One platform. Answers for everyone.

The industry-intelligent data mart built specifically for banks to access and take action on the right data at the right time.

How we can benefit financial institutions like yours

Increase net deposits, card income, and fees to existing customers.

Increase deposits by reducing churn of current and future high value customers.

Increase loan profitability and reduce loan loss reserves.

Industry Intelligent

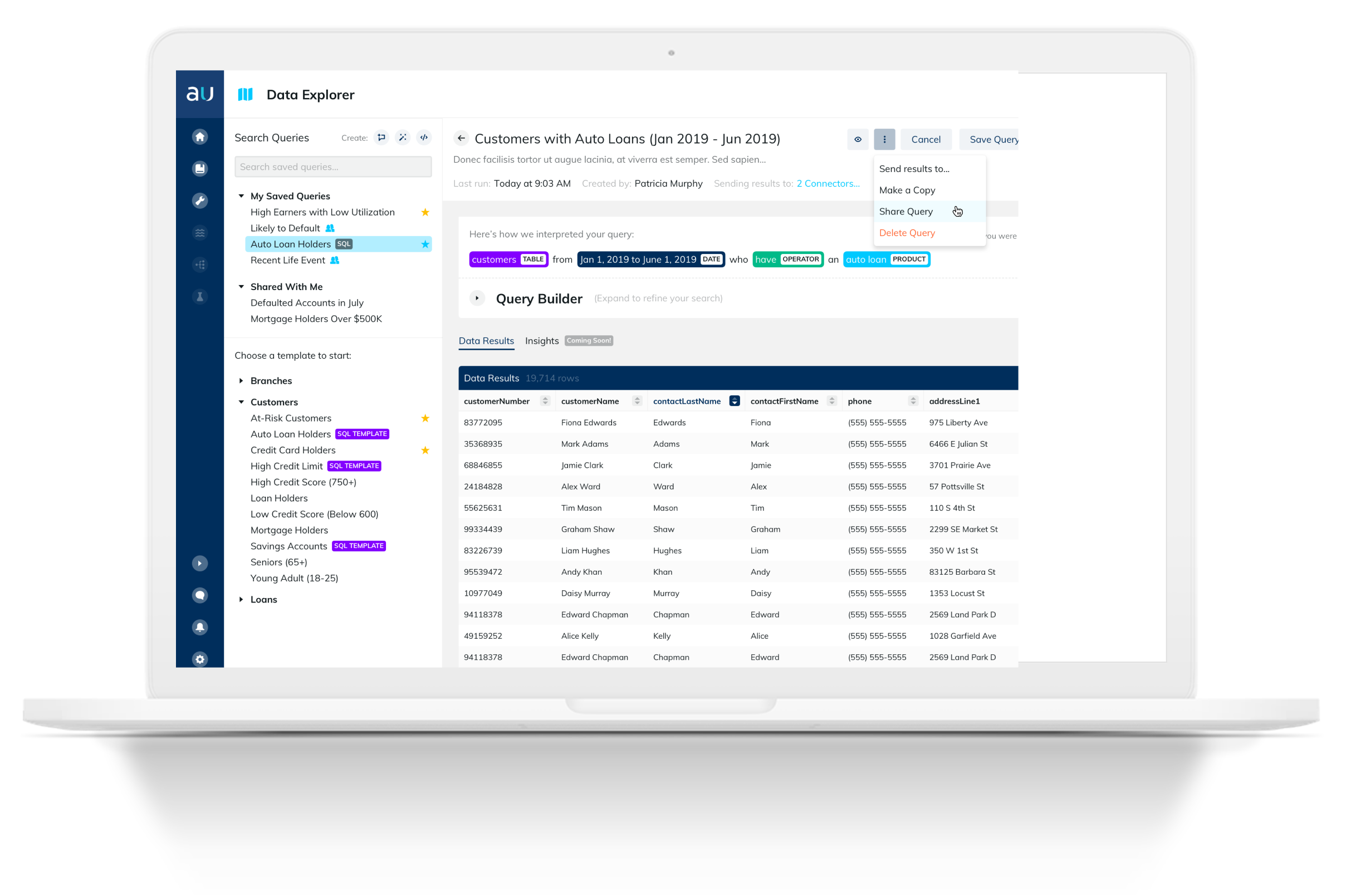

Industry-intelligent data marts get you the answers you’re looking for, faster. You don’t have time for customizations or costly consulting. With Daybreak’s industry intelligent data mart, we assemble data from your business and enrich it with third-party sources to create meaningful libraries that your team can access in minutes to get the information needed to execute business-impactful initiatives like improving customer experiences, decreasing attrition, or gaining a competitive edge.

Universal Access to Data

Simplify the data overload. Get everyone on the same page. Daybreak is data-source agnostic so whether you are using inputs from a third-party source or delivering to Tableau, Power BI, or other dashboards, you can securely connect your existing systems in one location. Now, everyone on your team can access your powerful data and put it to use faster.

Faster Insights

Data-backed answers to your most pressing questions as the sun rises. Say goodbye to stale data. With Daybreak, you receive the data insights you need quickly, consistently, and securely every day. We convert rich, transactional data about your customers into actionable insights using our predictive models, so you can quickly understand the landscape and make informed decisions that advance your strategic business priorities. Our Innovation Lab releases new predictive models and Smart Features™ each quarter.

"Daybreak has broken down our data silos and given stakeholders across the organization access to insights they have never had before. We are limited only by our own imagination in terms of the types of insights we can uncover."

John Kamin

EVP and Chief Information Officer, Provident Bank

These financial institutions have answers:

Questions about Daybreak? Let's get them answered.