AI Solutions Accelerate Business Outcomes for Midsize Financial Institutions

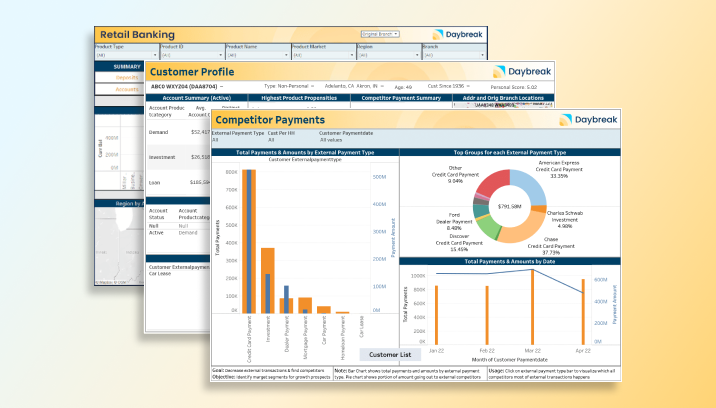

Midsize financial institutions make better decisions when they utilize AI solutions to discover insights in their data. By combining powerful analytics and intelligence services with an experienced data science team, organizations can gain access to an affordable alternative to HyperCloud-based AI solutions. The Aunalytics® Innovation Lab was established to fulfill the need for deep insights, catering to midsize financial services organizations lacking large AI budgets. This highly specialized team of data scientists produces data-driven analytic insights for companies seeking unique predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

To speed insights for financial services customers, the Innovation Lab has developed AI-powered Smart Features. Smart Features are customized to leverage insights obtained from data-driven machine learning models. By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments.

“Demand for intelligence services by financial services organizations is strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

As the financial services industry is one of the top consumers of business intelligence and analytics, these organizations are on the hunt for cutting-edge technology in their mission to identify customer preferences with regard to financial products as well as the need to better understand operational systems and conditions throughout the business. Data platform and predictive analytics solution providers like Aunalytics are the primary enablers behind many next-generation initiatives and are managing the lion’s share of this work for community banks and credit unions by extracting strategic insights, prioritizing market share, expanding products/services, and monitoring key performance indicators (KPIs) to maintain operational excellence. As a result, this has supported community financial institutions to better compete against national banks by strengthening the level of decision making, while empowering white glove service with powerful data analytics.

The Key to Data-Driven Success for Mid-Market Companies Starts Here

The Key to Data-Driven Success for Mid-Market Companies Starts Here

What’s the #1 pain point for IT professionals? According to the business knowledge resource Insights for Professionals, it’s data center management. With this reality in mind, the foundation of digital transformation success for a data-driven business must begin at the data center level, where servers store your data, CPUs power your computations, and your systems are ideally kept stable, operational, and secure for all users, including those accessing company systems and data from multiple remote locations. Competitive mid-market companies rely on data center engineers who specialize in uptime by proactively preventing downtime, as well as connectivity, storage, security, and monitoring.

What’s the #1 pain point for IT professionals? According to the business knowledge resource Insights for Professionals, it’s data center management. With this reality in mind, the foundation of digital transformation success for a data-driven business must begin at the data center level, where servers store your data, CPUs power your computations, and your systems are ideally kept stable, operational, and secure for all users, including those accessing company systems and data from multiple remote locations. Competitive mid-market companies rely on data center engineers who specialize in uptime by proactively preventing downtime, as well as connectivity, storage, security, and monitoring.

To read more, please fill out the form below:

Aunalytics Managed IT Services Safeguard Local Government Against Disruptive Weather, Cyber, and Pandemic Events

Partnering with Aunalytics for managed IT services has proven to be an extremely beneficial decision for one Ohio county government. Logan County, Ohio, has faced several significant events over the past few years, including severe weather, cyberattacks, and of course the pandemic—all of which challenged the resiliency of the county’s IT infrastructure.

Partnering with Aunalytics for managed IT services has proven to be an extremely beneficial decision for one Ohio county government. Logan County, Ohio, has faced several significant events over the past few years, including severe weather, cyberattacks, and of course the pandemic—all of which challenged the resiliency of the county’s IT infrastructure.

As a primarily rural area, the county is in short supply of experienced technology professionals available to assist with IT management. As a result, the decision was made to contract with a skilled managed IT services provider with regional operations. This has evolved into what is today a strategic relationship with Aunalytics where the IT services and solution provider is integrated both horizontally and vertically to oversee nearly all aspects of the county’s IT operations. This includes oversight of applications, as well as servers, storage, endpoint devices, security, networking, and data protection to ensure business continuity.

This partnership has been particularly beneficial as Logan County has faced a series of challenging events:

- A powerful storm damaged the county’s courthouse, resulting in a complete closure and relocation of court staff and systems. The IT and business recovery experts at Aunalytics helped to set up transitional offices, upgrade servers, desktops and laptops to enable remote access to all required information stores, allowing the court to proceed with operations. Once repairs to the courthouse were complete, relocation support back to the building began and re-orchestration of all IT infrastructure was completed by the Aunalytics’ IT services and support team.

- In early 2021, the Jobs and Family Services Office was also severely damaged after the weight of ice and snow collapsed the roof, necessitating evacuation to a temporary facility. As with the damaged courthouse, the managed IT services team coordinated with a rented facility prior to occupancy and wired the location for operations, minimizing downtime and facilitating the quick re-opening of the temporary office location in order to return services to the community.

- The past 12 months have also seen a recurring stream of cyberattacks, where Aunalytics has defended the county’s sensitive data and systems from downtime. However, in one instance, a server at the sheriff’s headquarters was struck by an attack, resulting in a printer issue. The attack occurred on a Friday when Aunalytics took immediate action and rectified the printer issue over the weekend, returning it to proper operation by Monday morning.

- Adding to the challenges, the COVID-19 pandemic began in March of 2020, causing a number of IT issues as county employees worked remotely, exposing a large number of computing endpoints in the form of laptops, desktops, printers and other network-connected devices outside of the county walls. Aunalytics assisted by improving virtual private network (VPN) services for much higher traffic volumes than usual and managed these systems so that county employees could re-establish their work environments from home where they would be protected against the contagious and, in some cases, deadly virus.

Measuring Success

The county measures the success of its outsourced IT operations by looking at uptime and risk mitigation. Aunalytics has provided an IT services foundation that reduces the number of internal employee hours allocated to IT management and monitoring. Aunalytics enables Logan County staff to work remotely in a much more efficient and reliable manner than otherwise possible. Furthermore, both the security and disaster recovery capabilities implemented have been exceptional, guarding the county against serious downtime for many years.

According to Jack Reser, Auditor of Logan County, “The causes of downtime in a distributed IT infrastructure can be innumerable and the county has definitely had its share of events putting its services at risk. However, Aunalytics has been a reliable IT services partner, quickly responding to our challenges and with expertise that ensures we are returned to the people’s business without delay. Aunalytics has been a steadfast IT partner that we plan to work with closely in 2022 and beyond.”

Learn more about how Aunalytics Managed IT Services have benefitted the Logan County government by downloading the full case study.

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Lowering Cybersecurity Insurance Premiums with Managed Security Services - PDF

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.