Carolinas' LAUNCH 2025

Carolinas' LAUNCH 2025

Embassy Suites by Hilton Charlotte Concord, Concord, NC

Aunalytics to attend Carolinas Credit Union LAUNCH 2025

Aunalytics is thrilled to be an exhibitor at the Carolinas Credit Union LAUNCH 2025 in Concord, NC on February 12-13, 2025. Aunalytics will be at booth #1 to educate credit union stakeholders on how our technology solutions can make their jobs easier and more effective.

The Sightglass Productivity Platform enables credit unions to use AI to increase deposits and more effectively identify and deliver new services and solutions—allowing them to compete with large national banks. Aunalytics also partners with credit unions to deliver cloud, backup, and managed IT solutions that are robust and secure—streamlining the implementation process and providing solutions as-a-service.

GoWest MAXX Convention 2024

GoWest MAXX Convention 2024

Gaylord Rockies Resort & Convention Center, Aurora, CO

Aunalytics to attend the 2024 GoWest MAXX Convention

Aunalytics is thrilled to be an exhibitor at the 2024 GoWest MAXX Convention in Aurora, CO on October 13-16, 2024. Aunalytics will be at booth #193 demonstrating our member intelligence solution which enables credit unions to use AI to increase deposits and more effectively identify and deliver new services and solutions—allowing them to compete with large national banks.

2024 Jack Henry Connect

2024 Jack Henry Connect

Phoenix Convention Center, Phoenix, AZ

Aunalytics to attend 2024 Jack Henry Connect

Aunalytics is excited to attend 2024 Jack Henry Connect. Representatives from Aunalytics will be demonstrating our customer intelligence solution at booth #830. Aunalytics enables financial institutions to increase deposits and more effectively identify and deliver new services and solutions for their customers and members so they can better compete with large national banks.

2024 BankTech Conference

2024 BankTech Conference

DoubleTree by Hilton Hotel Chicago - Oak Brook, Oak Brook, IL

Aunalytics to be featured at the Innovators' Showcase at the 2024 BankTech Conference

Aunalytics is excited to attend and exhibit at the 2024 BankTech Conference, presented by a partnership of Illinois, Indiana, Michigan, and Ohio state banking associations in Oak Brook, IL. Kyle Davis, VP, Managed Analytics from Aunalytics will be demonstrating how our customer intelligence solution enables banks to increase deposits and more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

2024 Indiana Credit Union League Annual Meeting & Convention

2024 Indiana Credit Union League Annual Meeting & Convention

JW Marriott Indianapolis, Indianapolis, IN

Aunalytics to attend the 2024 Indiana Credit Union League Annual Meeting & Convention

Aunalytics is thrilled to be an exhibitor at the 2024 Indiana Credit Union League Annual Meeting & Convention in Indianapolis, IN on October 2 – 4, 2024. Aunalytics will be at booth #20 demonstrating our member intelligence solution which enables credit unions to use AI to increase deposits and more effectively identify and deliver new services and solutions—allowing them to compete with large national banks.

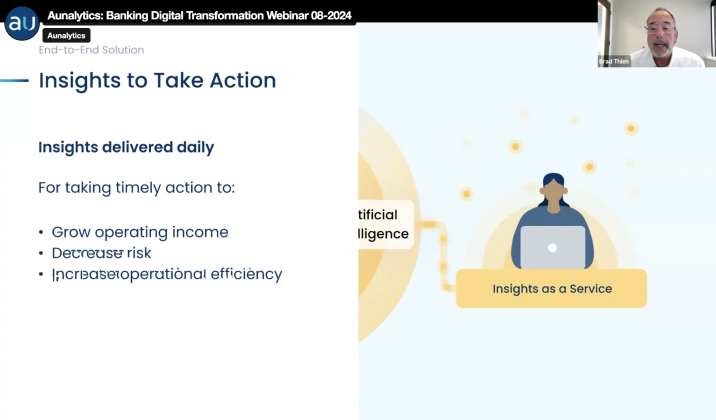

Digital Transformation in Community Banking Webinar

Digital Transformation in Community Banking

With the help of AI technologies, community banks have successfully been able to strengthen relationships, reduce churn, increase deposits, and improve ROI enterprise-wide by utilizing the data they already have at their fingertips—and your organization can, too. However, successful digital transformation can be a major challenge for midsized and community-based banks. Adopting new technologies, shifting operational mindsets, and hiring the talent necessary to build and execute upon AI solutions is a major endeavor. Many banks do not even know where to begin. In this presentation, discuss the steps and considerations for aggregating data across your bank to create a 360-degree view of your customers, why that is important, and ways other community banks have found success through analytics initiatives.

Staying Secure: Recent Security Breaches and Essential Prevention Strategies

The increasing reliance on digital technologies has led to the increased frequency of security breaches. Recent incidents have highlighted vulnerabilities across several industries, emphasizing the importance of robust cybersecurity measures. Here, we examine some notable security breaches that have recently made headlines, detailing the “how” and the responses taken to mitigate future risks.

Microsoft Azure and Executive Accounts

In a significant cyberattack on Microsoft Azure in January 2024, hackers exposed the accounts of hundreds of Microsoft senior executives to unauthorized access, with the use of phishing attacks and malicious links. The attackers used a password spray attack to break into the accounts, which is when an attacker tries several passwords across multiple user accounts to avoid detection systems. This breach allowed unauthorized access to Microsoft email accounts, leading to the exfiltration of sensitive emails and attached documents. The attackers also targeted source code and infrastructure, emphasizing the importance of heightened vigilance against sophisticated phishing tactics.

One extremely effective way to ward against this type of attack is to create strong passwords and change them regularly to prevent them from being hacked, as well as using multi-factor authentication.

Bank of America Third-Party Data Breach

Attackers understand that large banks have robust cybersecurity measures to protect their networks. However, many third parties lack similar resources and may not yet prioritize cybersecurity education or infrastructure. This makes them more likely to be targets for cybercriminals seeking vulnerabilities to exploit when sharing data with major institutions. This incident underscores the critical need for financial institutions to strengthen third-party vendor security protocols and ensure robust data protection measures.

The ransomware group LockBit orchestrated a breach targeting Bank of America in February 2024 via its third-party vendor, Infosys McCamish. Personal information—including names, Social Security numbers, and account details of over 57,000 individuals—was compromised.

Ascension Ransomware Attack

Such attacks necessitate comprehensive cybersecurity strategies to safeguard critical healthcare infrastructure and ensure uninterrupted patient care. Moreover, ensuring robust disaster recovery plans and reliable backups can get services back on track faster, which is particularly crucial for healthcare systems, because extended delay can directly impact patient care and safety.

Ascension, the owner of 15 hospitals in Michigan, fell victim to a ransomware attack in May 2024 that disrupted electronic health records systems, phone systems, and scheduling processes. Non-emergency procedures and appointments were suspended, highlighting the operational impact of cybersecurity incidents on healthcare services.

New York City Metropolitan Transportation Authority (MTA) Cyberattack

In 2020, research showed that municipalities, which are already vulnerable targets for cybercrime, faced 44% of global ransomware attacks—equating to approximately 133,496,000 incidents. An April 2021 cyberattack on the New York City Metropolitan Transportation Authority (MTA) compromised 18 systems, including those controlling train operations and safety mechanisms. This breach posed serious implications for public safety and operational continuity.

Following the attack, MTA swiftly implemented federally recommended security enhancements and mandated password changes and VPN switches for employees and contractors, illustrating proactive steps to fortify cybersecurity defenses.

Moving Forward: Prevention Procedures

Preventing security breaches requires a multi-faceted approach that empowers teams and safeguards organizational assets. Regular training sessions are essential to educate employees on identifying phishing emails, creating robust passwords, and understanding the importance of safeguarding sensitive information. This measure ensures everyone understands their role in preventing data breaches.

Strengthening asset management through classification, organization, automation, and continuous monitoring helps maintain an up-to-date inventory, facilitating informed decision-making and enhancing troubleshooting capabilities. Effective management and monitoring of access rights, supported by IAM, routine account audits, SSO, and multi-factor authentication, are also critical for ensuring only authorized personnel have access to certain resources.

Another strategy to prevent security breaches is implementing robust firewalls and antivirus software services, which can serve as the frontline defense against malicious threats. Regular updates to these defenses are crucial to identifying and addressing vulnerabilities promptly. Additionally, implementing automated data backup systems across multiple locations provides a safety net against data loss and physical damage, ensuring business continuity even in the face of unforeseen incidents. By integrating these preventive measures into comprehensive cybersecurity strategies, organizations can effectively mitigate risks and protect sensitive information from increasingly sophisticated cyber threats.

At Aunalytics, we are committed to preventing security breaches—protecting customer data is our top priority. We adhere to stringent security protocols, including regular employee training, robust encryption measures, and continuous monitoring of access controls. Our goal is to ensure our clients are utilizing the latest security technologies and best practices to stay protected, while having the right backup and disaster recovery strategies in place to get their businesses back up and running as quickly as possible in the event of a cyber event or disaster scenario.

2024 PACB Annual Convention

2024 PACB Annual Convention

Pennsylvania Association of Community Bankers

The Omni Homestead Resort, Hot Springs, VA

Aunalytics to exhibit at the 2024 PACB Annual Convention

Aunalytics is excited to attend and exhibit at the 2024 PACB Annual Convention, presented by the Pennsylvania Association of Community Bankers in Hot Springs, VA. Representatives from Aunalytics will be demonstrating how our customer intelligence solution enables banks to increase deposits and more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

Cornerstone ELEVATE 2024 Credit Union Leadership Summit

Cornerstone ELEVATE 2024 Credit Union Leadership Summit

Hampton Inn Houston Downtown, Houston, TX

Aunalytics to attend the ELEVATE Credit Union Leadership Summit

Aunalytics is thrilled to be an exhibitor at the Cornerstone ELEVATE Leadership Summit in Houston, TX on September 4 – 6, 2024. Aunalytics will be at booth #101 demonstrating our member intelligence solution which enables credit unions to use AI to increase deposits and more effectively identify and deliver new services and solutions—allowing them to compete with large national banks.

Banking Forward: Analytics Trends in Financial Services

Banking Forward:

Analytics Trends in Financial Services

In the world of financial services, staying ahead of competition means embracing analytics trends that enhance customer and member experiences and operational efficiency. As technology continues to reshape the industry, financial institutions are turning to advanced analytics solutions to gain insights on customer and member behaviors.

Higher Customer and Member Engagement through Online and Mobile Services

Improving the online and mobile experiences is at the forefront of modern banking strategies. Institutions are not only investing in robust mobile banking apps but also leveraging app data to gain deep insights into customer or member behavior. By analyzing transaction patterns, engagement metrics, and user feedback, banks can uncover valuable insights that inform strategic decisions and improve service offerings. This increased access to mobile services significantly enhances the customer and member experience by providing convenient access to financial information anytime, anywhere.

It’s important to note that improved mobile services play a crucial role in shaping personalized experiences, which have become a cornerstone of customer engagement in the banking industry. Through advanced analytics, banks can decipher intricate client data to understand their preferences, goals, and financial behaviors. This allows them to create tailored advice and personalized financial plans on a large scale. Detailed client profiles allow banks to anticipate needs and offer relevant products and services proactively, thereby enhancing customer satisfaction and loyalty.

Highly Personalized Advising

Advising Services, like personalized experiences, is another solution that ensures each client receives tailored assistance aligned with their specific needs. Advising Services have evolved significantly with the integration of customer relationship management (CRM) technology. By using CRM tools, banks can compile comprehensive customer profiles enriched with transaction history, communication preferences, and financial goals. This wealth of data allows financial advisors to deliver customized guidance that addresses each customer’s unique circumstances and aspirations. Such personalized advisory services foster stronger client relationships, driving loyalty and retention in a competitive market.

Enhanced Customer Service through AI-Powered Chatbots

Similarly, AI (Artificial Intelligence) is revolutionizing customer interactions within the banking sector and how they might seek out help. AI-powered chatbots are being deployed to handle routine inquiries and provide instant assistance, reducing wait times and enhancing customer satisfaction. These chatbots are integrated seamlessly into banking platforms, offering users real-time support and guidance. Moreover, AI-driven virtual assistants are being used to deliver personalized money management tips, empowering customers and members with actionable insights to make informed financial decisions.

Open Banking Initiatives

And while AI is implemented to assist clients, open banking ensures that clients retain ultimate control over their data. Open Banking represents a new era of connectivity and collaboration in financial services. By securely sharing customer information through APIs (Application Programming Interfaces), banks can build partnerships with third-party applications and services. This integration allows for enhanced functionalities such as aggregated financial insights, streamlined payment processes, and personalized financial recommendations.

Predicting and Preventing Fraud and Cyberthreats

Finally, with the increase of cyberthreats and ransomware, cybersecurity and fraud detection continue to trend as well. Effectively identifying and mitigating malicious threats calls for strategic planning and investments in tools and infrastructure. Investing in cybersecurity further enhances customer and stakeholder trust by committing to protecting their data and assets.

In conclusion, the banking and credit union sectors are embracing advanced analytics trends to enhance customer experiences, streamline operations, and drive sustainable growth. By leveraging technologies like AI, CRM, and open banking principles, institutions can deliver personalized services that cater to individual needs and preferences effectively. Embracing these trends not only positions banks as industry leaders but also ensures they remain relevant and responsive to evolving customer expectations in a digitally-driven world.

At Aunalytics, we are committed to empowering community banks and credit unions with cutting-edge solutions that leverage these trends. By partnering with us, community banks and credit unions can optimize their operations, strengthen customer and member relationships, and prevent cyberattacks and fraud events that can erode consumer trust. We believe in supporting our clients to ensure that they remain at the forefront of the financial services sector.