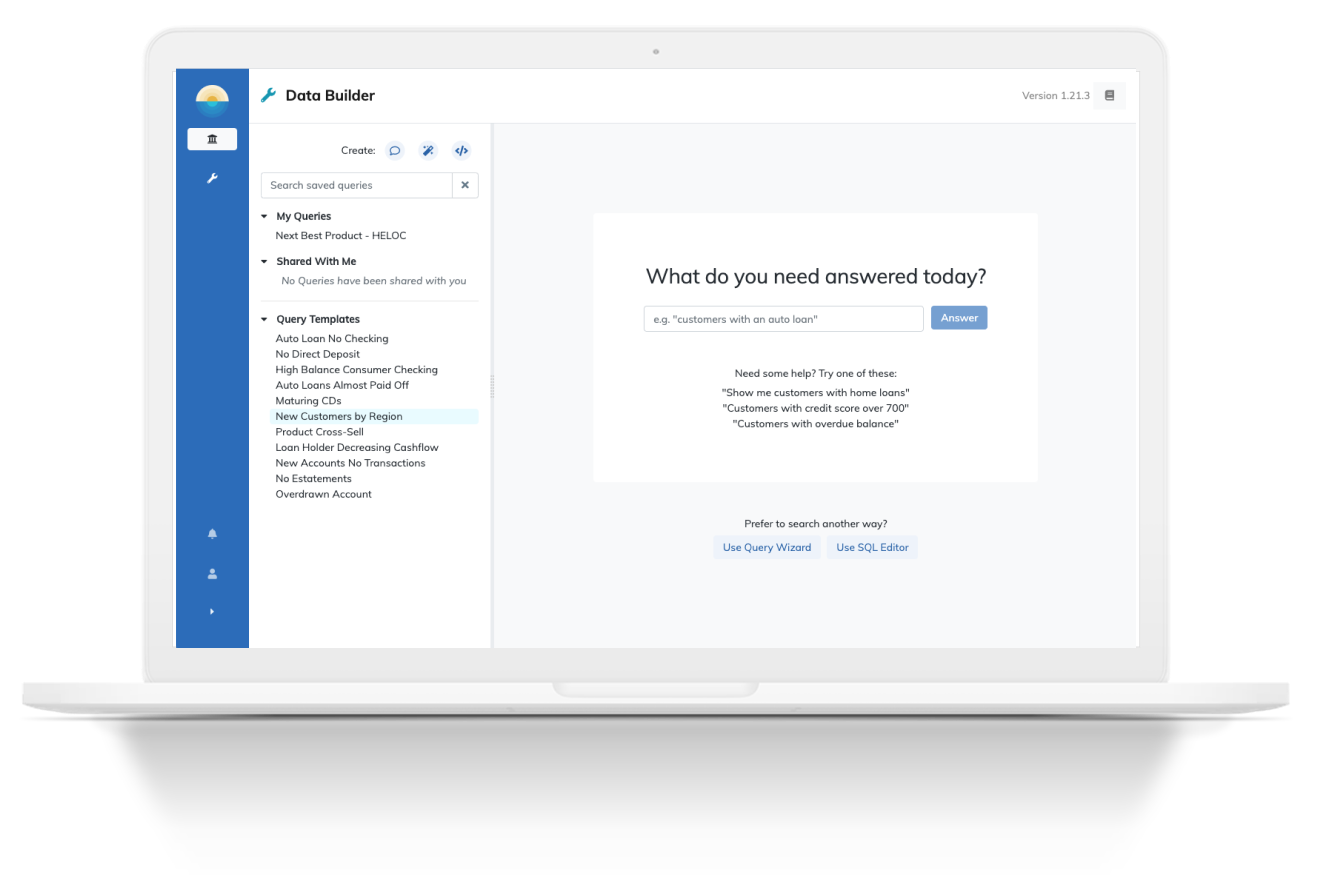

What are Natural Language Answers?

Imagine the ability to get answers from the data in your organization by simply asking a question like “how many residential accounts opened last month,” “give me a list of all accounts 90-days overdue,” or “products with monthly sales volume over 1,000 units.” Over the past few decades, advances in machine learning have made it easy to get answers from search engines like Google using natural language questions. Consumers can easily search for products and services by entering phrases like “Find mortgage lenders near me” or “grocery stores within five miles.”

At Aunalytics, we understand that the competitive edge in today’s business environment depends on data-driven decisions based on a dependable and accurate datamart. To that end, we have built the Daybreak™ analytical database to provide a relational data model of industry focused data points that deliver maximum value to businesses in a specific industry like financial services, healthcare billing, or retail.

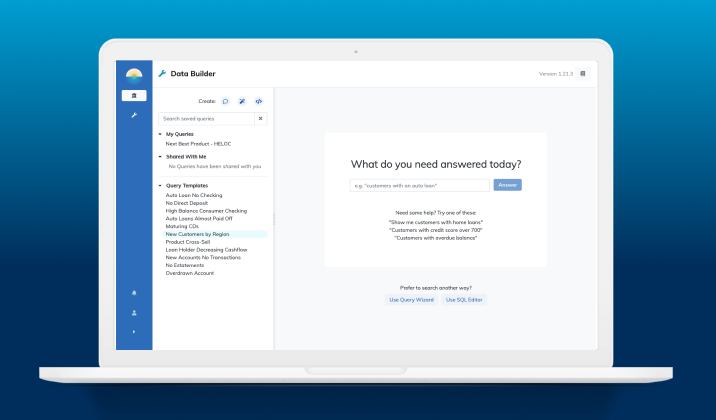

Daybreak Natural Language Answers™ extends the power of this data to all members your business. Natural Language Answers is a machine learning solution that turns finding answers to industry specific business questions into a Google-like experience for your datamart. Finding answers is easy using natural language search phrases. Just ask a question and our machine learning models will translate your question into a structured query and return results that you can download as CSV files, or visualize as bar charts, line charts, or other graphs in the Insights dashboard within the Daybreak app.

Natural Language Answers brings the revolutionary power of search that consumers have had access to since the birth of the modern search engine to business users looking for answers within their proprietary data. Business leaders with an eye to the future will understand just how revolutionary a data search tool like Natural Language Answers can be to operations. Just as it is difficult to remember life before the advent of the search engine, the advent of data search tools like Natural Language Answers represents a similar transformation in decision making for business in the next ten years.

Why the Data Lake – Benefits and Drawbacks

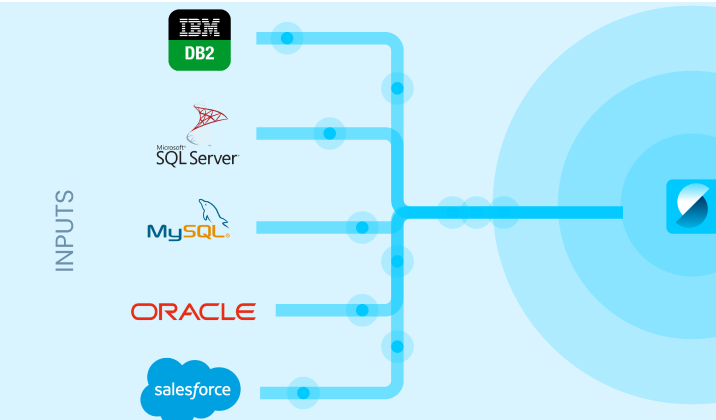

A data lake solves the problem of having disparate data sources living in different applications, databases and other data silos. While traditional data warehouses brought data together into one place, they typically took quite a bit of time to build due to the complex data management operations required to transform the data as it was transferred into the on-premise infrastructure of the warehouse. This led to the development of the data lake – a quick and easy cloud-based solution for bringing data together into one place. Data lake popularity has climbed significantly since launch, as APIs quickly connect data sources to the data lake to bring data together. Data lakes have redefined ETL (extract, transform and load) as ELT, as data is quickly loaded and transforming it is left for later.

However, data in data lakes is not organized, connected, and made usable as a single source of truth. The problem with disparate data sources has only been moved to a different portion of the process. Data lakes do not automatically combine data from the multiple relocated sources together for analytics, reporting, and other uses. Data lakes lack data management, such as master data management, data quality, governance, and data accuracy technologies that produce trusted data available for use across an organization.

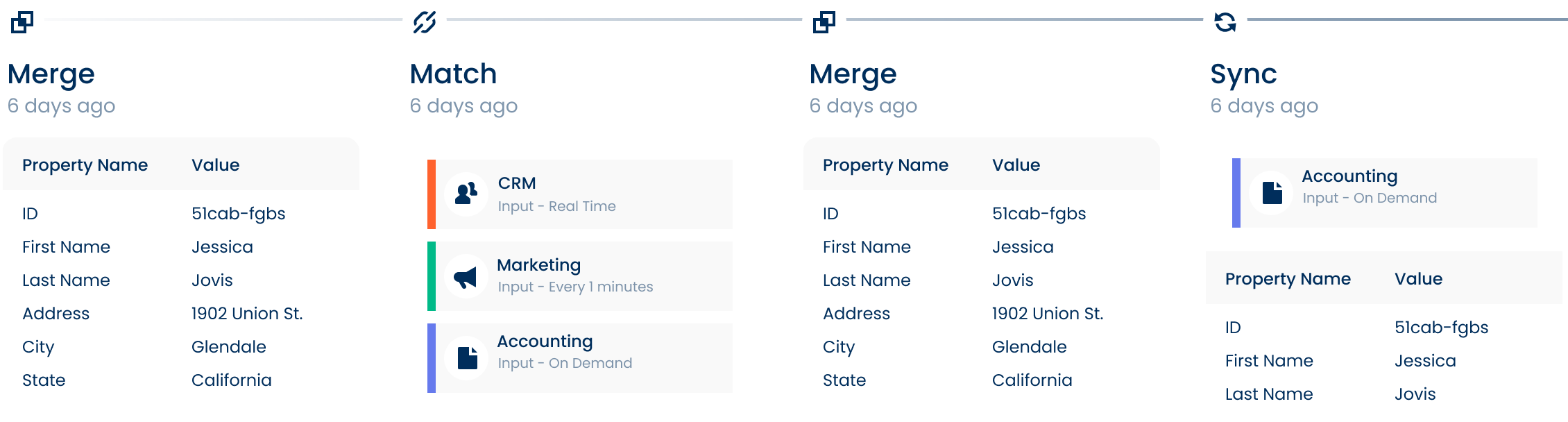

Solutions, such as the cloud-native AunsightTM Golden Record, bring data accuracy, matching, and merging to the lake. In this manner, data lakes can have the data management of data warehouses yet remain nimble as cloud solutions. Ultimately, the goal is to bring the data from the multiple data silos together for better analytics, accurate executive reporting, and customer 360 and product 360 views for better decision-making. This requires a data management solution that normalizes data of different forms and formats, to bring it into a single data model ready for dashboards, analytics, and queries. Pairing a data lake with a cloud-native data management solution with built in governance provides faster data integration success and analytics-ready data than traditional data warehouse technologies.

Aunsight Golden Record takes data lakes a step further by not only aggregating disparate data, but also cleansing data to reduce errors and matching and merging it together into a single source of accurate business information – giving you access to consistent trusted data across your organization in real-time.

What are Smart Features?

Machine learning is a leading component of today’s business landscape, but even many forward-looking business leaders in the mid-market have difficulty developing a strategy to leverage these cutting edge techniques for their business. At Aunalytics, our mission is to improve the lives and businesses of others through technology, and we believe that what many organizations need to succeed in today’s climate is access to machine learning technology to enhance the ability to make data driven-decisions from complex data sources.

Imagine having the ability to look at a particular customer and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our products is this customer most likely to choose next?

- How likely is this customer to default or become past due on an invoice?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics’ Innovation Lab data scientists have combed through data from our clients in industries like financial services, healthcare, retail, and manufacturing and have developed proprietary machine learning techniques based on a solid understanding of the data commonly collected by businesses in these sectors.

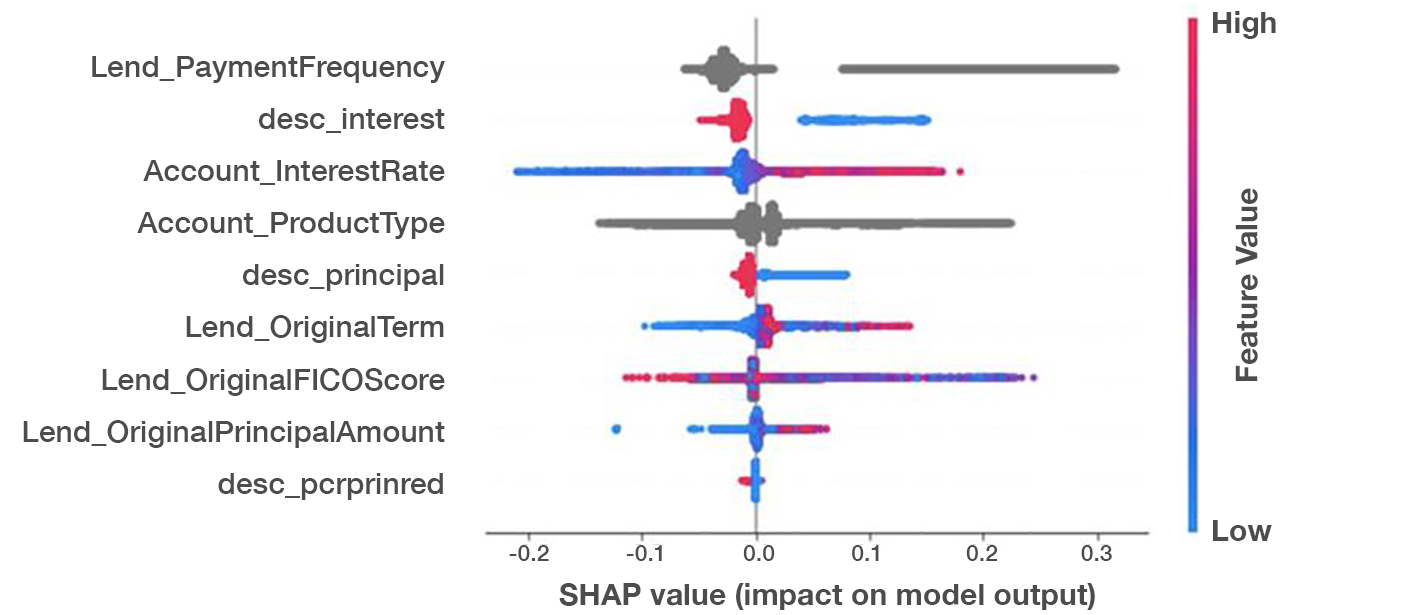

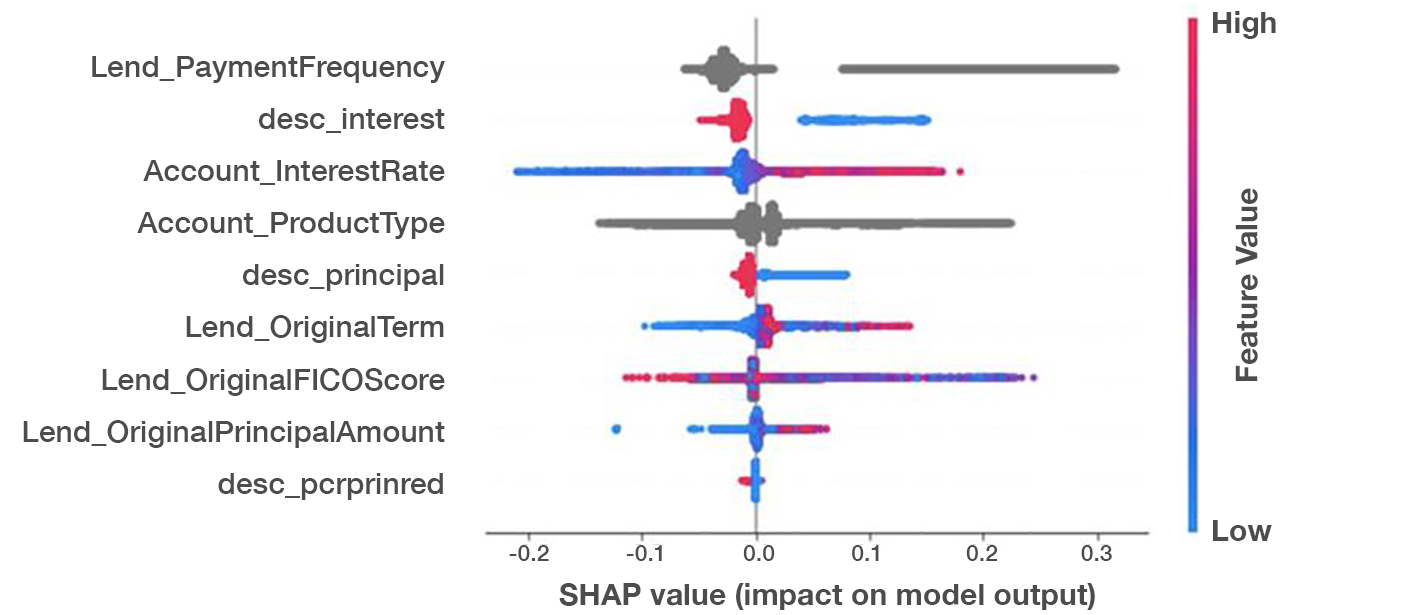

A SHAP (Shapley Additive Explanations) value chart for a remarkably accurate loan default risk model we developed shows which features have the highest impact on risk prediction.

From this, we append insights gleaned from machine learning to data models. We add high value fields to customer records to reveal insights about a customer learned from our algorithms. Smart Features provide answers to pressing business questions to recommend next steps to take with a particular customer to deepen relationships, provide targeted land and expand sales strategies, provide targeted marketing campaigns for better customer experiences, and yield business outcomes.

Machine learning techniques enable more accurate models of risk, propensity, and customer churn because they represent a more complex model of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Smart Features are one way that Aunalytics provides value to our clients by lending our extensive data science expertise to client-specific questions. Through these machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with businesses in your industry.

Where Can I Find an End-to-End Data Analytics Solution?

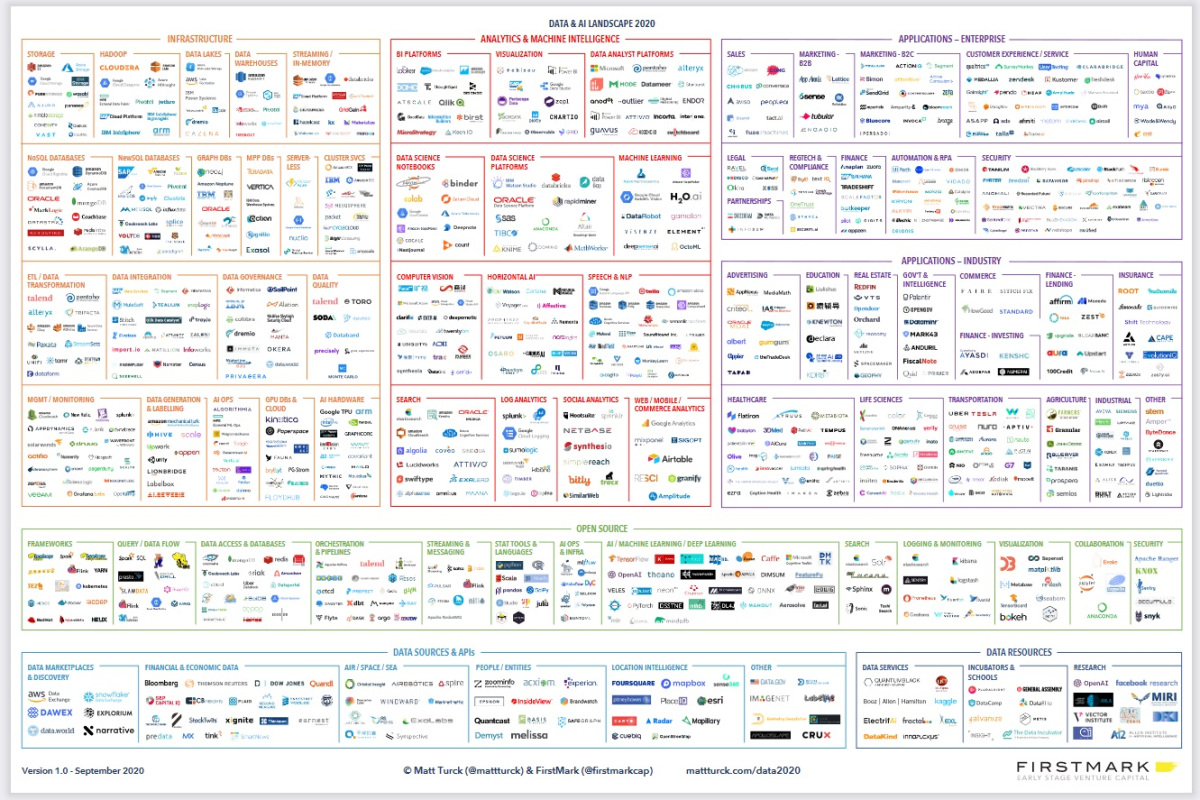

The data analytics landscape has exploded over the past decade with an ever-growing selection of products and services: literally thousands of tools exist to help business deploy and manage data lakes, ETL and ELT, machine learning, and business intelligence. With so many tools to piece together, how do business leaders find the best one or ones? How do you piece them together and use them to get business outcomes? The truth is that many tools are built for data scientists, data engineers and other users with technical expertise. With most tools, if you do not have a data science department, your company is at risk for buying technologies that your team does not have the expertise to use and maintain. This turns digital transformation into a cost center instead of sparking data driven revenue growth.

Image credit: Firstmark

https://venturebeat.com/2020/10/21/the-2020-data-and-ai-landscape/

Aunalytics’ side-by-side service model provides value that goes beyond most other tools and platforms on the market by providing a data platform with built-in data management and analytics, as well as access to human intelligence in data engineering, machine learning, and business analytics. While many companies offer one or two similar products, and many consulting firms can provide guidance in choosing and implementing tools, Aunalytics integrates all the tools and expertise in one end-to-end solution built for non-technical business users. The success of a digital transformation project should not be hitting implementation milestones. The success of a digital transformation project should be measured in business outcomes.

Why it is Important to Have Real-time Data for Analytics

Analytics based upon stale data provides stale results. Fresh data powers up-to-date decision-making.

Real-time data ingestion, integration and cleansing to create a golden record of business information ready for analytics is critical to make better business decisions. This type of ingestion uses technology such as change data capture to bring across only new bits of data – changes to the existing data – as they are made in the business. Streaming allows for efficient processing (cleansing, matching, merging), rather than piling up changes all day and batching them overnight for processing. Streamed data provides changes in real-time so that business decisions are not made based upon yesterday’s data. Although some data sources and systems only support batch transfer, data ingestion technologies are ready for when the core systems modernize. Hopefully the days of stalled analytics waiting for data to arrive will soon be behind us.

Without real-time data management, the time gap causes lags in decision-making that can cost companies time, money, and energy. Real-time data management enables:

- Rapid results

- Faster scaling

- Better decision-making

- More efficient data delivery

- Monetizing windows of opportunity

- Timely actions in response to current insights

- Improved and automated business processes

- Proactive decision-making instead of reactive

- Immediate responses as events unfold

- More personalized customer experiences

How to Use AI for Smarter Financial Institution Service

Data has long been used in decision making in the financial services industry. Statistical scoring models based on consumer data like FICO® have been used for half a century to guide lending decisions in the financial services sector. But today’s analytics space has evolved to the point where many other factors not easily digested by credit scoring bureaus play a roll. Imagine a deeper understanding of lending risk factors not commonly reported in credit scores:

- Number of changes of residence in the past five years

- Householding status (single or cohabiting/married)

Imagine having the ability to look at a particular client and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our financial products is this customer most likely to choose next?

- How likely is this customer to default or become past due on a mortgage?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics financial services experts understand the most pressing business questions specific for this industry. Working with our financial services experts, Aunalytics’ Innovation Lab data scientists have developed proprietary machine learning, AI and deep learning algorithms based on a solid understanding of the data commonly collected by financial institutions. Our data engineers understand the types of data commonly created and used by the industry, common data sources and have created integrations to bring data from across a bank together into a single analytics-ready feed. The end result is data organized into industry specific relational data marts ready to answer questions posed by business users from financial services institutions.

A SHAP value chart for a remarkably accurate loan default risk model we developed. A benchmark with testing data provided by one client was able to predict 30% of that customer’s loan defaults with 99% accuracy, or predict 75% of all loan defaults with 75% accuracy (i.e. 0.99 precision at 0.3 recall or 0.75 precision at 0.75 recall).

Take the example of a recent model we developed at Aunalytics to predict loan default risk. Looking at a chart of the SHAP (Shapley Additive Explanations) values for this model, we can see a number of common-sense observations confirmed. For example, high interest loans (represented by a pink dot in the Account_InterestRate line) and low FICO scores (represented by a blue dot in the Lend_OriginalFICOScore) positively correlate with default risk. This model discovered some much less intuitive characteristics of high risk loans as well: For some loans, payment frequency (Lend_PaymentFrequency) was actually the single most important factor for predicting loan defaults. Moreover, a well-known but not always properly appreciated factor to default risk is illustrated visually: the type of loan being underwritten (Account_ProductType) is in many cases just as important as a customer’s credit score to default risk. Auto loan applicants with high FICO scores might be more of a default risk than customers with low credit scores shopping for a home mortgage.

In so many cases, machine learning techniques enable more accurate and understandable models of risk, propensity, and customer churn because they represent a more complex model understanding of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Through AI and machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with financial services businesses.

What is the best analytics tool for business users?

What is the best data analytics tool for business users? As more business leaders face this question in recent years, most are finding just how hard it is to answer. The data analytics landscape has exploded over the past decade with an ever-growing landscape of products and services: literally thousands of tools exist to help business deploy and manage data lakes, ETL and ELT, machine learning, and business intelligence. With so many tools to piece together, how do business leaders find the best one or ones?

As with most things, the best tool set is simply the one that tailors itself best to the problems and questions that need to be solved. For some users, this could be how to integrate and clean data across siloed systems. Others may want to know how to publish analytical datasets of relevant data and metrics to analysts and marketing researchers. Others may have questions about how to derive value from large amounts of data with machine learning.

The Answers Platform

Aunalytics has built its data platform of tools to answer all of these questions. We believe in providing answers to questions with our integrated data analytics platform and leveraging our industry expertise to put these tools to work for you.

Unlike most tools on the market, Aunalytics provides a comprehensive, end-to-end data platform with all the tools your organization needs:

- Data integration, cleaning, and migration in the loud with Aunsight™ Golden Record

- Data transformation, processing, and delivery with Aunsight Data Platform

- Machine Learning and Artificial Intelligence with Aunsight Data Lab

- Delivery and exploration of the data lake with the Daybreak™ Analytical Database

Side-by-Side Service Model

More importantly, Aunalytics’ side-by-side service model provides value that goes beyond most other tools and platforms on the market by providing access to human intelligence in data engineering, machine learning, and business analytics. While many companies offer one or two similar products, and many consulting firms can provide guidance in choosing and implementing tools, Aunalytics integrates all the tools and expertise in one company as your trusted partner in digital transformation.

A Comprehensive Platform

While there are a large number of options to choose from, we at Aunalytics believe our distinctive approach and comprehensive platform tools provide the best solution for all but the largest companies who may wish to create custom analytics solutions in-house. Wherever you are on the data analytics journey, from just beginning to explore the possibilities in your data to global companies with established data science teams, Aunalytics can provide a path through the complicated landscape of tools and infrastructure to grow your company’s data analytics program.

Six Steps Toward a More Secure Technology Environment

In the past few months, it’s become obvious that despite the world and our communities being hurt by the ongoing pandemic, hackers and bad actors are continually on the hunt for a good score. Ransomware attacks have been hitting hard at key infostructures; particularly schools. Schools have already paid over a half million dollars in ransom to some of these attackers.

In the last seven days, there have been over 20 attacks on these targets, ranging from inaccessible systems to full payouts to the attackers.

While there are no guarantees that your organization will not be hit, there are many things every organization can do to become less of a target and strengthen your own boundaries. Though some of these recommendations require an operations cost, many are free and only take a little time. ALL tactics are extremely valuable towards ensuring your organization is harder to hit.

Please contact Aunalytics if you’re interested in discussing the following steps toward a more secure technology environment.

- Only do work-related activities on work computers

- Check for password strength

- Review your spam and phishing filters (Microsoft Security)

- Train your users so they can maintain vigilance (in-house education, Knowbe4)

- Apply Multi-Factor Authentication (Microsoft, Okta)

- Put CXOs, VPs and organizational decision makers on an anti-spoof list (Microsoft Advanced Threat Protection)

Daybreak: A Foundation for Advanced Analytics, Machine Learning, and AI

Financial institutions have no shortage of data, and most know that advanced analytics, machine learning, and artificial intelligence (AI) are key technologies that must be utilized in order to stay relevant in the increasingly competitive banking landscape. Analytics is a key component of any digital transformation initiative, with the end goal of providing a superior customer experience. This digital transformation, however, is more than simply digitizing legacy systems and accommodating online/mobile banking. In order to effectively achieve digital transformation, you must be in a position to capitalize one of your greatest competitive assets—your data.

However, getting to successful data analytics and insights comes with its own unique challenges and requirements. An initial challenge concerns building the appropriate technical foundation. Actionable BI and advanced analytics require a modern specialized data infrastructure capable of storing and processing a large magnitude of transactional data in fractions of a second. Furthermore, many financial institutions struggle not only with technical execution, but also lack personnel skillsets required to manage an end-to-end analytics pipeline—from infrastructure to automated insights delivery.

In this article, we examine some of the most impactful applications of advanced analytics, machine learning, and AI for banks and credit unions, and explain how Daybreak for Financial Services solves many of these challenges by providing the ideal foundation for all of your immediate and future analytics initiatives.

Machine Learning and Artificial Intelligence in the Financial Industry

Data analysis provides a wide range of applications that can ultimately increase revenue, decrease expenses, increase efficiency, and improve the customer experience. Here are just a few examples of how data can be utilized within the financial services industry:

- Inform decision-making through business intelligence and self-service analytics:

While banks and credit unions collect a wide variety of data, traditionally, it has not always been easy to access or query this data, which makes uncovering the desired answers and insights difficult and time-consuming. With the proper analytics foundation, employees across the organization can begin to answer questions that directly influence both day-to-day and long-term decision-making.

For example, a data-informed employee could make a determination on where to open a new branch based on where most transactions are taking place currently, or filter customers by home address. They could also determine how to staff a branch appropriately by looking at the times of day that typically have the most customer activity, and trends related to that activity type.

- Improve collection and recovery rates on loans:

By implementing pattern recognition, risk and collection departments can identify and efficiently target the most at-risk loans. Loan departments could also proactively reach out to holders of at-risk loans to discuss refinancing options that would improve the borrower’s ability to pay and decrease the risk of default.

- Improve efficiency and effectiveness of marketing campaigns:

Banks and credit unions can create data-driven marketing program to offer personalized services, next-best products and improve customer onboarding, by knowing which customers to reach out to at the right time. Data-driven marketing allows financial institutions to be more efficient with their marketing dollars and track campaign outcomes better.

- Increased fraud detection abilities

Unfortunately, fraud has become quite common in the financial services industry, and banks and credit unions are investing in new technologies to fight it. Artificial intelligence can be used to detect triggers that indicate fraud in transactional data. This gives institutions the ability to proactively alert customers of suspected fraudulent activities on their accounts to prevent further loss.

These applications of machine learning and AI simply scratch the surface of what outcomes can be achieved by utilizing data, but they are not always easy to implement. Before a financial institution can embark on any advanced analytics project, they must first establish the appropriate foundational analytics infrastructure.

Daybreak is a Foundational Element for Analytics

There are many applications for analytics within the financial services industry, but the ability to utilize machine learning, AI, or even basic business intelligence is limited by data availability and infrastructure. One of biggest challenges to the achievement of advanced analytics initiatives is collecting and aggregating data across multiple disparate sources, including core data. In order to make truly proactive decisions based on data, these sources need to be updated regularly, which is a challenge unto itself.

Additionally, this data needs to be aggregated on an infrastructure built for analytics. For example, a banking core system is built to record large amounts of transactions and is designed to be a system of record. But it is not the optimal type of database structure for analytics.

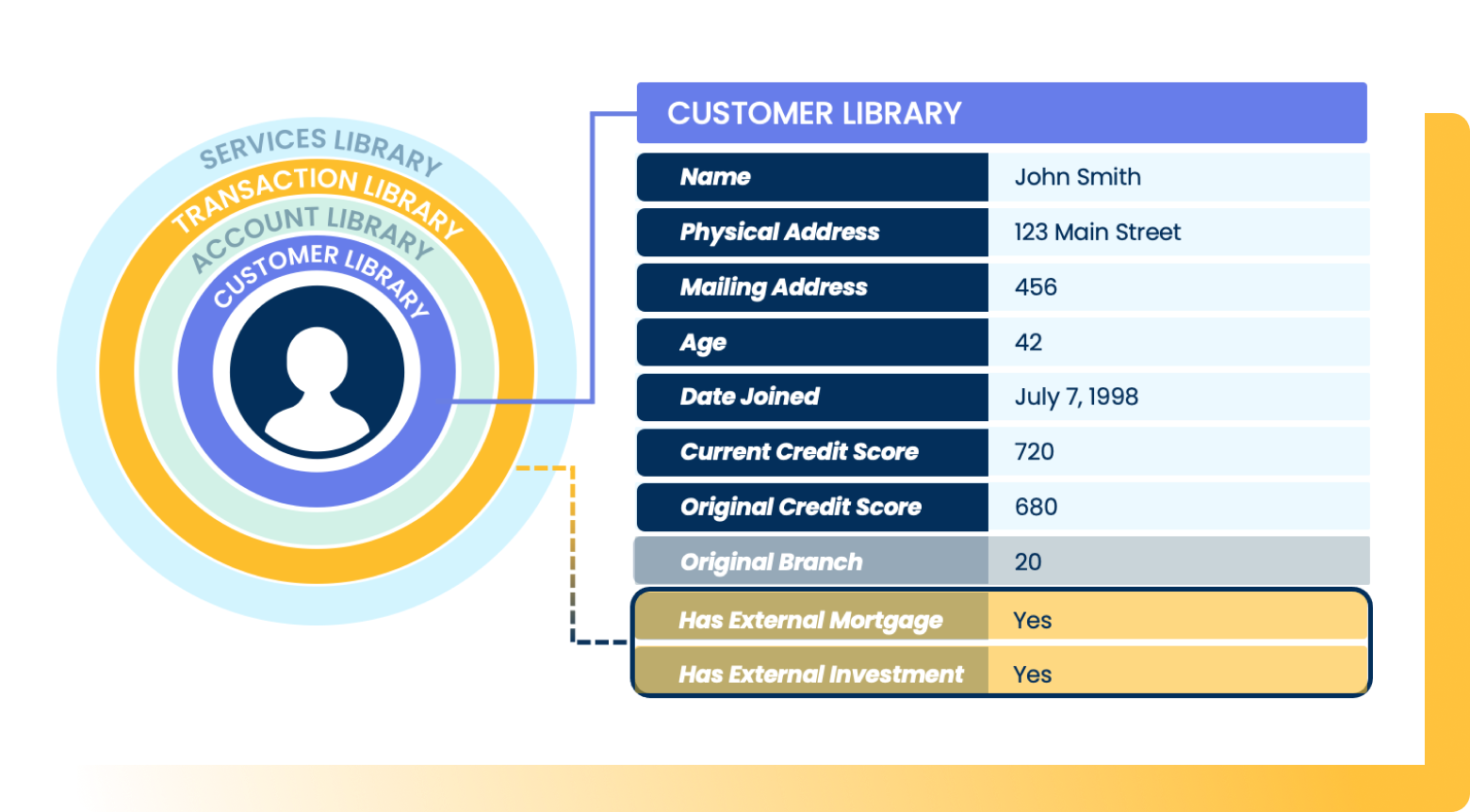

To solve these challenges, Aunalytics has developed Daybreak, an industry-intelligent data mart built specifically for banks and credit unions to access and take action on the right data at the right time. Daybreak includes all the infrastructure components necessary for analytics, providing financial institutions with an up-to-date, aggregated view of their data that is ready for analysis. It offers users easy-to-use, intuitive analysis tools for people of all experience levels—industry-specific pre-built queries, the Data Explorer guided query tool, or the more advanced SQL Builder. Daybreak also provides easy access to up-to-date, accurate data for more advanced analytics through other modeling and data science tools.

Once this infrastructure is in place, providing the latest, analytics-ready data, the organization’s focus can shift to implementing a variety of analytics solutions, such as advanced KPIs, predictive analytics, targeted marketing, and fraud detection.

Daybreak Uses AI to Enhance Data for Analysis

In addition to providing the foundational infrastructure for analytics, Daybreak also utilizes AI to ensure the data itself is both accurate and ready for analysis. Banks and credit unions collect large amounts of data, both structured and unstructured. Unfortunately, unstructured data is difficult to integrate and analyze. Daybreak uses industry intelligence and AI to convert this unstructured data into a structured tabular format, familiar to analysts. To ensure accuracy, Daybreak utilizes AI to perform quality checks to detect anomalies as data is added or updated.

This industry intelligence also allows Daybreak to create Smart Features from existing data points. Smart Features are completely new data points that are engineered to answer actionable questions relevant to the financial services industry.

Banks and credit unions are fortunate to have a vast amount of data at their disposal, but for many institutions, that data is not always easily accessible for impactful decision-making. That is why it is necessary to build out a strong data foundation in order to take advantage of both basic business intelligence and more advanced machine learning and AI initiatives. Daybreak by Aunalytics provides the ideal, industry intelligent foundation for financial institutions to jump start their journeys toward digital transformation, with the tools they need in order to utilize data to grow their organizations.

Aunalytics’ Client Success Team Drives Measurable Business Value

Transitioning to a more data-driven organization can be a long, complicated journey. A complete digital transformation is more than simply adopting new technologies (though that is an important component.) It requires change at all levels of the business in order to pivot to a more data-enabled, customer-focused mindset. Aunalytics Client Success is committed to helping organizations digitally transform by guiding and assisting them along every step of the journey, and ultimately, allowing them to thrive.

Below, the Client Success (CS) team has answered some of the most common questions about what they do and how they help organizations achieve measurable business outcomes.

What is Client Success?

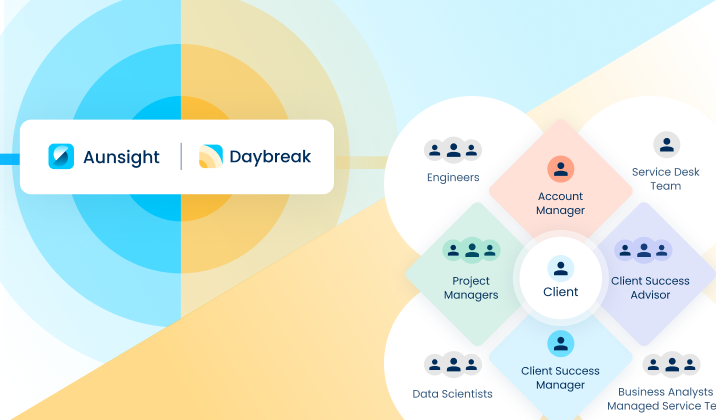

Aunalytics CS partners with clients to become their trusted advisor, by building a customized CS Partnership Plan utilizing the client’s unique business needs as the core goals. The CS Partnership Plan creates an exceptional client experience by consistently applying a combination of our team and technology to deliver measurable value and business outcomes for our clients.

What are the main goals of the Aunalytics Client Success team?

The Client Success team has four main goals:

- Designing targeted client experiences (by industry, product, and digital transformation stage)

- Recommending targeted next steps by simplifying and synthesizing complex information

- Delivering proactive and strategic support from onboarding to solution launch, ongoing support, and consulting

- Collecting and responding to client feedback on ways our service delivery can evolve

What are the various roles within the CS team?

There are two main roles within the CS team that interact with clients on a regular basis. The first is the Client Success Manager (CSM). The CSM manages day-to-day client tactical needs, providing updates and direction throughout the onboarding process. As the liaison between clients and the Aunalytics team, the CSM synthesizes complex information into clear actions, mitigates any roadblocks that may occur, and clearly communicates project milestones. The CSM works closely with the clients throughout their partnership with Aunalytics, from onboarding, adoption, support, and engagement.

The Client Success Advisor (CSA) works on high-level strategy with each client, translating Aunalytics’ technology solutions into measurable business outcomes. They partner with the clients’ key stakeholders to understand their strategic objectives and create a custom technology roadmap that identifies the specific steps necessary to reach their digital transformation goals. These goals are integrated into the client’s specific CS Partnership Plan to ensure we are aligned on objectives and key results, with clear owners, timelines, and expected outcomes.

How often can a client expect to hear from a CS team member throughout their engagement with Aunalytics?

The CS team is introduced to clients at the initial kickoff meeting and CSMs initiate weekly touch points to ensure onboarding milestones are being met and to communicate action items, responsible parties, and next steps. During these calls the CS team (CS Manager, CS Advisor, Data Engineer, & Business Analyst) will review the project tracker—highlighting recent accomplishments, key priorities, and next steps. Each item is documented, assigned an owner, a timeline, and clear expectations around completion criteria.

What is the Aunalytics “Side-by-Side Support” model and how does the CS team help facilitate this?

Our side-by-side service delivery model provides a dedicated account team, comprised of technology (Data Engineers (DE), Data Scientists (DS), and Business Analysts) and data experts (Product Managers, Data Ingestion Engineers, and Cloud Infrastructure Team), to help transform the way our clients work. The account team collaborates across the company, in service of the client, to ensure that everyone on the team is driving towards the client’s desired outcomes. The CSA captures this information in the CS Partnership Plan to ensure alignment, key priorities, and ownership of time-bound tasks.

The CS team partners with Aunalytics’ Product, Ingestion, and Cloud teams to share client questions, recommendations, and future enhancement ideas. The Partnership Plan is a custom document that evolves with the client’s ever-changing needs. The CSA reviews the Partnership Plan with the client every quarter to capture new goals, document accomplishments, and create feasible timelines for implementation. The goal of the CSA is to create a relationship with the client, in which they view the CSA as a key member of their internal team (e.g. the same side of the table vs. a vendor).

A successful partnership with Aunalytics’ Client Success team is when concrete business outcomes and value are realized by the client, through the use of Aunalytics’ solutions (products + service).

What are some examples of business outcomes that CS has helped Daybreak for Financial Services clients achieve?

In addition to guidance throughout the initial implementation of Daybreak, CS has assisted banks and credit unions with the execution of a number of actionable business cases, such as:

- Assisting Financial Institutions with implementation of self-service analytics programs;

- Improving collection and recovery rates on loans;

- Implementing pattern recognition to make sure that risk and collection departments are efficiently targeting the most at-risk loans;

- Creating data driven marketing programs to offer personalized services, next-best products, and onboarding. Data-driven marketing allows financial institutions to be more efficient with their marketing dollars and track campaign outcomes better;

- Integration with 3rdparty software systems.

The Aunalytics Client Success team is instrumental in helping clients realize measurable business value. Together with Aunalytics’ strong technology stack, this side-by-side delivery model ensures that all clients are equipped with the resources they need to affect positive change within the organization and achieve their digital transformation goals.