Bank Jumpstarts Journey to Predictive Analytics & AI

Provident Bank, a mid-sized bank with $10 billion in assets, is the oldest community bank in New Jersey with branches across two states. Although they have successfully met their customer’s needs for more than 180 years, they knew that they needed to invest in technologies today that would carry them into the future.

Sign up below to receive the banking case study in your email

Answers for everyone.Built for banks like you.

How Daybreak benefits financial institutions like yours

Increase net deposits, card income, and fees to existing customers.

Increase deposits by reducing churn of current and future high value customers.

Increase loan profitability and reduce loan loss reserves.

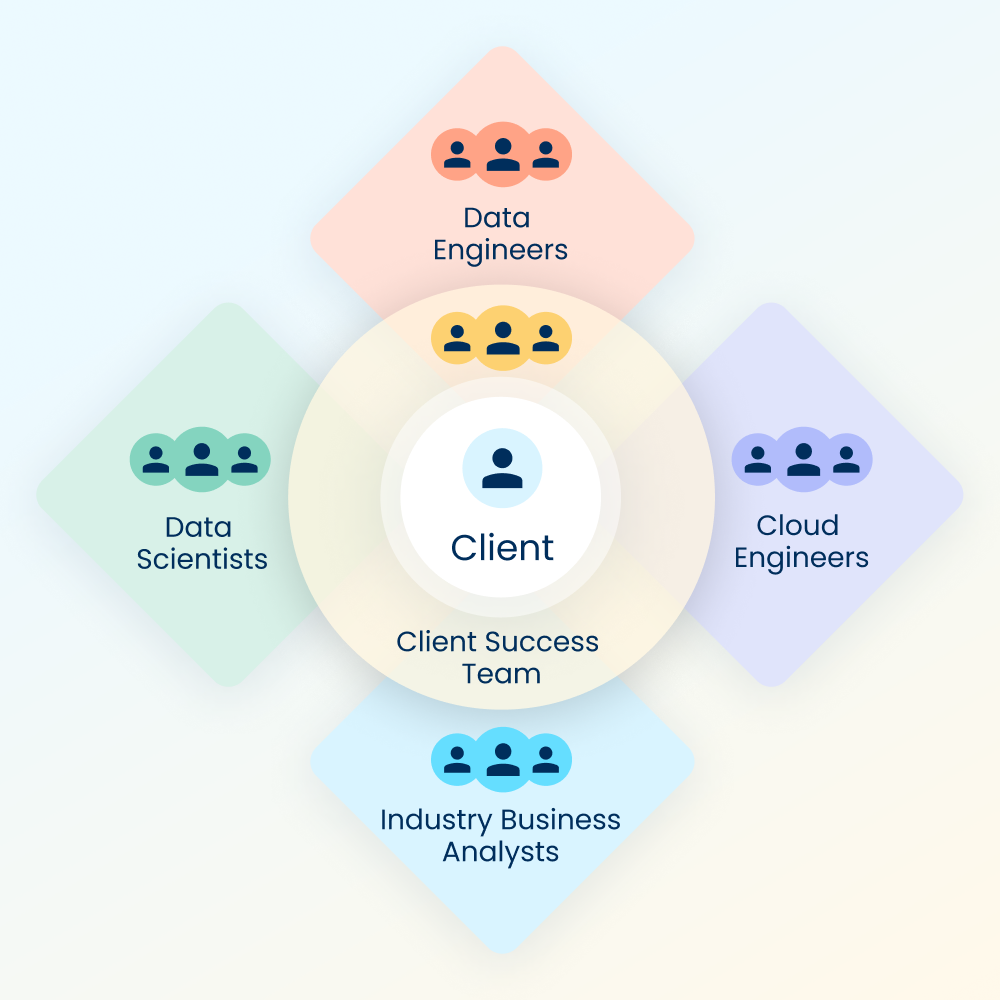

Access to a team of experts

Our talented team of data scientists, engineers, and analysts are here to help.

In the current market, it can be difficult for midsized financial institutions to hire the technical talent for advanced analytics. With Aunalytics by your side, we provide a team of experts who will assist you every step of the way. You will have access to the right tools, resources, and support throughout our end-to-end process. Integrate, enrich and utilize data marts with our team beside you to get better answers. Be ready for your AI, machine learning, and predictive analytics journey with the right foundation.

Data Integration & Preparation

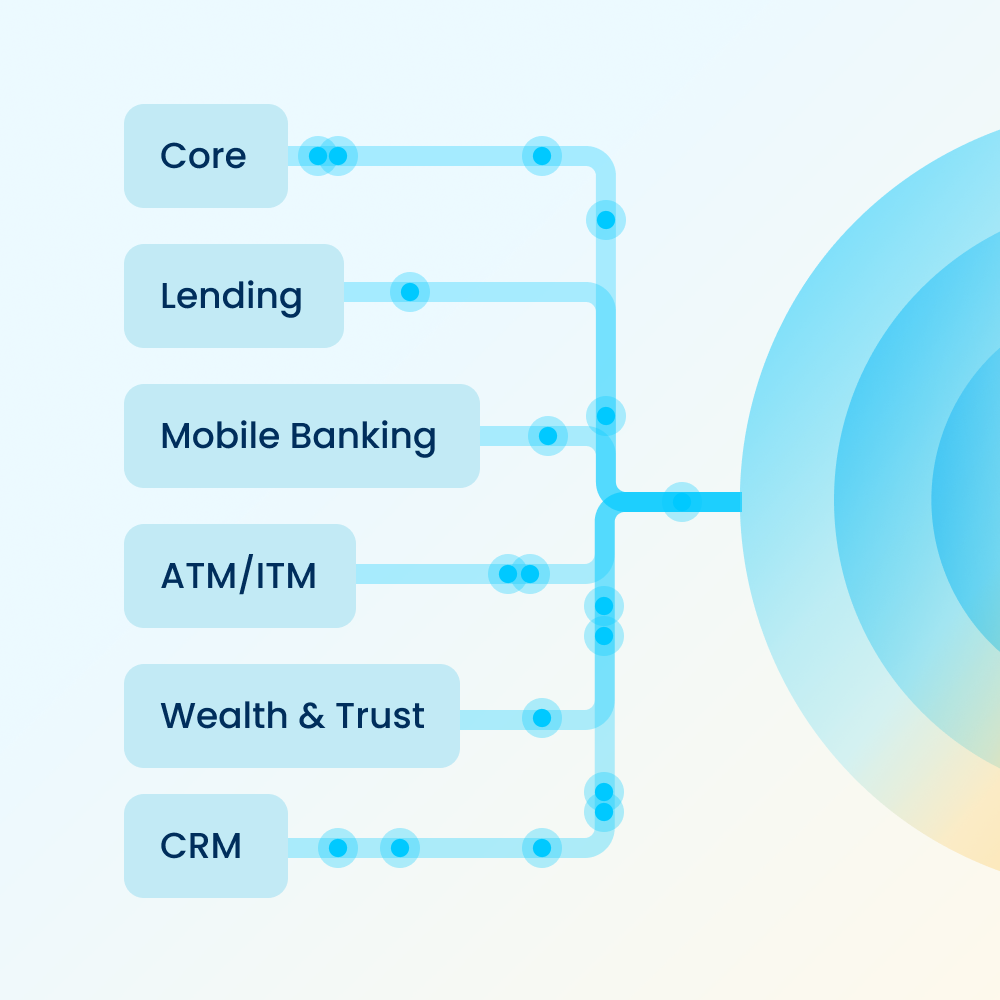

Integrated, cleaned data updated daily.

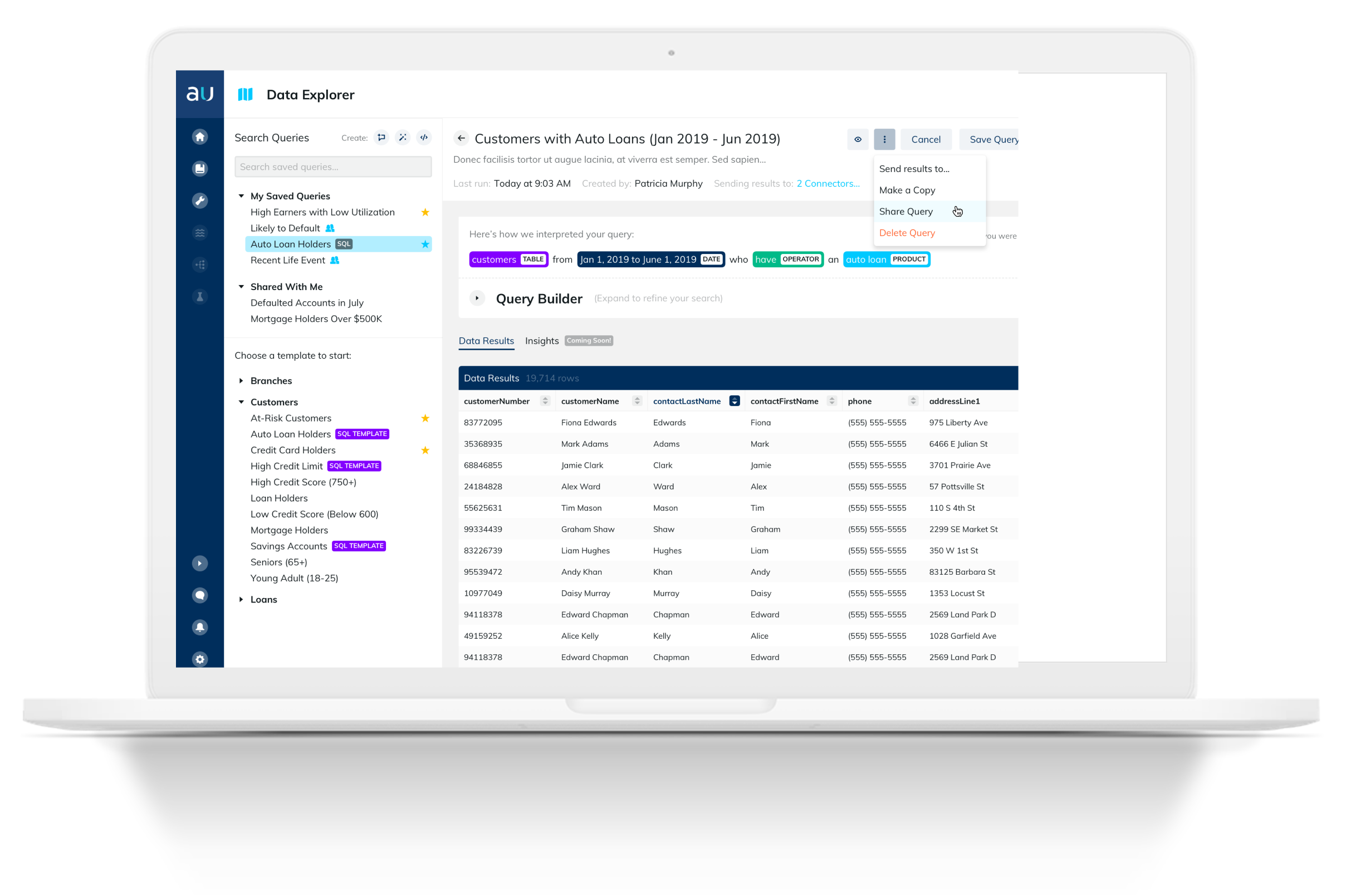

Daybreak integrates and cleanses data from disparate sources across your financial institution, so that analytics is based upon a complete picture of accurate information. We can integrate your transactional data, core data, data from other internal line of business applications, and even third party data. The entire process is automated so you get updated data on a daily basis.

Insights as a Service

Get answers to industry-relevant questions with analytics.

AI-powered Smart Features™, created by our data scientists in our Innovation Lab, mine the data to add knowledge beyond basic statistics and aggregations—giving you real, actionable insights from your data.

Actionable Business Results

Daybreak gives you actionable insights that provide real business value.

Find opportunities in your data and act on them. With Daybreak, you can measure marketing campaign effectiveness. You achieve targeted cross-selling using product propensity models to offer the right product to the right customer at the right time. You can quickly assess KPIs such as branch profitability and make data driven decisions for where to open new locations. With AI powered insights, you can take your personalized, white glove services to a whole new level by anticipating customer needs and providing a better overall experience.

"Daybreak has broken down our data silos and given stakeholders across the organization access to insights they have never had before. We are limited only by our own imagination in terms of the types of insights we can uncover."

John Kamin

EVP and Chief Information Officer, Provident Bank

These financial institutions have answers: