How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

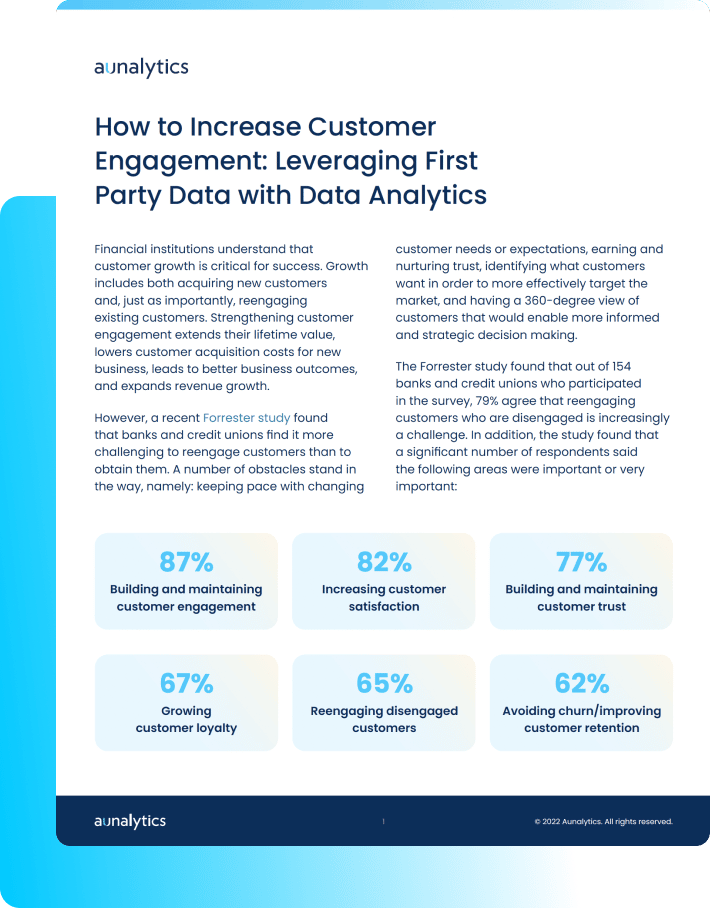

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Related Content

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Aunalytics to Feature Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at Financial Services Events in November and December

Leading Data Management and Analytics Provider Will Showcase How AI-Powered Analytics Can Increase Business Wins with Real-Time Customer Insights and Highly Personalized Interactions

South Bend, IN (November 1, 2022) - Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, announced today its participation at three financial services events in November and December. The company will showcase its DaybreakTM for Financial Services advanced data analytics solution and demonstrate how midmarket banks and credit unions can use artificial intelligence (AI)-powered data analytics to increase business wins and compete more effectively.

November and December events include:

- Ohio Bankers League Annual Meeting, November 2-3

- The Financial Brand Forum 2022, November 14-16

- Annual CUSO Conference, December 1-4

Daybreak for Financial Services enables midsize financial institutions to gain customer intelligence and grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“It is critical now more than ever that mid-market banks and credit unions take action based on real-time insights that deliver a 360-degree view of customers or members so they can be nimbler and pivot their strategies as the market shifts course,” said Katie Horvath, Chief Marketing Officer of Aunalytics. “Aunalytics solutions offer this granular level of insights as a service at speed to inform banking strategies. Using Aunalytics Daybreak for Financial Services, mid-market banks and credit unions can now deploy advanced analytics to more highly personalize their interactions with customers and members. It enables them to target-market more efficiently with the right product offering at the right time, and win business away from competitors to increase revenue. We look forward to meeting with bankers and credit unions in the coming months, and demonstrating how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Tweet this: .@Aunalytics to Feature Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at Financial Services Events in November and December #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a leading data management and analytics company delivering Insights-as-a-Service for mid-sized businesses and enterprises. Selected for the prestigious Inc. 5000 list for two consecutive years as one of the nation’s fastest growing companies, Aunalytics offers managed IT services and managed analytics services, private cloud services, and a private cloud-native data platform for data management and analytics. The platform is built for universal data access, advanced analytics and AI – unifying distributed data silos into a single source of truth for highly accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI for accurate mission-critical insights. To solve the talent gap that so many mid-sized businesses and enterprises located in secondary markets face, Aunalytics’ side-by-side digital transformation model provides the technical talent needed for data management and analytics success in addition to its innovative technologies and tools. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

2022 Annual CUSO Conference

2022 Annual CUSO Conference

TradeWinds Island Grand Resort, St. Petersburg, FL

Aunalytics to attend the 2021 Annual CUSO (Credit Union Service Organization) Conference

Aunalytics will be attending the Annual CUSO (Credit Union Service Organization) Conference as a lunch sponsor. Aunalytics has developed Daybreak™ for Financial Services, which enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

The Financial Brand Forum 2022

The Financial Brand Forum 2022

ARIA Hotel & Casino, Las Vegas, NV

Aunalytics to Attend the The Financial Brand Forum 2022 as a Gold Sponsor

Aunalytics is thrilled to attend the The Financial Brand Forum 2022 in Las Vegas, Nevada as a Gold Sponsor. Join Aunalytics at booth #413, where representatives will be demonstrating Daybreak™ for Financial Services, a cloud-native data platform which enables financial institutions to focus on critical business outcomes and make data-driven business decisions. Daybreak enables a variety of use cases through AI-driven insights, such as reducing customer churn, increasing wallet share, and optimizing branch allocation decision-making.

2022 Ohio Bankers League Annual Meeting

2022 Ohio Bankers League Annual Meeting

Hyatt Regency, Columbus OH

Aunalytics Excited to Attend the 2022 OBL Annual Meeting as a Reception Sponsor

Aunalytics is excited to attend the 2022 Ohio Bankers League (OBL) Annual Meeting as a Reception Sponsor. Aunalytics will be demonstrating Daybreak™ for Financial Services, a cloud-native data platform which enables community banks to focus on critical business outcomes and make data-driven business decisions in order to compete with large financial institutions.

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

In a recession economy, it is imperative to cut costs and employ efficient strategies to grow operating income. Here’s what banking institutions can do to make marketing and sales teams more efficient, and achieve better returns.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Related Content

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

In a recession economy, it is imperative to cut costs and employ efficient strategies to grow operating income. Here’s what banking institutions can do to make marketing and sales teams more efficient, and achieve better returns.