Aunalytics Brings Its Portfolio of Managed Services, Enterprise Cloud, and Data Cleansing Solutions to Taste of IT Conference in Ohio

Leading Data Management and Analytics Company to Join More Than 400 IT Professionals for a Day of Networking and Learning

South Bend, IN (November 15, 2022) – Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, will feature its managed services, enterprise cloud, and data cleansing portfolio at the Taste of IT Conference on November 16, 2022. The one-day event, which will be attended by more than 400 IT professionals, will be held at the Sinclair Conference Center in Dayton, Ohio.

Aunalytics provides IT and security expertise to mid-market businesses in the areas of financial services, healthcare, manufacturing and professional services. The company’s Secure Managed Services offering combines mission critical IT services leveraging zero-trust end-to-end security to ensure data is protected regardless of a user’s location. Aunalytics provides managed components that offer stability and security, and its next-generation managed services offering is powered by a data platform that provides data-driven IT answers and embedded security that focuses on people and access.

The full suite of managed IT and integrated security services empowers businesses with a complete, all-encompassing approach that includes 24/7/365 monitoring and management, a synchronized network security platform, workstation and server patching, internet protection, email filtering and security, Office 365 management and security, multi-factor authentication, data and device encryption management, and security awareness training.

The company delivers advanced security for defending against modern threats through a team of engineers and analysts with expert skills and toolsets and, in regulated industries, Aunalytics provides the additional technology and controls required to manage risk. Its team of experts is dedicated to analyzing ever-changing rules and regulations and helping users to create processes and policies for data protection and meet compliance requirements within those industries that are regulated.

Aunalytics’ Enterprise Cloud offering is comprised of infrastructure solutions that provide a highly redundant and scalable platform for hosting servers, data, analytics and applications at any performance level. With the Aunalytics® Cloud Storage and Compute solution, users are assured the highest levels of security, accessibility, expertise, scalability, and savings. Aunalytics’ data centers, located in Northern Indiana and Southwest Michigan, meet the most rigorous standards for security, weather protection, temperature and humidity controls, fire suppression and more.

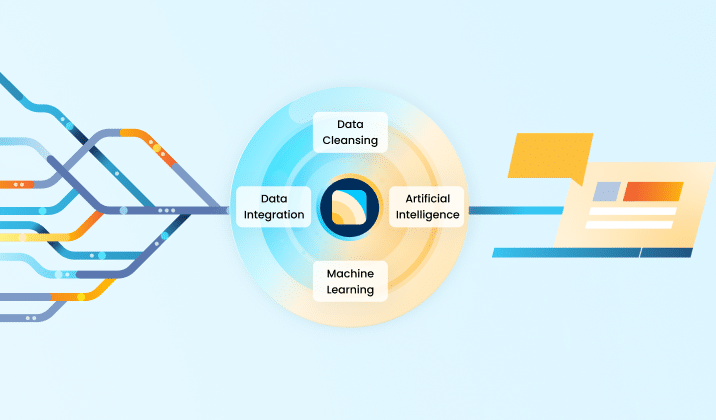

As data continues to expand exponentially, the challenge of data cleansing is rapidly becoming more difficult, as well as expensive. Aunalytics’ Aunsight™ Golden Record turns siloed data from disparate systems into a single source of truth across the organization. Powered with data accuracy, the cloud-native platform cleanses data to reduce errors, and Golden Record as a Service matches and merges data together into a single source of accurate business information, giving users access to consistent, trusted data across the organization in real-time. With this self-service offering, users can unify all their data to ensure enterprise-wide consistency and better decision making.

“IT executives want practical, real-world knowledge about business changing technology and management solutions that are absolutely critical to drive their businesses forward,” said Robert Lizotte, Local Market Leader, Columbus Region, Aunalytics. “As digital transformation continues to be a high priority for many organizations, our portfolio of managed services, enterprise cloud, and data cleansing solutions provides the tools they need to accelerate their digital transformation journeys. We look forward to participating at a Taste of IT and demonstrating how Aunalytics can help IT professionals advance their business success.”

Tweet this: .@Aunalytics Brings Its Portfolio of Managed Services, Enterprise Cloud, and Data Cleansing Solutions to Taste of IT Conference in Ohio #ToIT22 #Datamanagement #Informationtechnology #Managedservices #Enterprisecloud #Datacleansing #Dataplatform #Dataintegration #Dataaccuracy #Digitaltransformation #ITsecurity #Securitytechnology

About Aunalytics

Aunalytics is a leading data management and analytics company delivering Insights-as-a-Service for mid-sized businesses and enterprises. Selected for the prestigious Inc. 5000 list for two consecutive years as one of the nation’s fastest growing companies, Aunalytics offers managed IT services and managed analytics services, private cloud services, and a private cloud-native data platform for data management and analytics. Aunalytics’ data management platform is built for universal data access, advanced analytics and AI – unifying distributed data silos into a single source of truth for highly accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI for accurate mission-critical insights. To solve the talent gap that so many mid-sized businesses and enterprises located in secondary markets face, Aunalytics’ side-by-side digital transformation model provides the technical talent needed for data management and analytics success in addition to its innovative technologies and tools. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Daybreak Allows Financial Institutions to Increase Wallet Share with Competitor Payment Smart Feature

In the competitive financial services landscape, increasing revenue through new customer acquisition alone is a challenge. According to the Harvard Business Review, it can be anywhere from five to 25 times more expensive to acquire a new customer than to retain an existing one. While new customer acquisition is important, retention and expansion of existing relationships should be a high priority—especially during economic downturns when reducing costs is imperative. A recent report by Bain & Company states, “In financial services, a 5% increase in customer retention produces more than a 25% increase in profit. Why? Return customers tend to buy more from a company over time.” Therefore, it makes sense for community banks and credit unions to focus on retention and increasing wallet share of existing customers.

Winning Back Business by Identifying Competitor Payments

Many community bank customers and credit union members utilize multiple financial institutions for various products. They may have a checking or savings account at their local bank or credit union, but an IRA account at a large, national investment firm, or a loan through another financial institution. By identifying which customers have external accounts and which products they may have through other institutions, community banks and credit unions can take steps to win back that business and increase wallet share of their existing customers and members. Daybreak‘s Competitor Payments Smart Feature mines transactional data and uses AI algorithms to flag external products with competing financial institutions on all active customers/members. These insights can be used to make more attractive targeted offers to win back business.

Watch the video below to see how banks and credit unions can utilize Daybreak’s Competitor Payments insights to win back business from competing institutions:

In addition to providing the ability to discover competitor payment insights in transactional data, Daybreak allows community banks and credit unions to compete with large financial institutions by…

- Understanding customers,

- Optimizing processes, and

- Revealing actionable insights.

See how Daybreak Customer Intelligence for Financial Institutions is the customer data platform that makes it easier for community banks and credit unions to gain actionable insights and achieve positive business outcomes.

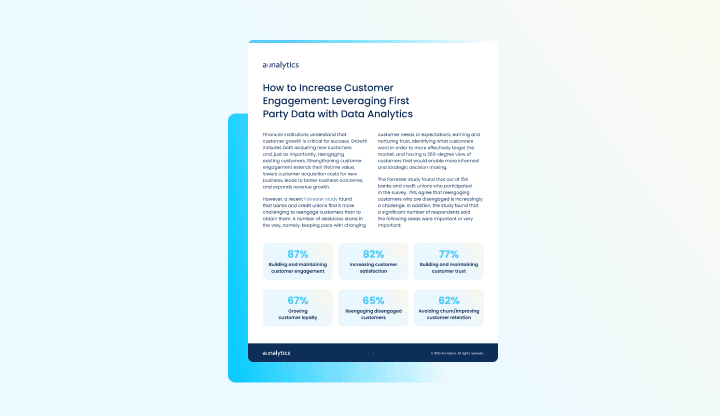

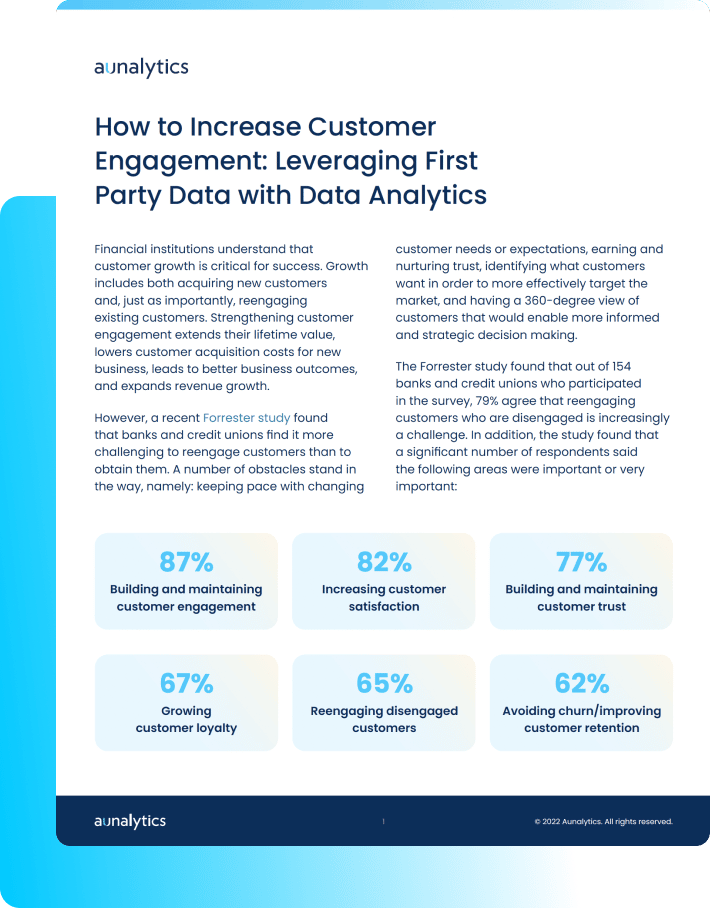

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Cloud or On-Prem Servers—Which Is Better for Your Company?

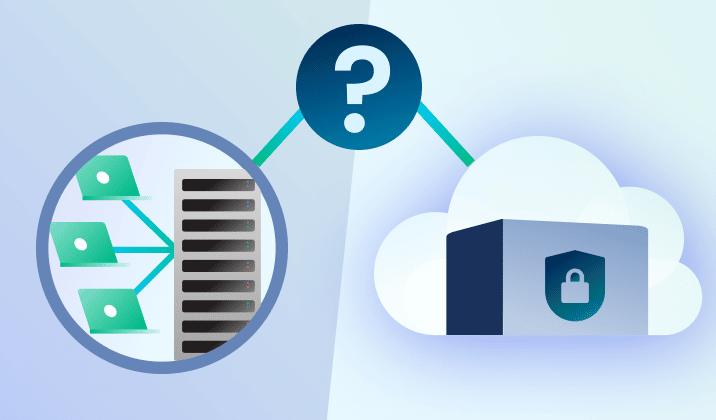

Every organization needs to manage its data to get its desired business outcomes. For a company to access its data and use it in day-to-day operations, dashboards, reporting, and data analytics, it either needs a cloud or on-premises solution to facilitate compute, storage, and data management strategies.

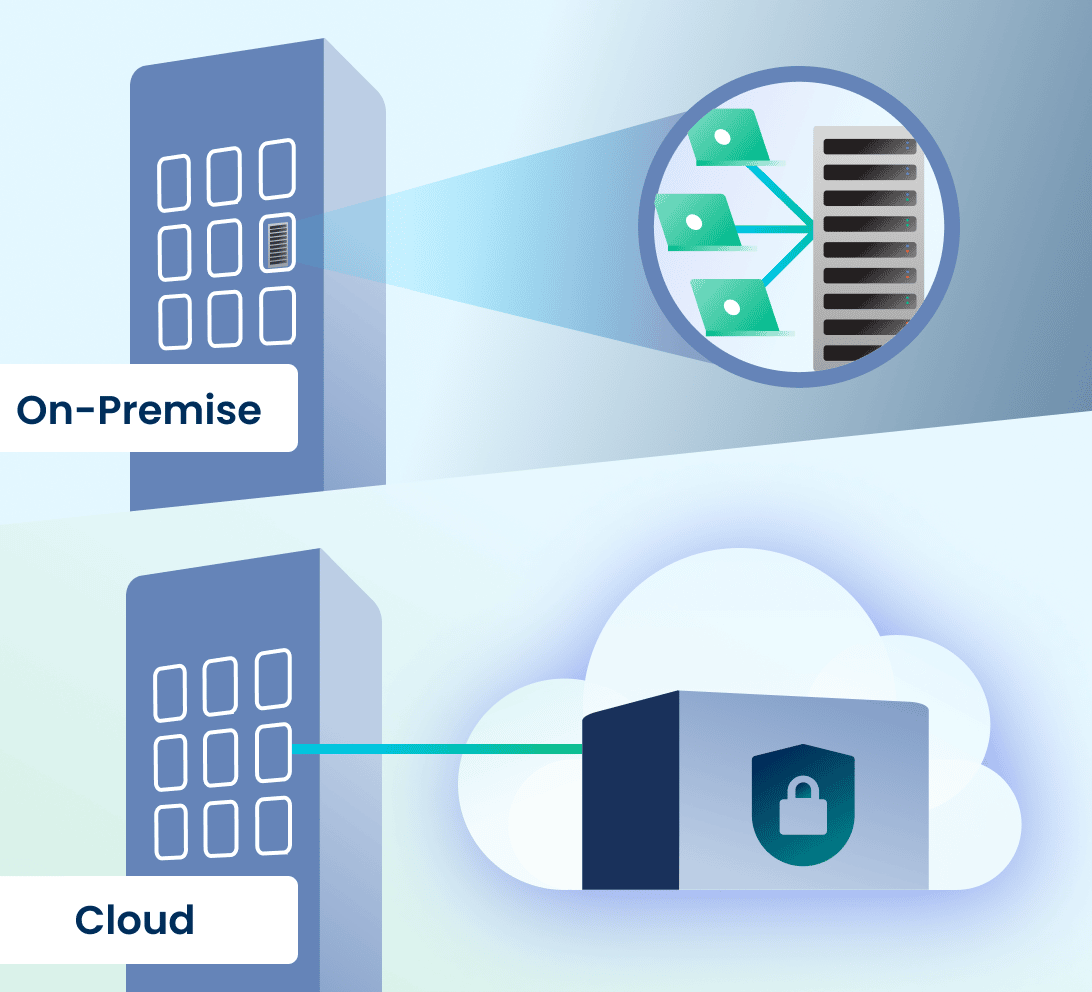

What’s The Difference Between The Cloud And On-Premises Data Storage?

An on-premises data server is hardware that you maintain on your company’s premises for storing, processing, and accessing information through your organization’s networks. An in-house IT department is needed to maintain, turn over/replace, and upgrade the hardware, keep it stable and operational, and secure it.

A cloud storage solution run by an expert and backed by a cutting-edge data center provides the same functions as an on-premises server and more. It does not exist on your company’s premises and the data on it is accessed through the internet. All updates and maintenance tasks are performed by the cloud provider, who owns and operates its own hyper-secure data centers to safeguard your data in case of failure, cyberattack, or outage. Like on-premises servers, access to cloud data can be set by administrators to be permission-based to allow access only by authorized personnel.

On-Premises vs. Cloud—Which Option Best Suits Modern Business Needs?

There are more factors when choosing between using a cloud computing solution or keeping servers on-premises, including customizability and scalability, security concerns, and the budget for your organization’s data management strategy. While on-premises data servers regularly require hardware upgrades in your physical locations to expand alongside your business’s growing needs, a cloud storage and computing solution with access to highly advanced data centers is scalable based upon your workload. Unlike an on-premises server that can take a lot of time and money to set up and ready for operation, cloud service providers ensure you can access your cloud for computing and storage needs almost instantly.

In some mid-sized companies, server rooms tend to be used for multiple purposes, which means that they are sometimes unlocked, unsecured, and allow for unauthorized access that compromises data security. Many mid-sized companies do not have 24/7/365 monitoring of their server rooms, specialized climate controls needed for a data center, and do not consistently deploy or regularly schedule hardware upgrades to keep the systems reliable before something goes down.

One mid-market employee shares the story of a server closet that her company had in a previous workplace. For starters, it could be accessed by nearly every employee of the company. She recounted that the IT department placed portable dehumidifiers in the room to keep moisture down. The IT department’s regular practice was to empty the server closet dehumidifiers in the office’s kitchen sink. Unfortunately, a new IT employee happened to trip while carrying one of the dehumidifiers and spilled water all over the server room. Every employee of the company was affected—they found out that the work they had done since the last backup, which happened to be 5 days ago, had disappeared. Even worse, their servers were down for several days after the incident, further impacting their daily business operations.

Although in the past, people feared that cloud would not be secure, or a company would lose control over its data—cloud has proven to be more secure than on-premises hardware. First, cloud vendors host their own data centers and because this is their main business, they have cutting-edge climate control environments to protect their clients’ data. Cloud vendors adhere to frequent hardware replacement turn-over schedules to keep uptime maximized and cloud operations state-of-the-art. Cloud vendors monitor their data centers 24/7/365, are security experts, and have strict controls in place in order to service clients in highly regulated industries with rigorous data security needs. For most mid-sized businesses, it is more cost effective to rely upon the expertise of a cloud vendor for data security and uptime than to host and maintain its own servers, stay on top of the latest security threats, and staff its data center (or data closet) for monitoring to prevent downtime and security breaches.

Large enterprises often can afford to build their own data centers providing them an alternative to an external cloud provider. However, this is incredibly expensive and can set organizations back by USD $10-25 million on yearly setup and operation costs. This infrastructure also takes a lot of time to be implemented and in today’s fast-paced business environment, this might not be entirely acceptable for decision-makers.

Yet, even for enterprises, on-premises solutions no longer make the most sense. Most modern business applications are cloud-native. Cutting-edge data analytics solutions are cloud-native and connect and integrate data sources using cloud technologies. Clouds are better suited for analytics than on-premises hardware, due to scalability and ability to absorb compute spikes (instead of having to invest in hardware with capacity for compute spikes as machine learning algorithms converge—which leads to excess capacity at other times).

According to Insights for Professionals, 63% of senior IT leaders and company executives who were surveyed expected to invest in cloud infrastructure-as-a-service in 2022. Considering the state of on-premises servers, which are becoming an obsolete technology that require an IT department to keep a constant eye on it, cloud technology is a natural progression in infrastructure for better data management. Gartner reports by 2025 almost 85% of companies will have moved to a cloud-first approach. Cloud technology has now evolved to a point where it provides better stability and security at a more economical price than on-premises solutions.

Mid-Market Company Considerations

Many organizations are operating in hybrid and multi-cloud environments. This means that they have some data in on-site servers, some data in cloud based line of business applications (relying on the application provider for data storage in whichever cloud the application vendor uses for its product), and many have some data in a public cloud.

However, mid-market companies have added considerations when choosing a cloud solution. Most public cloud service providers do not offer data management services. You need to do this yourself. Yet, mid-market companies often do not have this expert talent in-house. For success, mid-market companies need a cloud hyper-scaler that also provides data engineering services to build data connectors and pipelines, warehouses, data lakes, and the like. This skill set is different from a typical IT employee. Hyper-scalers—who can help organizations with data management, transform data from disparate sources into a decision and analytics-ready status, and bring transactional data into the forefront using a cost-effective cloud solution—tend to be private cloud vendors. For this reason, private cloud solutions make more sense than public cloud for mid-sized organizations.

A side-by-side partnership with an experienced cloud-native data platform company will have a measurable and positive impact on mid-market company data management strategies, with built-in access to technical resources and experts, so that your company does not need to hire new FTEs to support data management. Rely on the data management companies for data management so that your company can focus on your main line of business.

Aunalytics’ high performance private cloud provides a highly redundant and scalable platform for hosting servers, data, analytics, and applications at any performance level. Aunalytics delivers data management in a side-by-side service model, bringing companies the technology and the talent needed for data management success. To learn more about our Enterprise Cloud solution, click here.

Aunalytics to Feature Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at Financial Services Events in November and December

Leading Data Management and Analytics Provider Will Showcase How AI-Powered Analytics Can Increase Business Wins with Real-Time Customer Insights and Highly Personalized Interactions

South Bend, IN (November 1, 2022) - Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, announced today its participation at three financial services events in November and December. The company will showcase its DaybreakTM for Financial Services advanced data analytics solution and demonstrate how midmarket banks and credit unions can use artificial intelligence (AI)-powered data analytics to increase business wins and compete more effectively.

November and December events include:

- Ohio Bankers League Annual Meeting, November 2-3

- The Financial Brand Forum 2022, November 14-16

- Annual CUSO Conference, December 1-4

Daybreak for Financial Services enables midsize financial institutions to gain customer intelligence and grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“It is critical now more than ever that mid-market banks and credit unions take action based on real-time insights that deliver a 360-degree view of customers or members so they can be nimbler and pivot their strategies as the market shifts course,” said Katie Horvath, Chief Marketing Officer of Aunalytics. “Aunalytics solutions offer this granular level of insights as a service at speed to inform banking strategies. Using Aunalytics Daybreak for Financial Services, mid-market banks and credit unions can now deploy advanced analytics to more highly personalize their interactions with customers and members. It enables them to target-market more efficiently with the right product offering at the right time, and win business away from competitors to increase revenue. We look forward to meeting with bankers and credit unions in the coming months, and demonstrating how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Tweet this: .@Aunalytics to Feature Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at Financial Services Events in November and December #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a leading data management and analytics company delivering Insights-as-a-Service for mid-sized businesses and enterprises. Selected for the prestigious Inc. 5000 list for two consecutive years as one of the nation’s fastest growing companies, Aunalytics offers managed IT services and managed analytics services, private cloud services, and a private cloud-native data platform for data management and analytics. The platform is built for universal data access, advanced analytics and AI – unifying distributed data silos into a single source of truth for highly accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI for accurate mission-critical insights. To solve the talent gap that so many mid-sized businesses and enterprises located in secondary markets face, Aunalytics’ side-by-side digital transformation model provides the technical talent needed for data management and analytics success in addition to its innovative technologies and tools. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com