Grow Deposits by Knowing Exactly Who Needs You, and When.

Turn your transaction data into timely, qualified leads your team can act on with Auna, the AI Assistant for Banks and Credit Unions, powered by our Intelligent Data Warehouse.

Is your team missing opportunities?

Auna helps you change that.

Community banks and credit unions are built on relationships. But the way you find and act on those opportunities hasn’t kept pace with how your customers move their money today. You need a better system.

With Auna, The AI Assistant for Community Banks and Credit Unions, you receive:

A proprietary data model specifically for financial institutions

Your own data organized and ready for AI use

A team of both AI experts and financial industry experts focused on helping you drive deposit growth

More Qualified Leads.More Capacity.Real Deposit Growth.

We’re here to help you grow your core business — not hand you another tool to manage. With our Intelligent Data Warehouse and partnership approach, we help you:

10x

Generate 10x more qualified leads so your team always knows who needs you and when

3x

Triple your capacity to engage with those leads, without adding headcount

3-5%

Grow deposits by 3–5% annually by expanding and protecting primary checking relationships

Give your frontline teams more time to focus on meaningful connection, not manual research

Auna is Powered By The Intelligent Data Warehouse:Your New Relationship Engine

At the heart of our partnership is the data layer, where the intelligence lives. Most platforms stop at storing your data.

We integrate it, organize it, add our proprietary data model specific to banking, and make it useful.

Turning Data into Action

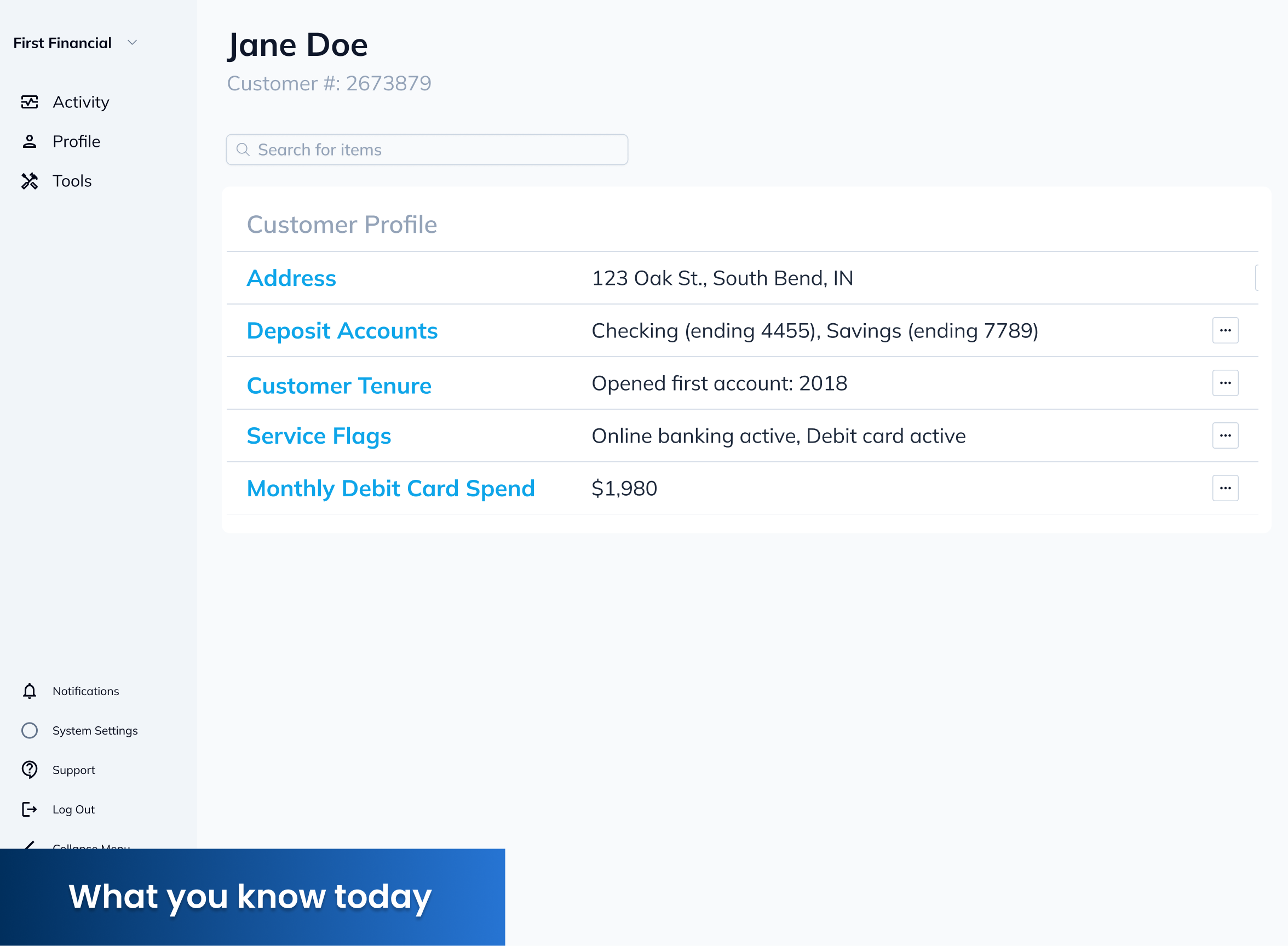

We don’t hand you a blank canvas. We deliver a fully built, proprietary data model designed specifically for community financial institutions. The Intelligent Data Warehouse:

- Integrates your data from across the institution

- Builds smart customer segments for you

- Surfaces real-time indicators of customer needs

Auna works alongside you in two ways:

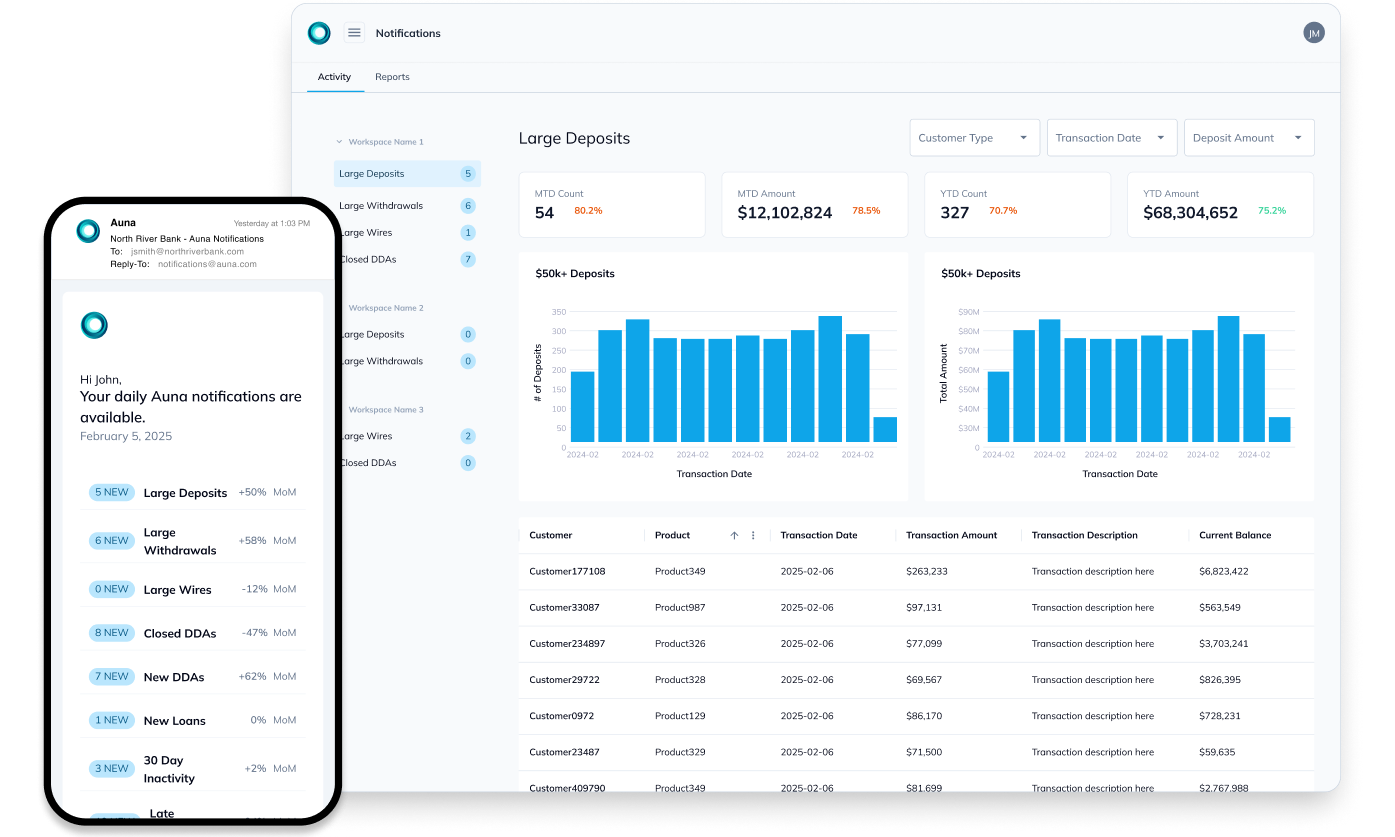

Notifications

Rely on the email updates, for personalized summaries of the metrics you want to track most.

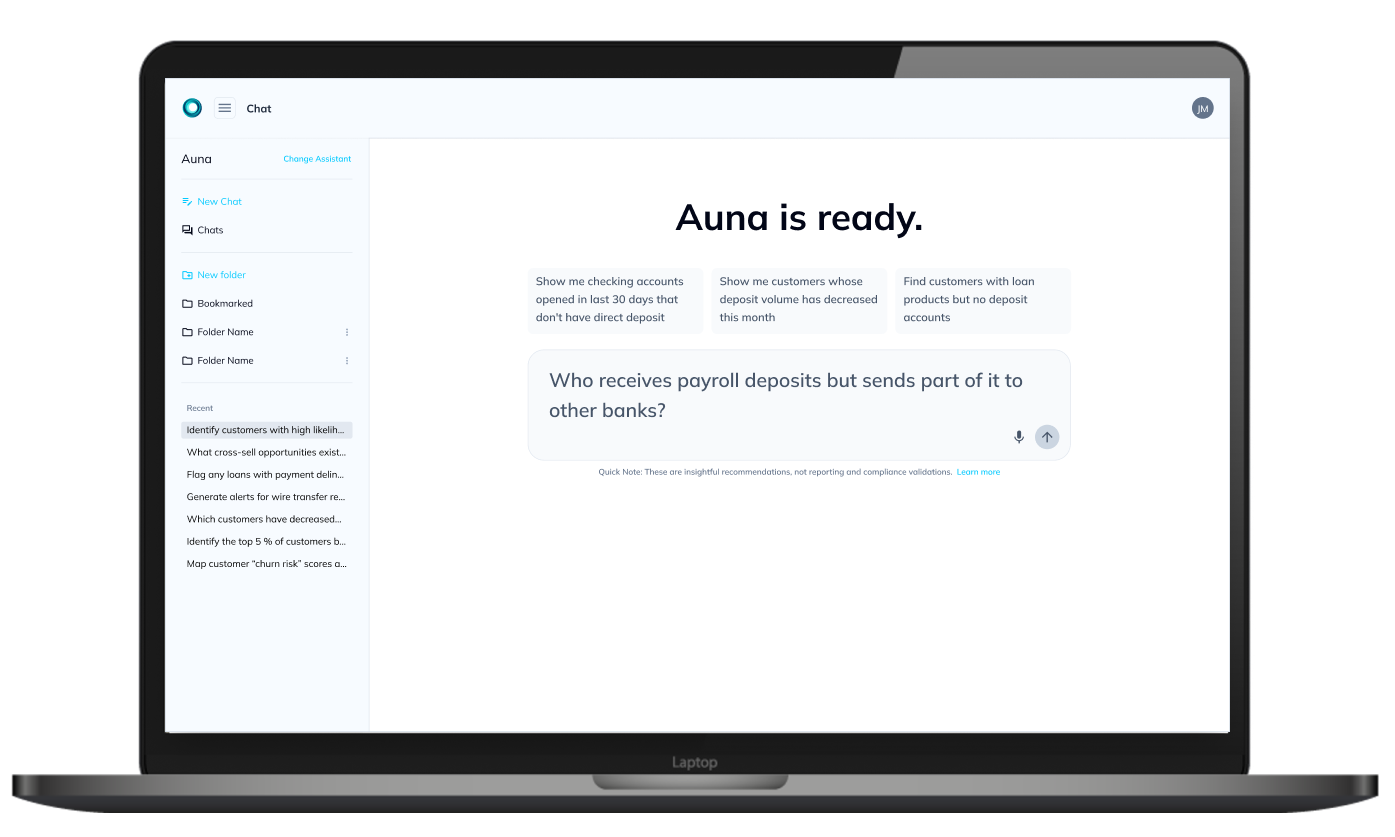

Chat

Use the conversational chat function to ask natural language questions and get answers from your data.

What can you do with Auna?

“Which small business clients are most likely to need a line of credit?”

“Who has large deposits but no lending relationship?”

“Show me households with declining deposits in the last 90 days that don’t have direct deposit”

“Who uses the mobile app but hasn’t tried bill pay or transfers?”

“Show me the top five customer segments with declining balances”

“Who receives payroll deposits but sends part of it to other banks?”

Be proactive, not reactive.Make smarter decisions with Auna’s data-driven insights.

Why Auna?

Industry Expertise

Rely on our proprietary data model specifically for financial institutions

Security

Your own data is organized and ready for AI use in a private, secure environment

Partnership

Work closely with our team of both AI and financial industry experts focused on helping you drive deposit growth

How does Auna work?

Data Layer

Integrates, organizes, and enriches raw banking data in domain-specific formats. This is the Intelligent Data Warehouse; contains verified facts—the AI doesn’t have to guess, which reduces hallucinations and improves accuracy.

Model Layer

Pulls the right information from memory, applies banking logic, weighs options, and makes decisions. Uses facts stored in memory, meaning faster, more accurate, and explainable results.

Application Layer

Delivers answers inside the tools you already use via a chat function and email updates. This is Auna.