Aunalytics Dashboards Deliver Insights and Actionable Business Opportunities to Mid-Market Banks and Credit Unions to Achieve Greater Visibility into Data, Strengthen Regional Market Position, and Compete More Effectively

Dashboards Augment Capabilities of Aunalytics Daybreak for Financial Services Cloud-Native Data Platform to Drive Customer Intelligence and Higher Strategic Value

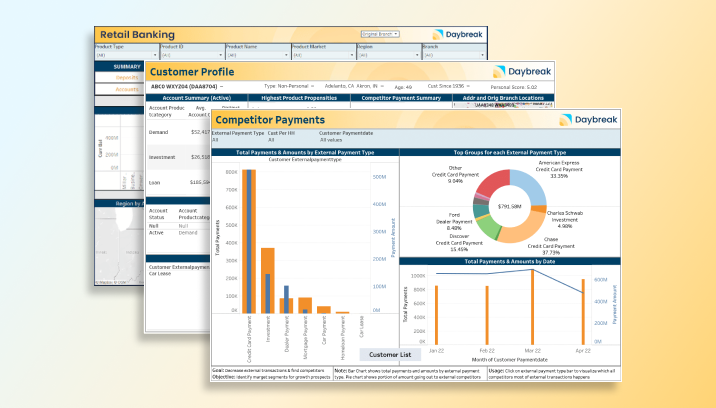

South Bend, IN (July 12, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today a new set of pre-built dashboards that augment the value delivered by the company’s DaybreakTM for Financial Services solution. The Daybreak dashboards are designed to deliver insights and actionable business results by revealing opportunities associated with customer, competitive, marketing, lending, and branch data and automatically presenting the data in a way that is easily understood, without any manual processes required.

Customer intelligence and personalized marketing in a digital world matters more than ever before, especially for mid-market banks that have traditionally relied on hometown, white glove service to win customers. With Aunalytics Daybreak for Financial Services, midsize financial institutions can target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. With the new Daybreak dashboards, mid-market banks and credit unions can achieve greater visibility into their data and identify more opportunities to strengthen their position in regional markets and compete more effectively.

The Daybreak for Financial Services cloud-native data platform integrates and cleanses data for accuracy and mines transactional data daily with AI-powered algorithms for customer intelligence and timely actionable insights that drive strategic value.

New Daybreak Dashboards include:

Customer Profile - This dashboard delivers an enriched profile of individual customers, powered by AI- insights that deliver intelligence on future customer growth beyond mere aggregations and reports of the past. The Customer Profile offers a 360-view of each customer including analysis of data integrated from multiple sources across the organization, and mined daily for timely fresh insights that can be acted upon. Banks can identify accounts that a customer has with competitors in order to make a more attractive offer to win their business and grow customer value. They can also determine the next best product offering for customers today, based upon their transactional behavior, and gain a deeper understanding of customers and the branches they use, beyond the origination branch.

Competitor Payments - Competitor Payments reveals insights for each customer, each competitor, and type of financial product. The dashboard tracks competitor payments by amount and how long they have been taking place so that a banker or credit union can determine when customers or members are likely to look for a new product, then create better offers as a result. Competitor Payments can drill down on credit cards, mortgages, auto loans, and investment products to identify a more competitive offer and use the segmented Customer List dashboard to target them. By using targeted competitive offers made to the right customers at the right time, banks can efficiently grow value from customers to increase net deposits.

Retail KPI - Retail KPI (key performance indicators) help banks to increase total deposits and accounts, and identify growth opportunities and potential. The dashboard delivers key performance metrics to retail leaders to understand the drivers of their account and deposit growth. It enables them to analyze deposits and balances over time and understand growth trends. It also provides data for overall institution performance, as well as detailed performance for each region, branch, market, product type and individual product to identify opportunities for growth and understand which branches are driving change.

Lending KPI - The Lending KPI dashboard delivers key performance metrics to lending leaders to understand the drivers of their loan and loan balance growth. It enables them to view trends over time for original loan amounts and outstanding loan balances. The dashboard provides data for overall institution lending performance and detailed performance of lending by branch, region, market, product type, and each product to uncover opportunities for growth and understand which products, team members, and branches are driving growth. The accompanying Lending Officer dashboard reveals performance insights by team member and shows loans closed and principle amounts over time.

Marketing KPI - This dashboard delivers key performance metrics to marketing leaders on campaign effectiveness to improve targeting and reduce account acquisition cost. It enables banks to target their institution’s marketing to reach the right customer at the right time with the right offer, making marketing operations more efficient and successful by using a data driven approach. Capabilities include:

- Track campaign performance by resulting deposits and new accounts

- Understand customer acquisition cost by region, branch and product type

- Assess account and balance growth by region, branch, and product type

- Understand new account demographics

Branch Reassignment - The Branch Reassignment dashboard delivers key information to business leaders to understand branch utilization and change over time based on where a customer originates and performs business. They can identify branch growth opportunities and areas where efficiencies can be improved, and view branch utilization to see customer banking patterns. With this, banks can determine which products to market at a particular branch and more precisely target those customers who are likely to need that product.

“Daybreak dashboards offer more than just reporting on the past. They connect the dots of relevant data and use predictive analytics to create a picture revealing intelligent insights that help financial institutions build smarter business strategies,” said Kyle Davis, Vice President of Daybreak, Aunalytics. “Designed to accelerate the value derived from AI-powered insights, Daybreak dashboards enable mid-market banks and credit unions to more clearly see the opportunities presented by their data and take action to increase net income and advance their competitive position.”

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Managed IT Services Drive Value for Mid-Sized Businesses

In today’s world, technology is essential to business. While many organizations simply see IT as a cost center, there are ways to mitigate these costs by utilizing managed IT services to increase reliability, reduce risk, and increase operational efficiency. Organizations must invest in IT to continue to stay relevant and secure in a changing world—employees working from home during and after the pandemic is a prime example. But this kind of flexibility requires continued innovation within the IT space, and mid-sized businesses oftentimes lack the resources to do so on their own. Managed IT solutions are the key to mitigating risk while continually improving business processes—providing real business value to the company.

In today’s world, technology is essential to business. While many organizations simply see IT as a cost center, there are ways to mitigate these costs by utilizing managed IT services to increase reliability, reduce risk, and increase operational efficiency. Organizations must invest in IT to continue to stay relevant and secure in a changing world—employees working from home during and after the pandemic is a prime example. But this kind of flexibility requires continued innovation within the IT space, and mid-sized businesses oftentimes lack the resources to do so on their own. Managed IT solutions are the key to mitigating risk while continually improving business processes—providing real business value to the company.

Increased Reliability

Modern businesses run on technology, making the IT department indispensable to daily operations. Unfortunately, outages can and do happen, and when they do, they can be very costly. Gartner estimates that on average, downtime costs companies $5,600 per minute or somewhere between $140K to $540K per hour. Even after an outage is resolved, it requires effort to restore lost data, make required updates, install necessary hardware upgrades, and ultimately get business back on track.

This worst-case scenario can be avoided by working with a managed IT services provider who works around the clock to manage hardware and software and will proactively address issues before they lead to costly outages and downtime.

Aunalytics offers a Secure Managed Services solution that includes 24/7/365 remote monitoring and management to mitigate the risk of your valuable infrastructure going down or becoming unavailable. Our advanced monitoring tool ecosystem allows us to not only respond to equipment that is reporting down in a timely manner, but also to proactively detect system issues and repair them ahead of downtime. Our remote monitoring agent includes client-based interactive support, performance management, alerting, asset management and reporting, while on-site support ensures issues can be resolved quickly at any time of day.

Reduced Security Risk

Ensuring that systems are up-to-date and constantly monitored is just one piece of the equation. Cyberattacks are an increasingly ubiquitous threat for businesses both large and small. In 2021, ransomware attacks increased by almost 105% worldwide, Fortune reports. And these increases are even higher in certain industries—in 2021, governments worldwide saw a 1,885% increase in ransomware attacks, while the health care industry faced a 755% increase, according to the 2022 Cyber Threat Report. In addition, attacks are becoming increasingly malicious and complex. Statista reports that the average duration of the downtime after a ransomware attack had increased from 15 to 20 days between Q1 2020 and Q4 2021.

Just as outages and disruptions due to technical issues can be avoided with proactive maintenance measures, there are steps organizations can take to avoid cyberattacks. McKinsey cites several tactics that have proven successful at mitigating cyberattacks which include: securing remote workstations, multifactor authentication, patch management, disabling user-level command-line capabilities and blocking TCP port 445, protecting Active Directory, and organization-wide education and training.

The in-house IT department of a mid-sized business could implement many of these tactics on its own, but generally these individuals are not data security experts. Knowing how to effectively monitor, manage, detect, prevent, and respond to cyberattacks is a very specialized skillset. Big enterprises have the bandwidth to take on these divisions. The mid-market does not.

By partnering with a managed IT services provider who is entrenched in the latest security best practices and strategies, mid-market companies avoid making costly mistakes and omissions. They can stay well-protected at all times. At Aunalytics, our security expertise includes proactive security services that your business needs to thrive. As threats evolve, your security solutions must adapt. We meet you where you are and guide you on a journey to mature your overall security posture and manage risk.

Increased Operational Efficiency

One of the biggest benefits to partnering with a managed IT services provider is increased operational efficiency. The IT team of a mid-sized business spends most of its time dealing with day-to-day challenges, and they don’t have time to think too far ahead. It can also be difficult for businesses to hire and retain IT talent. Mid-sized businesses increase operational efficiency when they utilize the talents of a managed IT services partner to advise, build, and maintain solutions on the forefront of technological advances. This partnership gives the organization’s internal team the freedom to focus on what they do best.

At Aunalytics, we strongly believe that innovation through technology makes teams more efficient. We are committed to helping organizations digitally transform by guiding and assisting them along every step of the journey. ultimately, allowing them to thrive by working side-by-side with existing teams to drive positive business outcomes through the use of Aunalytics’ technology and solutions.

Aunalytics Managed IT Services

To achieve our mission of helping mid-market businesses thrive, Aunalytics offers a wide range of managed IT and security services. It Aunalytics, we believe security is so vital that our Secure Managed Services solution includes embedded security. We offer everything needed to support the IT needs of mid-sized businesses, including:

- 24/7/365 Remote Monitoring & Management

- Synchronized Network Security Platform

- Internet Protection

- Workstation & Server Patching

- Office 365 Management & Security

- Email Filtering & Security

- Multi-Factor Authentication

- Data & Device Encryption Management

- Security Awareness Training

But at the core of all of our offerings is the team of experts that work side-by-side with clients to meet both their everyday needs and make improvements that will benefit them long-term. For urgent day-to-day issues, the Aunalytics Service Desk is available 24/7/365. Our Service Desk is comprised of knowledgeable technicians and engineers working in tandem to tackle technical issues—both simple and complex—that impact our clients. To keep your business moving forward for the future, we work with your team make improvements to your existing tech stack. With years of experience working with the mid-market, we are confident recommending new technologies and procedures your team may not even realize you need.

The technology and security experts at Aunalytics reduce your risk and increase your efficiency. Gain peace of mind by knowing that our team is there to support your tech initiatives and keep your business up and running and secure.

How to Assess True Branch Profitability in Mid-Market Banking - PDF

How to Assess True Branch Profitability in Mid-Market Banking

Branch profitability calculations are critically important for branch planning. Traditionally, the branch where a customer opens an account receives credit for that customer’s business. But it’s not always that simple. Learn how analyzing the right data can lead to more accurate results.

Data Scientists Need Usable Data

Data Scientists Need Usable Data

It is a well-known industry problem that data scientists typically spend at least 80% of their time finding and prepping data instead of analyzing it. Learn how a data platform can help mitigate this issue.