4 Questions Mid-market Companies Should Ask Themselves About Data Protection

4 Questions Mid-market Companies Should Ask Themselves About Data Protection

How safe is cloud security, which now often relies on “zero trust” security principles based on a user’s location rather than user credentials? While some worry that cloud security is less reliable than on-premise security, that’s not actually the case, particularly for mid-market businesses. The fact is that your data is actually more secure in a remote data center managed by security experts than by your in-house IT team.

You may feel a false sense of security by having your IT department guard your servers in a closet — but this strategy is extremely risky when it comes to data protection. It’s not standard for mid-market IT departments to possess expert skills in cloud security and data security, which are needed to properly safeguard data. Many mid-market companies, particularly those not in highly regulated industries, do not currently have Security Operations Centers.

What’s more, it came to light at the end of 2021 that cyber-insurance renewals are becoming at times prohibitively expensive for all industries due to the exponential increase in cyber-attacks seen last year. The only way for mid-market companies in all industries to lower cyber-insurance premiums and ensure coverage is to implement enhanced data security measures.

Since data protection has become the most prevalent challenge in the cybersecurity market, it’s no surprise to see that according to Insights for Professionals, data protection is the main focus in 2022 for 85 percent of businesses surveyed; 37 percent plan to invest up to $500,000 on data protection in 2022, and 31 percent plan to invest more than $500,000 on data protection over the next 18 months. McKinsey also reports that 85 percent of midsize enterprises plan to boost their IT security spend until 2023.

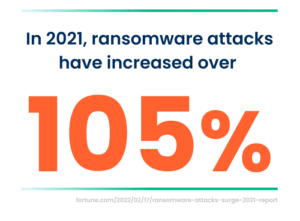

All-Time High Cybercrime

McKinsey reports that there are multiple motivations for these attacks, headed by the fact that pandemic-weary companies have become ripe for security vulnerabilities. Also, as advancing digitization continues to drive connectivity and employees now log in from anywhere — including unsecured home networks — it makes life easier for ransomware hackers. The traditional smash and grab approach is now being replaced with bad actors “dwelling” undetected within victims’ environments, which gives cybercriminals the lay of the land in understanding where the highest value information resides before selling it to the highest bidder.

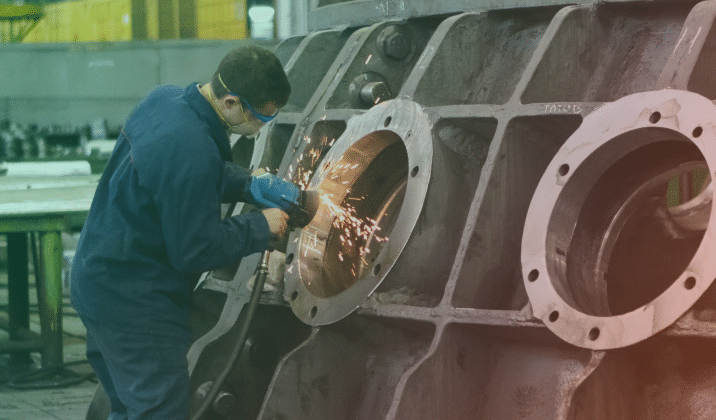

Another motivation for the continued attacks is their success: as more companies are forced to pay ransoms, hackers are further incentivized to build on their well-paid victories and continue innovating on this lucrative threat. Specific sectors are particularly at risk; keep in mind that in the U.S., supply-chain attacks rose 42 percent in Q1 of 2021, victimizing as many as 7 million people, while McKinsey shared that “security threats against industrial control systems and operational technology more than tripled in 2020.” The war in Ukraine has taught us lessons about attacks compromising infrastructure, utilities and government that can debilitate nations and be weaponized.

Paying Up

These massive numbers can seem overwhelming, and can also make it difficult to tell how much a ransomware attack can affect an individual company. To give you some perspective, consider these stats:

- NPR reported that Colonial Pipeline paid a $4.4 million ransom after the company shut down operations.

- CNBC reported that global meat producer JBS paid ransomware hackers $11 million.

- Insider reported that global insurance provider CNA Financial forked over a reported mind-blowing $40 million post-cyber-attack.

- The Washington Post reported that a ransomware attack on U.S. software provider Kaseya targeted the firm’s remote-computer-management tool and endangered up to 2,000 companies globally.

These costs are also just the tip of the iceberg for the companies victimized by ransomware hackers. Additional costs of such an attack include everything from paying third parties (like legal, PR, and negotiation firms), not to mention the opportunity costs of having executives, staff, and teams disconnected from their day-to-day roles for weeks or months to deal with the attack’s aftermath. Perhaps the biggest unaccounted-for expense is the resulting lost revenue.

Ask These 4 Questions

What can mid-market companies do in the face of these threats to their data’s safety? They should focus on strategies that address ransomware prevention, preparation, response, and recovery. Since this is an ongoing journey, threats continue to evolve and improve — so it’s critical to keep up to date with new threats of increasing sophistication, while being ready with cybersecurity strategies and best practices. The goal is to continue to build cyber maturity that creates a resilient approach. You may not be able to stop attacks from occurring, but when they do, they won’t have the same impact if you’ve prepared in this way.

As a starting point, these are four questions that every mid-market company should ask itself to determine the organization’s readiness for data defense:

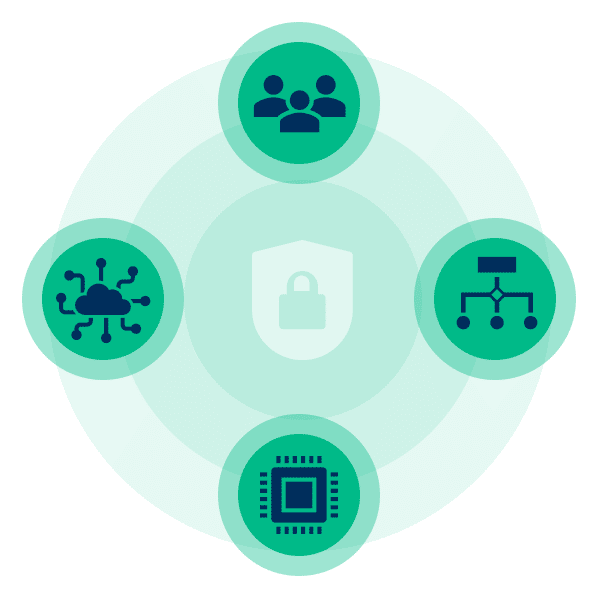

- When it comes to our people, do we have security focused IT leadership, trained cloud security experts, and data security experts?

- When it comes to our process, do we have defined IT security processes for proactively managing the security posture of our environments?

- When it comes to our technology, are we 100 percent confident in our security tech and our ability to actively monitor and detect threats around the clock?

- When it comes to our cloud architecture, are we confident that it allows for scalability without sacrificing security assurances?

If the answer is “no” or “I don’t know” to any of these questions, it is time to get your house in order — you are at risk. To stay alive, compete, and drive value, mid-market companies should shift their focus to data analytics, data management, security, and compliance. This requires a cloud-based data center, a cloud-native data management platform, and cloud-native analytics. Ensuring the right infrastructure to maximize the capabilities of data centers — and how they are able to manage and store data — is crucial to effective mid-market digital transformation.

Lowering Cybersecurity Insurance Premiums with Managed Security Services - PDF

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.

How to Assess True Branch Profitability in Mid-Market Banking - PDF

How to Assess True Branch Profitability in Mid-Market Banking

Branch profitability calculations are critically important for branch planning. Traditionally, the branch where a customer opens an account receives credit for that customer’s business. But it’s not always that simple. Learn how analyzing the right data can lead to more accurate results.

Data Scientists Need Usable Data

Data Scientists Need Usable Data

It is a well-known industry problem that data scientists typically spend at least 80% of their time finding and prepping data instead of analyzing it. Learn how a data platform can help mitigate this issue.

The Key to Data-Driven Success for Mid-market Companies Starts Here

The Key to Data-Driven Success for Mid-Market Companies Starts Here

Effectively managing data to support accessibility and security requires consistent monitoring and up-to-date solutions. Yet the latest research shows that investing in on-premise infrastructure for data management, compliance, and analytics is too pricey for most mid-market companies — and from the view of many IT directors, on-premise solutions have already morphed into old relics. In 2022, Insights for Professionals reported that nearly two-thirds (63 percent) of senior IT leaders and company executives aren’t planning to attempt to maintain servers on-premise. Instead, the majority of leaders surveyed plan to invest in cloud infrastructure as a service.

Moving into the Future

In short, entire businesses are migrating to the cloud, not just the technology. The infinite growth of data, applications, connections, and workloads will only further exacerbate businesses’ ability to adapt to new lines of business applications and platforms, meet security and governance requirements, and seamlessly orchestrate and analyze data for business outcomes. As a result, a growing number of mid-market companies are recognizing the value of working with partners to transition storage, computing, backup, and hosting services to cloud-based platforms to leverage the scale and compute power they can provide.

Gartner reports that by 2025, the vast majority — 85 percent — of enterprises will have already shifted over to a cloud-first approach. How did this changing of the guard occur so quickly? According to Gartner, it can be traced in part to the COVID-19 pandemic, which has accelerated cloud adoption since 2020, ushering it in as the “de facto new normal.” Gartner analysts including Gregor Petri even go so far as to state that “enterprise architecture and technology leaders should reject any new product that does not follow ‘cloud first’ as a guiding principle.”

Mid-Market Essentials

There are solid reasons behind mid-market businesses moving their data out of on-premise environments, particularly due to the efficiencies obtained from cloud-based business applications in multi-cloud and hybrid environments. This brings us back to data center vendors, who must then be ready to absorb the responsibility and cost of infrastructure capital expenses and maintenance — and it looks like many are already prepared to do so. In 2022 alone, nearly one-third (32 percent) of those surveyed by Insights for Professionals were planning to invest heavily in cloud management, to the tune of $500,000, while nearly 30 percent plan to spend even more. The largest part of this cloud management investment is being channeled toward security, with enterprises intending to spend 82 percent of this budget on data protection.

This is not a passing trend and is expected to have long-term consequences for purchase decisions in mid-market companies. By 2023, as scalability and cohesive cloud ecosystems join the ranks among the top three buying considerations for IT, Gartner anticipates that cloud architects will become key stakeholders when choosing tools for analytics and business intelligence. Here’s another surprising statistic to show the direction we’re heading in: while hyper-scale cloud providers (hyper-scalers) delivered and managed less than 1 percent of installed edge computing platforms in 2020, Gartner predicts this number to balloon to 20 percent by the end of 2023.

Different Needs for Mid-Market Players

There’s a catch, though, about hyper-scalers: most are not built for the mid-market. Therefore, mid-market companies won’t be able to reap the maximum benefit from the ability of traditional hyper-scale cloud providers to bring global business solutions, outsourcing, and consulting capabilities that can help other types of organizations migrate to, adopt, and build cloud-native offerings. It’s true that traditional hyper-scalers excel in leveraging the expertise of their cloud professionals to consult for platform re-architecture, application development, data migration, and transitioning services from technology stacks into macro- and microservices hosted in a data center on-premise, private cloud, public cloud (or any multi-cloud or hybrid combination thereof) — but not generally for mid-market companies.

Let’s drill down into some specific problems for mid-market players around hyper-scale cloud providers:

- It can be cost-prohibitive to obtain the level of help that most mid-market companies require, since most hyper-scalers are priced for large enterprises. Mid-market companies tend to need “white glove” services, which carry the highest price tag.

- Greater needs. Enterprises are more likely to already have in-house teams with the necessary skillsets to work with traditional hyper-scalers, compared to mid-market businesses that often have higher needs for expert help.

- No data analytics. While many enterprise hyper-scalers help migrate data to third-party cloud vendor platforms, their services end there, as they don’t offer data analytics.

Mid-market companies need technical experts to help build solutions on a mid-market budget — specifically, they require a hyper-scaler capable of providing an end-to-end solution focused on the mid-market sector. The goal in evaluating potential solutions providers should be for the cloud foundation to operate seamlessly with end-to-end data management and analytics solutions. With an end-to-end solution, mid-market businesses have the opportunity to obtain the results they desire without wasting time on a “Frankenstein” approach, assembling parts and pieces of multiple technologies and tools in an attempt to construct a reliable system that actually works. It’s only by going the end-to-end route that mid-market companies can receive the greater level of assistance they need on the technology front, as well as benefit from the robust data and analytics skillsets necessary to achieve meaningful business outcomes, without paying enterprise prices.

What Mid-Market Companies Need for Data-Driven Success and How to Get It

What Mid-Market Companies Need for Data-Driven Success and How to Get It

Using your data as an asset to drive competitive business growth and achieve cost cutting operational efficiencies is imperative for a company to compete, survive, and thrive. Increasingly, data and analytics have become a primary driver of business strategy and the potential of data-driven business strategies is greater today than ever.

Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions

Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions

Aunalytics CMO Katie Horvath explains how midsized banks and credit unions can enhance the customer or member experience by becoming more data-driven. Employing these strategies can lead to increased revenue, lower expenses, and increased operational efficiencies.

Aunalytics Managed IT Services Safeguard Logan County Ohio Against Disruptive Weather, Cyber, and Pandemic Events - PDF

Aunalytics Managed IT Services Safeguard Logan County Ohio Against Disruptive Weather, Cyber, and Pandemic Events

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions - PDF

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The allure of investing early in the “next big thing” has led to increased interest in crypto investment. As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big lose. As a bank or credit union, here’s what you need to know to protect your institution.

Aunalytics Powers Data Insights and Positive Outcomes for Horizon Bank Customers - PDF

Aunalytics Powers Data Insights and Positive Outcomes for Horizon Bank Customers

Community Bank Takes Strategy-First Approach to Streamline Customer Intelligence and Business Operations