Aunalytics Executive to Present Session on Mobile Offices & Working Remotely at the Michigan Municipal Treasurers Association’s 2022 Basic Institute Conference

Vice President of Sales - Cloud, Steve Burdick, Will Discuss Strategies to Improve Consistent Data Access While Protecting the Security Perimeter, How to Mitigate Risks and Create Better Remote Work Scenarios

South Bend, IN (April 20, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that Steve Burdick, Vice President of Sales - Cloud for Aunalytics, will present a session titled Mobile Offices & Working Remotely at the Michigan Municipal Treasurers Association’s 2022 Basic Institute conference on April 28. The conference will be held at the Comfort Inn & Suites in Mt. Pleasant, Michigan.

With remote work more prevalent than ever, most businesses now hold some form of sensitive data in the cloud and workers access company data from remote locations. Zero trust security principles based on a user’s credentials instead of a user’s location within a firewalled company facility, are the new norm.

Cybersecurity attacks have increased to higher than ever levels. It has been reported that ransomware attacks, which are reaching new levels of sophistication, increased more than 90 percent in 2021 with demands for payment skyrocketing into tens of millions of dollars.

Burdick's Mobile Offices & Working Remotely session will address how today’s modern work settings demand more mobility than ever, but the consequences of working remotely create cyber security challenges for all organizations. With distributed workforces becoming a critical part of the new reality, the security perimeter can span hundreds, and even thousands, of networks that are potentially exposed to risk at every point.

Session attendees will learn strategies to improve consistent access to data while protecting the security perimeter, how to mitigate risks, and create better remote work scenarios.

Tweet this: .@Aunalytics Aunalytics Executive to Present Session on Mobile Offices & Working Remotely at the Michigan Municipal Treasurers Association’s 2022 Basic Institute Conference #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

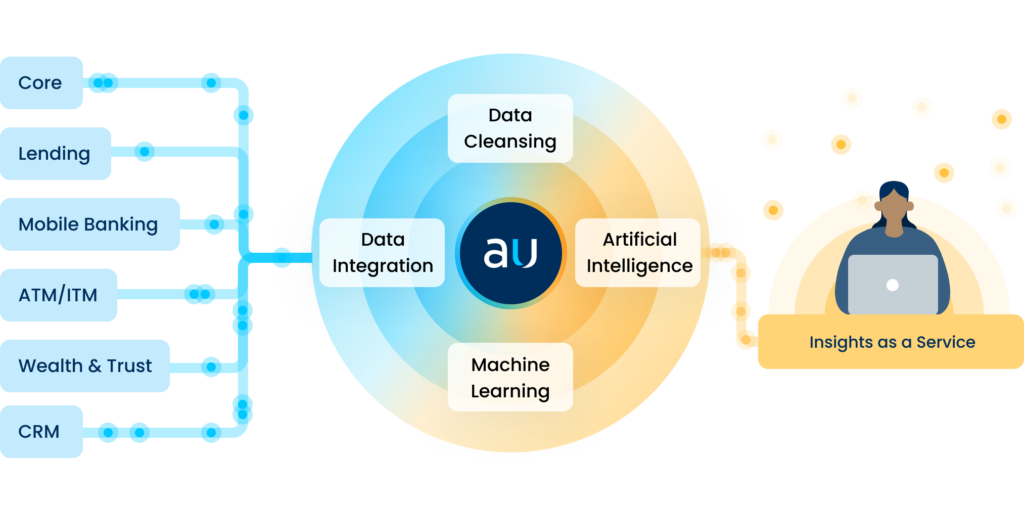

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

2022 NJBankers Spring Golf Outing

NJBankers Spring Golf Outing

Glen Ridge Country Club, Glen Ridge, NJ

Aunalytics to attend NJBankers Spring Golf Outing

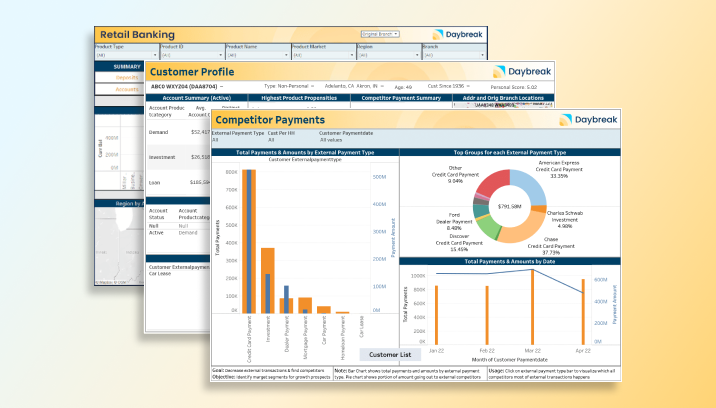

Aunalytics is excited to sponsor a foursome at the 2022 NJBankers Spring Golf Outing at Glen Ridge Country Club. Aunalytics’ Daybreak™ solution enables banks to use transactional data to more effectively identify and deliver new services and solutions for their customers.

Analytics Database Platform Powers Customer Insights and Positive Outcomes for Community Bank

Data experts at Aunalytics took a three-pronged approach to solve Horizon Bank’s business challenges using the Daybreak for Financial Services analytics database platform. The first move was to get the data right by converging disparate repositories, and organizing the information for ingestion in the proper application area. Horizon Bank leverages Daybreak’s robust, cloud-native platform to convert data into answers in support of a wide range of business intelligence applications. Daybreak allows Horizon’s executives to view system-wide data from all business units, cleansing and verifying records to provide enriched data for accurate, data-driven decision making. The aggregated data delivers a 360-degree view of customer information including behavioral data, from which the platform’s proprietary AI technology and deep learning models developed by Aunalytics data scientists glean actionable customer intelligence insights.

Deploying the Daybreak analytics platform has taken Horizon Bank and its 74 locations to the next level of services and support for customers, making it the preferred financial partner with compelling advantages over larger, competitive establishments. Learn more about the challenges Horizon faced to implement a data analytics platform, and how Daybreak helped them overcome those challenges by downloading the full case study.

MMTA 2022 Basic Institute

2022 Basic Institute

Michigan Municipal Treasurers Association

Mt. Pleasant, MI

Steve Burdick presenting "Mobile Offices & Working Remotely" at the MMTA 2022 Basic Institute

Steve Burdick, Vice President of Sales – Cloud, will be presenting “Mobile Offices & Working Remotely” at the 2022 Basic Institute event presented by the Michigan Municipal Treasurers Association. Steve will be giving tips on how organizations can keep their mobile workforce both comfortable and secure.

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The allure of investing early in the “next big thing” has led to increased interest in crypto investment. As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big loss. As a bank or credit union, here’s what you need to know to protect your institution.