Machine learning is a leading component of today’s business landscape, but even many forward-looking business leaders in the mid-market have difficulty developing a strategy to leverage these cutting edge techniques for their business. At Aunalytics, our mission is to improve the lives and businesses of others through technology, and we believe that what many organizations need to succeed in today’s climate is access to machine learning technology to enhance the ability to make data driven-decisions from complex data sources.

Imagine having the ability to look at a particular customer and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our products is this customer most likely to choose next?

- How likely is this customer to default or become past due on an invoice?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics’ Innovation Lab data scientists have combed through data from our clients in industries like financial services, healthcare, retail, and manufacturing and have developed proprietary machine learning techniques based on a solid understanding of the data commonly collected by businesses in these sectors.

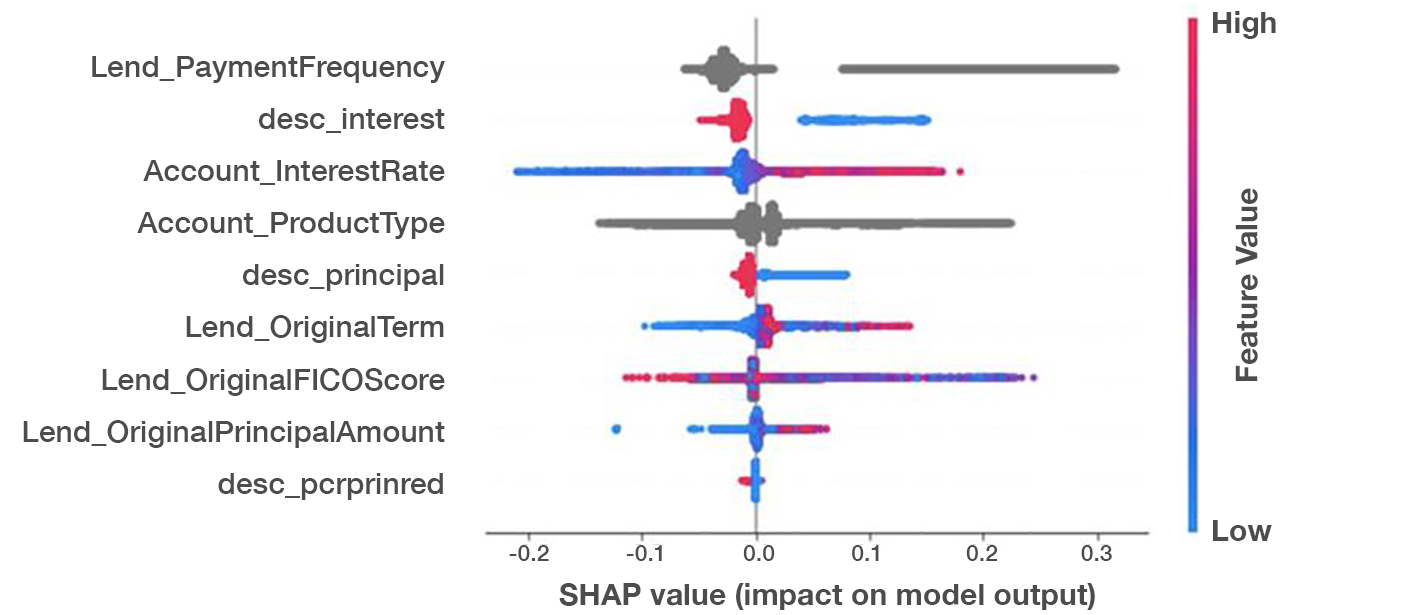

A SHAP (Shapley Additive Explanations) value chart for a remarkably accurate loan default risk model we developed shows which features have the highest impact on risk prediction.

From this, we append insights gleaned from machine learning to data models. We add high value fields to customer records to reveal insights about a customer learned from our algorithms. Smart Features provide answers to pressing business questions to recommend next steps to take with a particular customer to deepen relationships, provide targeted land and expand sales strategies, provide targeted marketing campaigns for better customer experiences, and yield business outcomes.

Machine learning techniques enable more accurate models of risk, propensity, and customer churn because they represent a more complex model of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Smart Features are one way that Aunalytics provides value to our clients by lending our extensive data science expertise to client-specific questions. Through these machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with businesses in your industry.