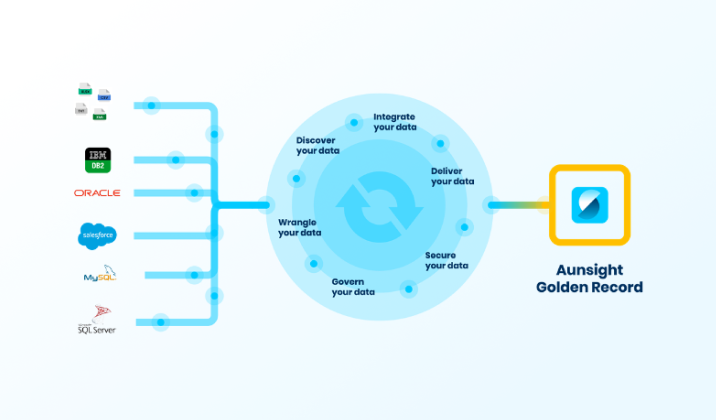

Integrate & Wrangle Siloed Data into a Single Source of Truth with Aunsight Golden Record

With Aunsight Golden Record, you don’t need dedicated resources with deep technical knowledge of code writing, data mapping, and building data models to perform months of mapping projects or build custom APIs. Pre-built smart API plugins easily profile your data and connect your sources to the platform in minutes. With a large library of available plugins, Aunsight Golden Record integrates all of your data sources and third party sources. From data silos to clean, integrated data to golden records of accurate business information.

Watch the video below to learn more about Aunsight Golden Record:

Aunsight Golden Record includes features that automate tasks required to the integrate and wrangle siloed data:

- Data Integration: No custom code or glue code required to use our platform. We’ve done the heavy lifting—just configure and go. Powerful pre-built connectors enable seamless integrations in minutes.

- Data Mapping: Auto-map to all your data sources. No more gruesome mapping projects to move your data. Find the data you are looking for quickly and easily with automatic schema discovery.

- Data Quality: Automated data quality checks, cross system comparisons and data quality notifications help you set and enforce data quality standards. Use data profiling results to set quality checks based upon expected values, ranges and anomalies.

- Data Matching & Merging: Automate de-duplication and relationship discovery of data across all your systems using fuzzy matching algorithms and ML on individual data fields. Combine data in motion in real-time from multiple sources to build and maintain a Golden Record that can be trusted.

- Data Governance: Data flow events are automatically retained and captured to show you where data came from and where it goes—changes made to your data over time are tracked in our audit trail timeline. Build a data catalog or dictionary as a foundation for governance.

- Data Delivery: Replicate your Golden Records of accurate business information forward to data warehouses, data lakes, dashboards or reporting applications. Our bidirectional sync allows you to write the accurate information back to source systems so that your entire organization operates off of the same information.

Our solution provides technology and automation of data integration and wrangling, so you can focus on achieving business outcomes. Click here to learn more about Aunsight Golden Record.

Predictive Customer Insights Drive Positive Business Outcomes for Community Banks and Credit Unions

Daybreak™ Customer Intelligence for Financial Institutions uses data from across your enterprise to reveal actionable, predictive customer insights. As a community bank or credit union, you know that providing white glove service is your competitive differentiator. The ability to anticipate needs not only leads to happy customers and members, but also leads to increases in revenue and reduced costs. But in order to make accurate predictions, you need access to the right data.

We know that transactional data tells a story…if you can interpret it. Reports from banking cores only show you the past. You need to be proactive—predictive customer insights enhance your white glove services so you can compete with larger financial institutions. We also know that smaller financial institutions usually don’t have the technical talent for advanced analytics, machine learning, and AI, or don’t know where to start to become data-driven. As a result, they do not achieve value from technology investments.

At Aunalytics, we believe that it takes the right combination of people and technology to achieve value. Daybreak gives you access to a team of technical experts paired with an end-to-end data platform. Instead of trying to piece together tools and technologies, we build and maintain the solution for you.

Watch the video below to learn more about the benefits of Daybreak’s predictive customer insights:

With Daybreak’s customer intelligence insights, you can:

- anticipate customer and member needs by offering the best product at the right time,

- grow relationships by winning business when your customers have products with competitors,

- reduce risk by predicting likelihood of loan default at the time of application, and recognize who is at risk for crypto-fraud, and more.

Daybreak provides an end-to-end solution, including both technology and expertise, so you can focus on business outcomes. Click here to learn more about the Daybreak solution.

Aunsight Golden Record creates a single source of truth for credit union data

Credit unions have a great deal of data spread across various systems. However, it is impossible to create a centralized, accurate and up-to-date record of all of this data manually. Aunsight™ Golden Record automates this process by aggregating, cleansing, and merging data into a single source of truth so credit unions have access to an accurate record of their data in one place.

Watch the video below to learn more about how Aunsight Golden Record, along with the expertise of the Aunalytics team, can help credit unions quickly and painlessly take charge of their data:

Daybreak's built-in data connectors and integrations speed insights for financial institutions

Got data? There’s a Daybreak connector for that! Our customer intelligence data platform, Daybreak™ for Financial Services, has built-in connectors for the financial services industry so credit unions and banks can put an end to siloed, disparate data. Daybreak connects to most relevant data sources, including core, lending, wealth, CRMs, and mobile banking. Whether structured or unstructured, on-prem or in the cloud, Daybreak can handle all types of data and sources.

In addition, Daybreak can feed cleaned, updated data to other systems you may be using, including BI platforms or analytics tools, through pre-built integrations. Watch the video below to learn more about Daybreak’s connectors and integrations.

Daybreak's Predictive Smart Features Add Additional Value for Credit Unions

Is your credit union in a position to hire experienced data scientists who will develop predictive algorithms to enrich your member relationships? With Aunalytics, you can take advantage an entire team of data science talent. Our customer intelligence data platform, Daybreak™ for Financial Services, includes industry relevant Smart Features™ —high value data fields created by our Innovation Lab using advanced AI to provide high-impact insights.

Watch the video below to learn more about how Smart Features provide additional value for credit unions.

Credit Unions Realize Business Outcomes Sooner by Utilizing Aunalytics' Expertise

Aunalytics speeds time to value for credit unions looking to dive into analytics. By offering a well-rounded team including technology experts—such as data engineers and data scientists—and subject matter experts with experience in the financial services industry, Aunalytics is able to implement our Daybreak solution quickly and get credit unions actionable business answers using machine learning and AI.

Watch the video below to learn more about how our team gets credit unions the answers they need faster.

Aunalytics on ActualTech Media's Spotlight Series

Aunalytics on ActualTech Media's Spotlight Series

Aunalytics CMO Katie Horvath sat down with David Davis of ActualTech Media to discuss helping companies with their data challenges. By providing Insights as a Service, we make sure data is managed and organized so it’s ready to answer your business questions.

Discovering the Keys to Engineering a Successful Digital Transformation Strategy (UofM)

Discovering the Keys to Engineering a Successful Digital Transformation Strategy

Katie Horvath speaks to the University of Michigan School of Engineering

Want to learn how to engineer a successful digital transformation strategy?

Watch the presentation!

Catch Katie Horvath’s, Aunalytics Vice President of Marketing & Communications, presentation to the University of Michigan School of Engineering sponsored by the IOE Department on “Discovering the Keys to Engineering a Successful Digital Transformation Strategy.” As a U of M IOE alumni, Katie shared industry insights with the engineering students, for what companies look for in data driven strategies. Rather than engineering new features for the sake of being cool, digital transformation must be tied to business outcomes including driving revenue and cutting costs. What are common pitfalls standing in the way of digital transformation success? How can we engineer data management for success? How do we transform data from a product of business into an asset? Learn why digital transformation projects fail and how to position a company to become data driven.