Cyber Insurance Continues to Skyrocket—Do You Have a Security Strategy in Place?

Cyber Insurance Continues to Skyrocket—Do You Have a Documentable Security Strategy in Place to Show You’re Prepared?

Cyber risk is a growing critical concern for organizations of all sizes and public entities globally, as we continue to rely on information technology and digital devices. But in the wake of steadily rising digital threats, cyber insurance is getting increasingly expensive—and difficult—for companies to procure.

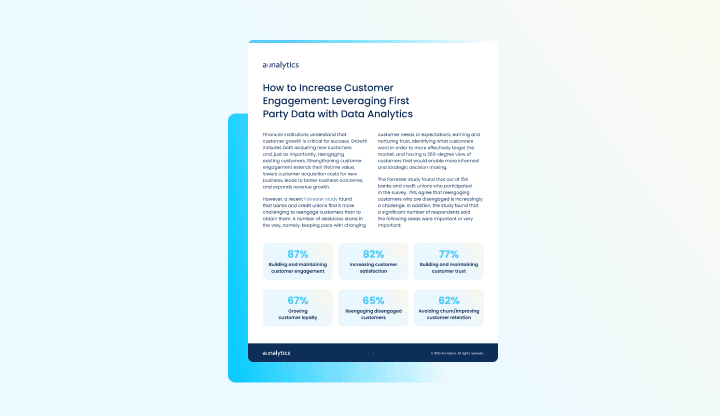

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Does Your Mid-Market Firm Have the Right Talent to Maximize Its Data Tech Investments?

Does Your Mid-Market Firm Have the Right Talent to Maximize Its Data Tech Investments?

Investing in digital transformation technologies can be a waste of money if your company forgets one important point. That point is, no matter how cutting edge the tech or tool may be, people are needed with specific technical expertise in order to derive true business value from these investments.

Unlike large enterprises, mid-market companies often try to find this expertise in their IT manager, hoping a jack-of-all-trades approach will take care of it. This is an unfortunate mistake, since it would require the IT manager to have unusual command over a long laundry list of duties, from data integration, ingestion, and preparation to data security, regulatory compliance, data science, and building pipelines of data ready for executive reporting from multiple cloud and on-premises environments. This is not just a tall order for a mid-market IT manager to pull off, but likely an impossible one.

At the same time, it’s unreasonable to expect that most mid-market firms can hire an entire division of data experts—who each need to be highly compensated—in order to achieve the organization’s digital transformation goals. Even if a mid-market player could afford it—which is unlikely to make economic sense—these talent resources are scarce and in high demand.

If you’re still wondering whether your IT manager’s skill set, leveraged by your in-house IT technicians, can properly run the gamut required to achieve value from your data technology investments, consider that the person in this position would need the ability to master a wide range of skill sets, from cloud architecture, database engineering, and master data management to data quality, data profiling, and data cleansing. More specifically, your IT manager would need to take on five additional specialized roles for technical talent that are critical for achieving value from data technology investments.

These roles are:

Chief Data Officer/Chief Digital Officer

A chief data officer (CDO) is focused on—you got it—data. Most mid-market companies understandably don’t have a CDO, which means they don’t have anyone who assures regulatory compliance for data handling while managing and exploiting information assets, reducing uncertainty and risk, and applying data and analytics to drive cost optimization and revenue objectives. For IT managers to fulfill a CDO role, they’d have to be equipped to bring a global perspective to company data, help their organization gain competitive advantage over peers, and manage data and analytics. They’d also need the ability to secure data, transform it into valuable business information, lead digital transformation initiatives, and use data for growth and operational efficiency.

Cloud Engineer

The primary job of a cloud engineer is to keep cloud data centers operational and secure for ecosystem users to be able to store and access their data. Cloud engineers are experts in minimizing downtime, managing access to data, managing compute and storage, and setting up cloud architectures for clients, tenants, and containers. They also monitor data center hardware, servers, networks, and communications systems for operational continuity and efficiency.

Data Security Expert

Mid-market firms also need a way to channel the talents of a data security expert, CISO, or cybersecurity director to ensure cyber-security for the company’s data. Data security experts must keep current on emerging threats while executing data security strategies to fend off and remediate attacks. This involves a wide range of duties, including working closely with the IT team to run the company’s Security Operations Center (SOC), constantly monitoring servers, networks, and workstations for security threats, and staying up to date on the changing compliance laws and regulations for the business, to name a few. While larger IT teams have bandwidth to fill cybersecurity needs inhouse, many midmarket IT teams do not have capacity for the 24/7/365 monitoring and security edits needed to thwart attacks, let alone bandwidth for executing on mitigation and response strategies needed to overcome them.

Data Engineer

A data engineer’s primary job is to prepare data for analysis or operational uses, which involves integrating data from different sources, as well as implementing and executing data profiling, cleansing, transforming, and normalizing data. Data engineers also work with data in motion and use master data management to ensure data consistency across an organization. Finally, a data engineer is your go-to technical resource for database construction and management, helping to optimize the company’s data ecosystem.

Data Scientist

It should be clear now why a mid-market IT manager should not be expected to take on these additional professional roles, but in case there’s any doubt, keep in mind that a data scientist is also needed. Data scientists develop algorithms and leverage deep learning models to analyze data with artificial intelligence and machine learning. The data scientist creates the “brain” of the data analytics solution to position it for providing accurate answers based on business information. Data scientists also mine data to find opportunities for business growth and efficiency. Ideally, the data scientist uses tools that enable non-technical business users to query data sets without having to write SQL or other code.

Master of One

If you’ve correctly determined that your mid-market IT department does not have enough time to absorb these data roles into their regular duties of keeping your company systems stable and responding to help desk tickets from your team, don’t despair. There’s a viable solution for mid-market businesses with this dilemma: they can partner with data experts who provide a side-by-side model coupling technology with talent. This allows the mid-market to efficiently compete, leveraging the necessary skillsets to achieve digital transformation success.

What does successful mid-market digital transformation require? The key is to have a cloud-based data center, a cloud native data management platform, and cloud native analytics, thus shifting the burden of procuring and maintaining the infrastructure to a third-party vendor in the data industry. Instead of attempting to reinvent the wheel in house, mid-market players should ensure they’re partnered with the right infrastructure to maximize the data-center capabilities, and data storage and management, for effective digital transformation.

Mid-market firms can gain the benefits of working with a wide range of experts including cloud engineers, data engineers, security experts, data scientists, and other highly skilled technical resources if they establish a partnership with a data platform company. By opting for this type of side-by-side expert help, the mid-market can achieve true business value—without needing to hire an entire data team.

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

How to Win Wallet Share While Cutting Costs in Financial Institution Operations

In a recession economy, it is imperative to cut costs and employ efficient strategies to grow operating income. Here’s what banking institutions can do to make marketing and sales teams more efficient, and achieve better returns.

Bridging the Mid-Market Talent Gap for Digital Transformation

Bridging the Mid-Market Talent Gap for Digital Transformation

To achieve business value from data technology investments, mid-market companies need the right technical expertise and talent. Yet many mid-market firms push this onto their IT manager, assuming that since it is technology related, IT has it. This is a mistake because most IT departments do not have time for data analytics. They are busy full time keeping company systems stable and secure, and providing support to your team members. This by necessity results in IT deprioritizing data queries over crucial cybersecurity attack prevention. Business analysts and executives get frustrated waiting for data query results, and the data is stale or the business opportunity has passed by the time query results are in.

But even if your IT team had time for it, it still is a mistake to rely on traditional technology administrators for data analytics success. This is unless your IT department has expertise across a wide range of skill sets, from cloud architecture, database engineering, master data management, data quality, data profiling, and data cleansing. What’s more, your IT manager would need to have command over data integration, data ingestion, data preparation, data security, regulatory compliance, data science, and building pipelines of data ready for executive reporting from multiple cloud and on premises environments.

When you read this laundry list of needs, it becomes clear that most mid-market IT departments lack the specialized experts needed to derive business value from their data. Unlike larger enterprises that have the resources to hire skilled staff for these roles, the midsize organization requires another option that provides access to the right tools, resources, and support. One that integrates, enriches and is trained in utilizing AI, machine learning, and predictive analytics to achieve more useful results.

Achieving Digital Transformation

Digital transformation has been defined by some as the integration of digital technology into all areas of a business, fundamentally changing how employees operate and deliver value to customers. Some of the challenges midsize businesses have with building an internal team to initiate this concept are employee pushback, lack of expertise to lead digitization initiatives, improper organizational structure, the absence of a digitization strategy and limited budget. As an alternative to building an internal operation, a more efficient way for mid-market businesses is to leverage the skillsets of experts by partnering with a consolidated group of experts, leveraging a side-by-side model that couples technology with talent. Look for solution providers that offer the following:

- Powerful cloud data centers paired with engineers skilled in architecting cloud-based applications and processes that better serve critical business requirements. These data centers are optimized for true multi-tenancy, built on seamlessly integrated hardware and software, offer business-driven configurability, world-class security and performant systems.

- Active Monitoring and Thoroughly Integrated Security. Monitoring and security should be pervasive across system infrastructure to defend against cyberattacks and provide remediation when required. Business customers will also expect full-time monitoring and on-demand help desk to address unexpected events. The data management platform underpinning applications should be monitored by experienced data engineers with success in building data warehouses, data lakes, and data pipes. They should also be able to integrate, cleanse, and transform data into decision-ready and analytics-ready business information.

- High ROI Business Insights that Drive Results. Data analytics investments need to provide real business value by giving actionable insights and finding opportunities within your data. With this in mind, data analytics should include access to data scientists and business analysts versed in your industry. These experts should be equipped to design AI-powered algorithms that answer the most pressing questions based on real-world business challenges.

Mid-Market Data Transformation for Enterprise-Class Results

Ensuring the right mix of hardware, software and resulting services are available to maximize the data center capabilities—and their ability to manage and protect data—is crucial to effective mid-market digital transformation. To compete and drive value, the cloud data center provider must deliver at all levels, with customizable business intelligence solutions powered by an effective data management platform that is secure and compliant. Successful mid-market digital transformation thus requires a shift of responsibilities for infrastructure procurement and maintenance to a third-party provider backed by experienced staff and best-in-class infrastructure.

When implementing a digital transformation project, your company gains from the many benefits this brings, such as a higher return on your IT investment, increased employee and customer experience, and greater business agility. This is further enhanced by leveraging experienced cloud engineers, data engineers, security experts, data scientists, and other highly skilled technical resources—achieving true business value from the investment. And by partnering with experts, your company’s time, resources, and innovation can be focused on its core competencies.

Why You Need Fresh Insights: Don’t Rely on Stale Data to Make Important Decisions - PDF

Why You Need Fresh Insights: Don’t Rely on Stale Data to Make Important Decisions

Too many mid-sized financial services institutions rely on reporting modules from their banking cores to try and understand business performance and make strategic decisions. However, there are problems with this approach.

Unlocking the Value of Data Analytics: What Mid-Market Companies Need to Understand

Unlocking the Value of Data Analytics: What Mid-Market Companies Need to Understand

- Not realizing they need to build pipelines to get the data from their multiple data sources to the analytics platform

- Tasking IT with implementing a data analytics solution, when the IT department does not have data science skillsets

- Basing analytics on data that is riddled with errors, incomplete, or stale, which compromises quality of decision-making due to the inaccuracy and tardiness of the underlying data.

- Relying on the reporting function of one data source and not taking into account data beyond that source for decision-making

- Using dashboards that provide insights into the past only, and not the future – a gap that needs to be bridged to compete with larger enterprises

It should also be noted that analytics requires massive storage and compute to mine data for actionable insights. Even in a cloud environment, which is less costly to maintain than on-premise servers, data analytics takes up a huge amount of compute to mine transactional data for AI-driven insights. Most data warehouses used by mid-market companies are not built for analytics, and their contracts with public cloud vendors for data storage often incur huge overage charges for compute spikes as millions of calculations are being completed for algorithms to converge for analytics results. Data analytics needs a cloud built for analytics. The mid-market should demand a built-in analytics cloud from an analytics solution, without a third-party public cloud contract to make it work (or attempt to host it in their regular institution data storage).

Industry Knowledge is Key

One of the most important aspects to understand is that there is no one-size-fits-all when it comes to data analytics. The value lies in industry specific data models, which must be built with algorithms using salient data points for a specific industry and appropriately weighted for that industry. For example, to build customer revenue in financial services, mining transactional banking data is important to reveal if a customer is doing business with competing financial institutions so that action can be taken to win this business over. In manufacturing, comparing product inventory at various channels and channel or retail sales locations is important for discerning sales performance and growth opportunities. In healthcare, mining insurance reimbursement claims for underpayments to recapture lost revenue requires comparisons of contracted amounts and fee schedules for multiple private insurance companies, plan coverages, and more. The true business value of analytics lies in industry specific data models and the data enrichment made possible by deep learning and the generation of actionable insights.

The Importance of Having the Right Expertise

This brings us to the requirement for data scientists and business analysts, which assist with achieving powerful and current actionable insights that lead to AI-driven decision-making and better business outcomes. Data scientists build algorithms to detect trends, patterns and predictions based upon the data, to position an enterprise for the future. Business analysts are industry specific and connect the dots between the data points relevant for answering business questions in that particular industry. They also help to design dashboards and other data visualizations to ensure that the insights generated answer questions important to that industry using industry-specific terminology, and analyze analytics results in the context of industry knowledge to reveal growth drivers and other opportunities for driving revenue. Typical IT departments do not have these skill sets.

Data Analytics Platform Requirements

Consider these questions when evaluating a data analytics platform:

- Which data sources are forming the basis for the insights: Is the analysis based upon only some of the data, leaving out important data sources? Do the analytics use the most important data points? Is too much data or the wrong data being used?

- How is the data cleansed for accuracy: To judge the accuracy of the insights, know what is being done to eliminate errors in the underlying data being analyzed. Garbage in leads to exponential garbage out when data is turned over to AI. Can the data be trusted?

- Which algorithms are being used to find insights: Is it a specialized or generic deep learning model? Is it optimized for the type of inquiry or result being sought? Is it tailored to a specific industry and weighted appropriately for that industry and the question posed? Can the results be trusted?

- Are the analytics results providing actionable insights such as how to grow revenue, improve efficiency or achieve other business outcomes? Are the results tied to solving business challenges, and not just AI for the sake of being cool?

Side-by-Side Approach

A side-by-side service model offers an alternative that goes beyond most tools and platforms on the market by providing a data platform with built-in data management and analytics, as well as access to human intelligence in data engineering, machine learning, and business analytics. Ideally it should operate as a cloud-based platform with a subscription service that places the burden of the data engineering expertise, technical tooling, and building and maintaining the infrastructure on the data management provider.

While many companies offer tools, and many consulting firms can provide guidance in choosing and implementing the tools, integration of all the tools and expertise in one end-to-end solution built for non-technical business users is key for digital transformation success for midmarket businesses.

Top 3 Actions for CIOs to Take Now in a Recession Economy - PDF

Top 3 Actions for CIOs to Take Now in a Recession Economy

The current economy poses a triple threat for business: persistent high inflation; scarce expensive talent; and global supply constraints. However, there are 3 actions CIOs should take to play offense to emerge from a recession on top.

The State of Ransomware in Financial Services 2022 - PDF

The State of Ransomware in Financial Services 2022

Mid-Market Companies: Here’s How to Manage Your Data for the Best Business Outcomes

Mid-Market Companies: Here’s How to Manage Your Data for the Best Business Outcomes

Data management should also include:

- Cleansing the data to reduce errors

- Normalizing it so that aggregated information may be used for reporting, analytics, and better decision-making

- Governance for compliance with regulated industry and data privacy laws, and to ensure authorized access

- An audit trail of changes made to the data and which systems are using it

Cost Concerns

It’s a big job, so it’s no surprise that enterprise-sized companies often have a financial advantage over the mid-market when it comes to data management. That’s because while enterprises likely have in-house teams with the necessary data management skillsets, it’s cost-prohibitive for most mid-market companies to invest in the technical talent needed for data engineering and management. Most mid-market companies do not have the data engineering expertise needed to use data management tools and technologies within their in-house IT team, or their IT team is too busy vigilantly keeping systems stable and secure—which should be IT’s primary and full-time focus.

Nearly half of IT professionals believe that data management is a significant barrier to digital transformation because digital processes and technologies such as the cloud are rapidly evolving and increasingly sophisticated. McKinsey & Company points out that the COVID-19 pandemic significantly accelerated these trends. This means successful data integration and management requires advanced data experts whose job is to stay current on quickly evolving data management technologies, which can be challenging for the mid-market to acquire. And even if you can find this talent, it often does not make financial sense for the mid-market to hire FTEs to obtain the skillsets needed for success.

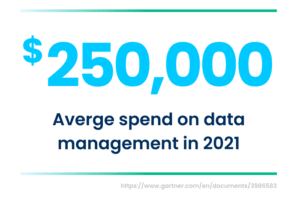

Heavy Investment

Looking ahead to 2024, Gartner also reports that cloud-native platforms will serve as the foundation for more than 75 percent of new digital workloads. This statistic is particularly meaningful for mid-market companies, where end-to-end solutions become a lifeline to leverage cloud technology efficiencies and advancements without the need for hiring in-house expert skill sets. The right end-to-end solution for the mid-market pairs the right combination of tools and technologies with access to the expert talent needed to achieve value and success. The right end to end solution includes everything so that mid-market companies need not spend years trying to piece together a solution out of countless possible tools and technologies. Building it just takes too much time and resources away from the primary business of most mid-market companies—and the mid-market does not have time to wait for this and thrive against competitive pressure from large enterprises.

By 2024, Gartner predicts that three quarters of organizations will have deployed multiple data hubs to drive data and analytics, since companies should only make decisions based on a complete picture of their data. But for mid-market companies with affordability concerns, few solutions meet the need for data management technology that enables companywide data integration as well as third-party data.

Solutions for the Mid-Market

Yet most hyper-scaler cloud service providers are priced for large enterprises, particularly to get the level of help that mid-market companies require. What’s more, many enterprise hyperscalers don’t offer data management, since their services focus only on migrating data to third-party cloud vendor platforms. Mid-market businesses need a hyperscaler capable of providing data management within a mid-market budget.

To ensure that important business decisions are not made based on inaccurate information, the mid-market needs an affordable data-cleansing solution.

Ideally, this means that data management would transform the data into decision-ready, analytics-ready status, including transactional data that sheds light on operations and customer behaviors. Gartner predicts that through 2024, half of organizations will adopt modern data quality solutions to better support digital business initiatives. To keep from falling behind, the mid-market must follow suit.

The Key to Consistency

In order to keep data consistent across the organization, another solution for the mid-market is to adopt master data management (MDM). MDM helps to ensure that if a customer’s contact information is updated through customer support, for example, then accounting and all other functional business units will receive the updated information. If data is kept in multiple siloes, operational efficiency decreases as employees spend time trying to track down data for reporting, analyzing, and determining which details are correct.

MDM technology has traditionally only been accessible to large enterprises due to its high cost, as most MDM platforms are a huge expense and implementation takes more than a year to achieve. These platforms typically also require highly skilled FTEs to use and maintain, which can be another cost consideration that rules out mid-market companies.

The answer to successful mid-market data management is to establish a side-by-side partnership with a data platform company to gain the benefits of working with experts and gain access to highly skilled technical resources to achieve true business value. By getting this help, you can devote your company’s time, resources, and innovation to your business and focus on what you do best.