Catalyst University 2022

Catalyst University 2022

Radisson Kalamazoo, Kalamazoo, MI

Aunalytics to Attend 2022 Catalyst University

Aunalytics is excited to once again attend Southwest Michigan First’s Catalyst University 2022 in Kalamazoo, MI. Aunalytics is participating as a speaker sponsor this year, and is pleased to present Chip Heath, best-selling co-author and professor at Stanford Graduate School of Business, teaching courses on business strategy and organizations. He will be speaking about how to translate numbers into things our brains can comprehend and use to tell compelling stories.

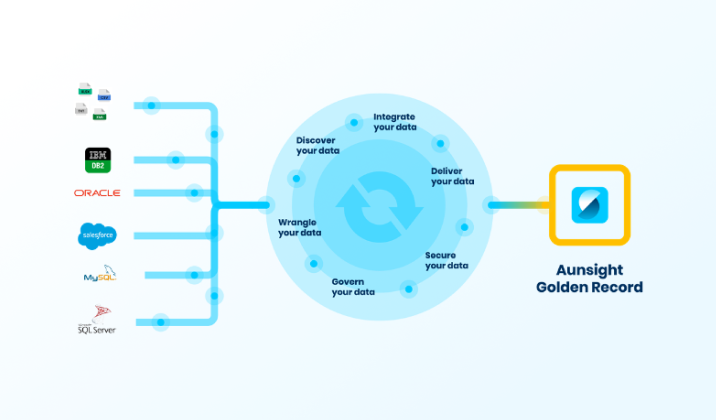

Aunsight Golden Record creates a single source of truth for credit union data

Credit unions have a great deal of data spread across various systems. However, it is impossible to create a centralized, accurate and up-to-date record of all of this data manually. Aunsight™ Golden Record automates this process by aggregating, cleansing, and merging data into a single source of truth so credit unions have access to an accurate record of their data in one place.

Watch the video below to learn more about how Aunsight Golden Record, along with the expertise of the Aunalytics team, can help credit unions quickly and painlessly take charge of their data: