Aunalytics Announces FedRAMP Ready Status of Its Cloud

Cloud Hosting Services Are Tested and Confirmed to Meet the Trust Principles of Confidentiality, Availability, Security, and Privacy for Federal Government Agencies

South Bend, IN (June 29, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that its Aunalytics Cloud solution has achieved Federal Risk and Authorization Management Program (FedRAMP) Ready status and is actively working toward FedRAMP certification. Certified cloud-based products help U.S. federal agencies meet increasingly complex regulations and defend against cybersecurity threats, prevent data loss, enforce compliance, and protect agency domains.

FedRAMP is a government-wide program which is an assessment and authorization process that federal government agencies have been directed to use to ensure security is in place when accessing cloud computing products and services. By applying the FedRAMP framework to their evaluation, government agencies have a uniform assessment and authorization of cloud information security controls, alleviated cloud security concerns, and increased trust in the validity of assessments.

“FedRAMP Ready status and, ultimately certification, represents one of the highest compliance standards and third party validations of our cloud hosting services, giving federal agencies the utmost confidence that our offering is tested and confirmed to meet the trust principles of confidentiality, availability, security, and privacy,” said Kerry Vickers, CISO Aunalytics. “Meeting these rigorous standards will benefit all of our clients in every industry and enable us to expand our footprint within the government sector by providing federal agencies, as well as defense contractors and others required to use FedRAMP certified suppliers, with a cloud infrastructure that is FedRAMP compliant.”

Listed as FedRAMP Ready on the FedRAMP Marketplace, Aunalytics is seeking an agency sponsor as it moves toward the second phase of being FedRAMP authorized.

Tweet this: .@Aunalytics Announces #FedRAMP Ready Status of Its Cloud #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Where Can I Find an End-to-End Data Analytics Solution?

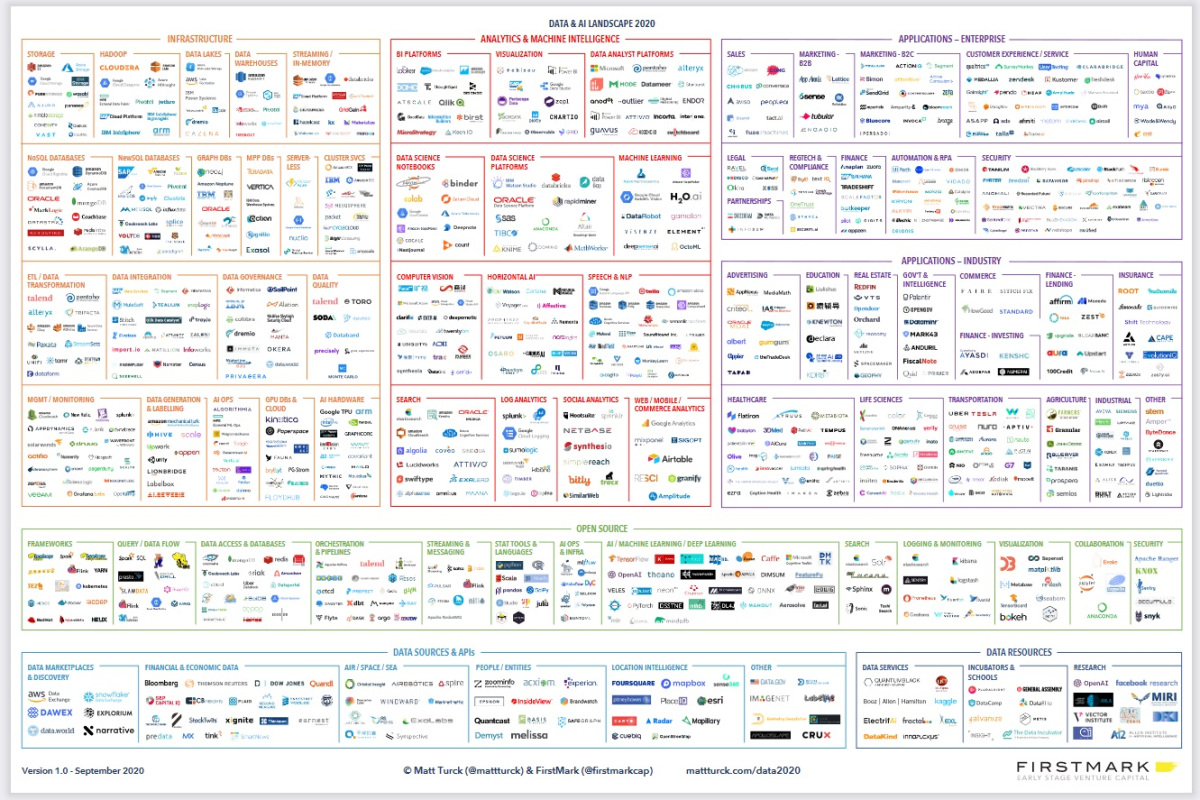

The data analytics landscape has exploded over the past decade with an ever-growing selection of products and services: literally thousands of tools exist to help business deploy and manage data lakes, ETL and ELT, machine learning, and business intelligence. With so many tools to piece together, how do business leaders find the best one or ones? How do you piece them together and use them to get business outcomes? The truth is that many tools are built for data scientists, data engineers and other users with technical expertise. With most tools, if you do not have a data science department, your company is at risk for buying technologies that your team does not have the expertise to use and maintain. This turns digital transformation into a cost center instead of sparking data driven revenue growth.

Image credit: Firstmark

https://venturebeat.com/2020/10/21/the-2020-data-and-ai-landscape/

Aunalytics’ side-by-side service model provides value that goes beyond most other tools and platforms on the market by providing a data platform with built-in data management and analytics, as well as access to human intelligence in data engineering, machine learning, and business analytics. While many companies offer one or two similar products, and many consulting firms can provide guidance in choosing and implementing tools, Aunalytics integrates all the tools and expertise in one end-to-end solution built for non-technical business users. The success of a digital transformation project should not be hitting implementation milestones. The success of a digital transformation project should be measured in business outcomes.

How to Assess True Branch Profitability in Mid-Market Banking

How to Assess True Branch Profitability in Mid-Market Banking

Branch profitability calculations are critically important for branch planning. Traditionally, the branch where a customer opens an account receives credit for that customer’s business. But it’s not always that simple. Learn how analyzing the right data can lead to more accurate results.

Fill out the form below to receive a link to the white paper.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Mid-Market Bank Achieves Targeted Marketing Success

Mid-Market Bank Achieves Targeted Marketing Success

Customers are increasingly demanding digital banking experiences, immediate results and responses to sales and service inquiries, and easy-to-use online platforms. While it is common for banks to invest in building mobile and online banking platforms, industry trailblazers are now harnessing the power of data and analytics to drive revenue and smarten operations.

Fill out the form below to receive the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

The Problem with Relying on Your IT Department for Data Analytics

The Problem with Relying on Your IT Department for Data Analytics

IT departments are primarily concerned with maintaining security and keeping systems operational. IT owns the business function of minimizing internal and external security risks and vulnerabilities, and maintaining core business systems and operations. By asking your IT department to implement data analytics, you are asking them to take focus off of what they are trained to do and dabble into new areas of technology without having the expertise to do so.

Fill out the form below to receive the white paper.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Why it is Important to Have Real-time Data for Analytics

Analytics based upon stale data provides stale results. Fresh data powers up-to-date decision-making.

Real-time data ingestion, integration and cleansing to create a golden record of business information ready for analytics is critical to make better business decisions. This type of ingestion uses technology such as change data capture to bring across only new bits of data – changes to the existing data – as they are made in the business. Streaming allows for efficient processing (cleansing, matching, merging), rather than piling up changes all day and batching them overnight for processing. Streamed data provides changes in real-time so that business decisions are not made based upon yesterday’s data. Although some data sources and systems only support batch transfer, data ingestion technologies are ready for when the core systems modernize. Hopefully the days of stalled analytics waiting for data to arrive will soon be behind us.

Without real-time data management, the time gap causes lags in decision-making that can cost companies time, money, and energy. Real-time data management enables:

- Rapid results

- Faster scaling

- Better decision-making

- More efficient data delivery

- Monetizing windows of opportunity

- Timely actions in response to current insights

- Improved and automated business processes

- Proactive decision-making instead of reactive

- Immediate responses as events unfold

- More personalized customer experiences

How to Use AI for Smarter Financial Institution Service

Data has long been used in decision making in the financial services industry. Statistical scoring models based on consumer data like FICO® have been used for half a century to guide lending decisions in the financial services sector. But today’s analytics space has evolved to the point where many other factors not easily digested by credit scoring bureaus play a roll. Imagine a deeper understanding of lending risk factors not commonly reported in credit scores:

- Number of changes of residence in the past five years

- Householding status (single or cohabiting/married)

Imagine having the ability to look at a particular client and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our financial products is this customer most likely to choose next?

- How likely is this customer to default or become past due on a mortgage?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics financial services experts understand the most pressing business questions specific for this industry. Working with our financial services experts, Aunalytics’ Innovation Lab data scientists have developed proprietary machine learning, AI and deep learning algorithms based on a solid understanding of the data commonly collected by financial institutions. Our data engineers understand the types of data commonly created and used by the industry, common data sources and have created integrations to bring data from across a bank together into a single analytics-ready feed. The end result is data organized into industry specific relational data marts ready to answer questions posed by business users from financial services institutions.

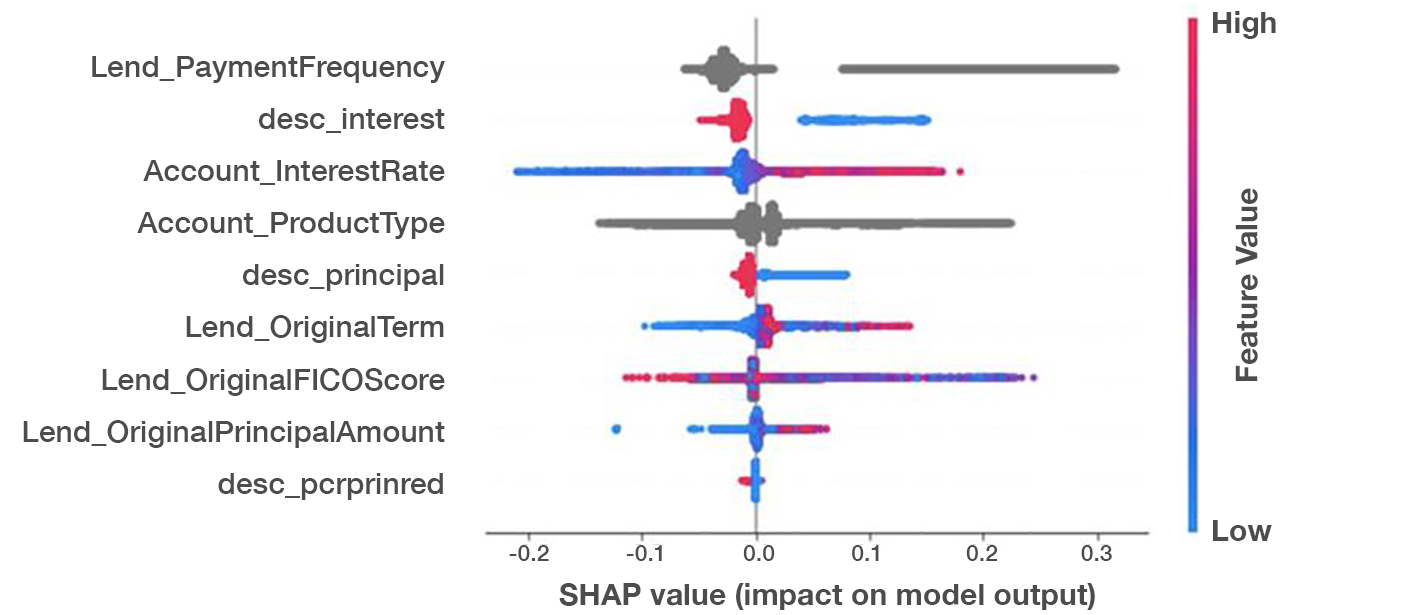

A SHAP value chart for a remarkably accurate loan default risk model we developed. A benchmark with testing data provided by one client was able to predict 30% of that customer’s loan defaults with 99% accuracy, or predict 75% of all loan defaults with 75% accuracy (i.e. 0.99 precision at 0.3 recall or 0.75 precision at 0.75 recall).

Take the example of a recent model we developed at Aunalytics to predict loan default risk. Looking at a chart of the SHAP (Shapley Additive Explanations) values for this model, we can see a number of common-sense observations confirmed. For example, high interest loans (represented by a pink dot in the Account_InterestRate line) and low FICO scores (represented by a blue dot in the Lend_OriginalFICOScore) positively correlate with default risk. This model discovered some much less intuitive characteristics of high risk loans as well: For some loans, payment frequency (Lend_PaymentFrequency) was actually the single most important factor for predicting loan defaults. Moreover, a well-known but not always properly appreciated factor to default risk is illustrated visually: the type of loan being underwritten (Account_ProductType) is in many cases just as important as a customer’s credit score to default risk. Auto loan applicants with high FICO scores might be more of a default risk than customers with low credit scores shopping for a home mortgage.

In so many cases, machine learning techniques enable more accurate and understandable models of risk, propensity, and customer churn because they represent a more complex model understanding of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Through AI and machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with financial services businesses.

Aunalytics to Participate as a Silver Sponsor at the Michigan Bankers Association Annual Convention

Leading Data Platform Provider Will Feature Daybreak for Financial Services Providing Mid-sized and Community Banks with Valuable Business Insights Using Advanced Analytics to Accelerate Competitive Advantage

South Bend, IN (June 9, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will participate as a Silver Sponsor at the upcoming Michigan Bankers Association Annual Convention, June 16-18 on Mackinac Island, MI. The company will showcase its DaybreakTM for Financial Services solution that enables bankers to better target and deliver new services and solutions for their customers to remain competitive. On the last day of the convention Aunalytics’ Client Relationship Director, Taylor Oake, will have the honor of introducing the final keynote speaker, Kyle Carpenter, the youngest living recipient of the Medal of Honor.

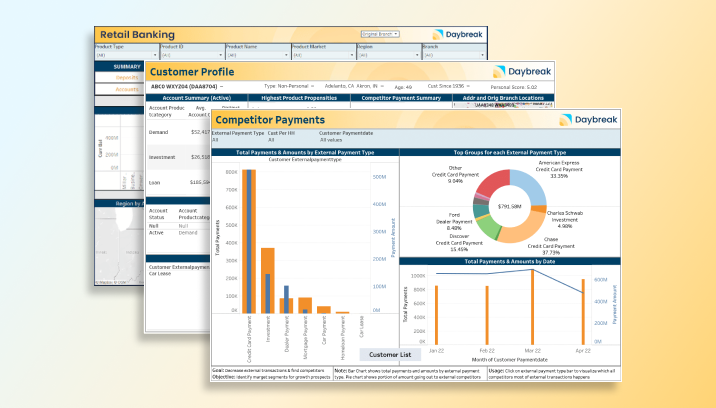

Built from the ground up for mid-sized community banks and credit unions, Daybreak for Financial Services is a cloud-native data platform with advanced analytics that empowers users to focus on critical business outcomes. The solution seamlessly cleanses data for accuracy, ensures data governance and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and business insights for competitive advantage.

“Financial institutions have a massive amount of data that is typically siloed across the organization. Aggregating and integrating this data is difficult and time consuming,” said Rich Carlton, President, Aunalytics. “The utilization of digital banking platforms enables them to harness the power of their data to gain valuable insights and better target and deliver new services and solutions for their customers. We’re pleased to be a silver sponsor at the upcoming Michigan Bankers Association convention and show how our Daybreak for Financial Services solution can help bankers intelligently anticipate customer needs and deliver the right products and services at the right time.”

Tweet this: .@Aunalytics will showcase its advanced analytics data platform at @mibankers Annual Convention #Dataplatform#Dataanalytics#Dataintegration#Dataaccuracy#ArtificialIntelligence#AI #Masterdatamanagement#MDM#DataScientist#MachineLearning#ML#DigitalTransformation#FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Sabrina Sanchez

The Ventana Group for Aunalytics

(925) 785-3014

sabrina@theventanagroup.com

What is the best analytics tool for business users?

What is the best data analytics tool for business users? As more business leaders face this question in recent years, most are finding just how hard it is to answer. The data analytics landscape has exploded over the past decade with an ever-growing landscape of products and services: literally thousands of tools exist to help business deploy and manage data lakes, ETL and ELT, machine learning, and business intelligence. With so many tools to piece together, how do business leaders find the best one or ones?

As with most things, the best tool set is simply the one that tailors itself best to the problems and questions that need to be solved. For some users, this could be how to integrate and clean data across siloed systems. Others may want to know how to publish analytical datasets of relevant data and metrics to analysts and marketing researchers. Others may have questions about how to derive value from large amounts of data with machine learning.

The Answers Platform

Aunalytics has built its data platform of tools to answer all of these questions. We believe in providing answers to questions with our integrated data analytics platform and leveraging our industry expertise to put these tools to work for you.

Unlike most tools on the market, Aunalytics provides a comprehensive, end-to-end data platform with all the tools your organization needs:

- Data integration, cleaning, and migration in the loud with Aunsight™ Golden Record

- Data transformation, processing, and delivery with Aunsight Data Platform

- Machine Learning and Artificial Intelligence with Aunsight Data Lab

- Delivery and exploration of the data lake with the Daybreak™ Analytical Database

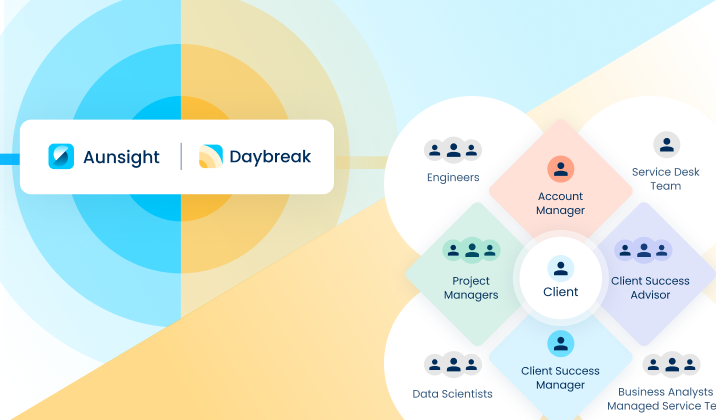

Side-by-Side Service Model

More importantly, Aunalytics’ side-by-side service model provides value that goes beyond most other tools and platforms on the market by providing access to human intelligence in data engineering, machine learning, and business analytics. While many companies offer one or two similar products, and many consulting firms can provide guidance in choosing and implementing tools, Aunalytics integrates all the tools and expertise in one company as your trusted partner in digital transformation.

A Comprehensive Platform

While there are a large number of options to choose from, we at Aunalytics believe our distinctive approach and comprehensive platform tools provide the best solution for all but the largest companies who may wish to create custom analytics solutions in-house. Wherever you are on the data analytics journey, from just beginning to explore the possibilities in your data to global companies with established data science teams, Aunalytics can provide a path through the complicated landscape of tools and infrastructure to grow your company’s data analytics program.