2021 Illinois Bankers Association Annual Conference

Illinois Bankers Association Annual Conference

Virtual Event

Aunalytics attended the 2021 Illinois Bankers Association Annual Conference

Aunalytics was pleased to attend the 2021 Illinois Bankers Association Conference. While virtual this year, Aunalytics featured their Daybreak™ for Financial Services solution with advanced analytics that enables bankers to more effectively identify and deliver new services and solutions for customers for greater competitive advantage.

2021 Community Bankers Association of Ohio Annual Convention

2021 Community Bankers Association of Ohio Annual Convention

Hilton Columbus at Easton, Columbus, OH

Aunalytics attended the 2021 CBAO Annual Convention as a Gold Sponsor

Aunalytics recently attended the Community Bankers Association of Ohio 47th Annual Convention in Columbus. As a Gold Sponsor, Aunalytics demonstrated Daybreak™ for Financial Services for community banking professionals at Booth 17.

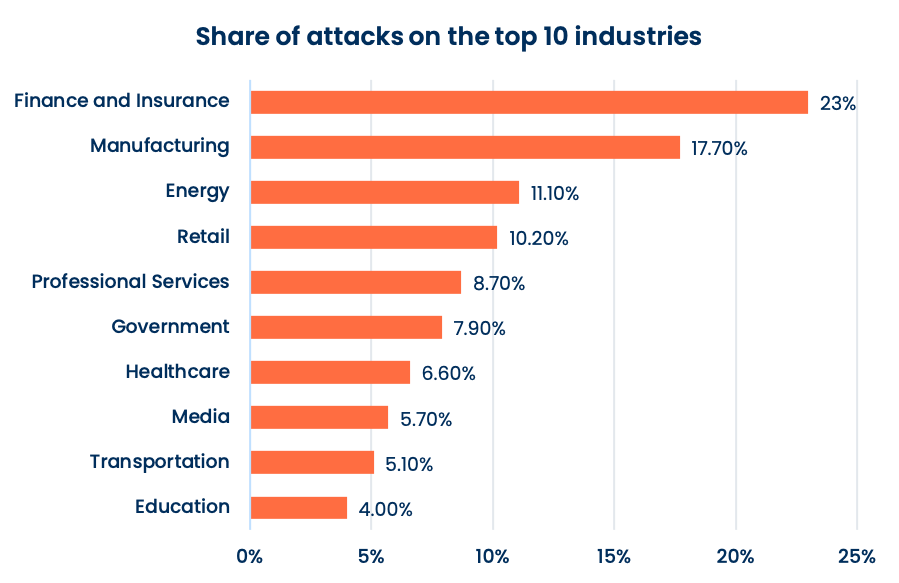

Top 10 Cyberattacked Industries in 2020

According to IBM in its X-Force Threat Intelligence Index, the top 10 industries suffering the most cyberattacks in 2020 were:

1. Finance and Insurance

Most Common Type of Attack: Server access attack

Since 2016, the finance and insurance industry has been the most attacked industry. In 2020, attacks increased over 2019 by 238%. Hackers seeking to profit financially from attacks often hit this industry. Paralyzing banks is usually less of a goal with attacks on this industry, but accessing internal systems can yield hefty illicit returns. However, during the pandemic, hackers seeking to paralyze infrastructure including nation-state cyber criminals also hit banking institutions to cause chaos.

2. Manufacturing

Most Common Type of Attack: Ransomware

The attacks against manufacturers doubled in 2020 compared to 2019. 21% of all 2020 ransomware cyberattacks hit the manufacturing industry. However, this industry also saw 4X more BEC attacks than any other industry, and a significant number of data theft attacks. Hackers renewed interest in this industry, likely trying to take advantage of supply chain disruption and operational chaos caused by the global pandemic, as consumers saw (and continue to experience) shortages in manufactured goods.

3. Energy

Most Common Type of Attack: Data theft

35% of attacks in the energy sector involved data theft, while only 6% involved ransomware. This was likely indicative of hacker motivations to hit this industry including IP theft, customer data theft and extorsion. BEC and server access attacks were also notable in this industry.

4. Retail

Most Common Type of Attack: Credential theft

Attacks on the retail industry were actually lower in 2020 than in 2019. This was likely due to fewer retail transactions taking place during the 2020 (less room to hide as a hacker). Retail is typically a target because of the high volume of credit card and financial transactions.

5. Professional Services

Most Common Type of Attack: Ransomware

Professional services saw the highest percentage of attacks from ransomware attacks of any industry. Data theft and server access attacks were also common in 2020. These organizations are typically attractive to cyber criminals because they serve as a path to further victims and often hold confidential data about customers.

6. Government

Most Common Type of Attack: Ransomware

Government received the second highest number of ransomware attacks of the industries, totaling a third of the attacks that this industry faced. Yet, only 38% of state and local government employees have been trained on ransomware prevention. This industry also faced a large burden in moving operations to accommodate work from home environments, as much of this industry had all team members working on site, and was not equipped for moving a remote workforce. Data theft attacks were also notable.

7. Healthcare

Most Common Type of Attack: Ransomware

The healthcare industry suffered twice as many cyberattacks in 2020 than in 2019, likely due to hackers taking advantage of operational chaos caused by the global pandemic, shifts in workforce to cover emergency medical care while furloughing operational and administrative staff due to revenue challenges caused by elective medical services being put on hold. Hackers, including nation-states looking to disrupt and steal data from organizations in this industry, targeted those in medical research and development attempting to invent COVID-19 vaccines, as well as frontline providers.

8. Media

Most Common Type of Attack: Malicious domain name squatting

90% of malicious domain name spoofing attempts targeted the media. This sector includes telecommunications and mobile communications providers, as well as media and social media outlets that can play a critical role in political outcomes, especially during election years. The timing of 2020 being a U.S. presidential election year likely drove this type of attack in this industry.

9. Transportation

Most Common Type of Attack: Malicious insider / misconfiguration

Attacks against the transportation industry were much lower in 2020, likely because everyone was sheltering in place and travel bans existed across the globe during 2020. This industry ranked #3 in 2019 and fell to #9 in 2020.

10. Education

Most Common Type of Attack: Spam / adware

Education has historically been vulnerable to cyberattacks due to a large decentralized surface area of users hard to control with staff and students regularly logging into systems from home to complete and grade course work. However, the user and device based security measures that this distributed surface area drove for security protection before the pandemic, better equipped education for security operations during the pandemic than other industries accustomed to relying on firewall protection.

Aunalytics Daybreak™ for Financial Services Named a Finalist in Computing’s Cloud Excellence Awards 2021

Advanced Analytics Solution Is Recognized in the ‘Most Innovative Use of Data in the Cloud’ Category

South Bend, IN (August 11, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced that its DaybreakTM for Financial Services has been named a finalist in Computing’s Cloud Excellence Awards in the category of Most Innovative Use of Data in the Cloud. The solution enables midsize banks and credit unions to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

The Computing Cloud Excellence Awards recognize some of the very best of the cloud industry, from the most innovative and compelling products and vendors, to the top use cases from end-user firms.

Aunalytics’ Daybreak for Financial Services offers the ability to target, discover and offer the right services to the right people, at the right time. The solution empowers mid-market financial institutions with advanced analytics and valuable business insights to improve customer relationships, strategically deliver new products and services through data-driven campaigns, and increase competitive advantage with the Aunalytics® side-by-side digital transformation model.

Built from the ground up for midsize banks and credit unions, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Midsize and community banks struggle with massive amounts of siloed data that is difficult to integrate and harness for greater business value,” said Rich Carlton, President, Aunalytics. “Daybreak for Financial Services mines transactional bank data every day to deliver timely insights, such as which product is a customer most likely to purchase next. This enables mid-market banks and credit unions to more efficiently target and deliver new services and solutions for their customers so they can compete with national banks. We’re thrilled to be shortlisted for Computing’s Cloud Excellence Awards 2021 and recognized for the work we’ve done to help midmarket financial institutions gain a competitive edge against their large, national counterparts.”

The Cloud Excellence 2021 winners will be announced at a live awards ceremony on Thursday, September 23 at The Montcalm London Marble Arch in London. For more information, visit: https://event.computing.co.uk/cloudexcellenceawards/en/page/home.

Tweet this: .@Aunalytics Daybreak for Financial Services Named a Finalist in Computing’s Cloud Excellence 2021 Awards #CloudExcellenceAwards #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers' businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at http://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

What is the Aunalytics ‘Propensity to Churn’ Smart Feature?

Customer churn represents lost opportunities as customers move their business to one of your competitors. At Aunalytics, we have nearly a decade of experience developing such models for clients in various industries, including financial institutions. For client subscribers to our Daybreak™ Analytical Database, the churn propensity report Smart FeatureTM offers a uniquely valuable dataset for understanding the risk factors that could indicate customers are about to take their business elsewhere.

The algorithm behind this Smart Feature was developed by studying historical customer churn data from many different client institutions to discover common patterns in the typical behaviors that precede account churn. One key approach to developing this algorithm was to redefine churn beyond simply customers who closed an account; instead, churn was defined to include customers who suddenly drew down a high-balance account and never returned that account balance to its previous level after a period of months. By looking at the data in this way, our data scientists were able to understand that the behaviors that predict churn often happen many months or years before an account is actually closed—for example, a customer stops using direct deposit or bill pay services, then withdraws most of the balance a few weeks to months later but doesn’t actually close the account for a few years.

Aunalytics to Showcase Daybreak for Financial Services at August Industry Events Attended by Illinois, Indiana, Ohio, and Tennessee Bankers

Leading Data Platform Provider Will Demonstrate Its Advanced Analytics Solution Designed to Help Community and Midsize Banks Compete Against National Financial Institutions

South Bend, IN (August 3, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will feature its advanced analytics solution for midsize and community banks at four industry events attended by bankers from Illinois, Indiana, Ohio, and Tennessee in August. Aunalytics DaybreakTM for Financial Services enables bankers to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

Aunalytics will demonstrate Daybreak for Financial Services at:

- Community Bankers Association of Ohio Annual Convention, August 10-12

- Illinois Bankers Association Annual Conference (virtual), August 11-14

- Indiana Bankers Association Convention, August 15-17

- Tennessee Credit Union League Annual Convention & Expo, August 18-20

Aunalytics’ Daybreak for Financial Services offers the ability to target, discover and offer the right services to the right people, at the right time. The solution empowers mid-market financial institutions with advanced analytics and valuable business insights to improve customer relationships, strategically deliver new products and services through data-driven campaigns, and increase competitive advantage with Aunalytics’ side-by-side digital transformation model.

Built from the ground up for midsize and community banks, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Massive amounts of siloed data are difficult to integrate and present a real challenge to midsize and community banks that want to get a better foothold against their larger counterparts,” said Rich Carlton, President, Aunalytics. “Daybreak for Financial Services mines transactional bank data every day to deliver timely insights, such as which product is a customer most likely to purchase next. This enables mid-market banks to more efficiently target and deliver new services and solutions for their customers so they can compete with national banks. We look forward to meeting with bankers from Illinois, Indiana, Ohio, and Tennessee, and demonstrating how Daybreak helps them anticipate customer needs to deliver the right products and services at the right time to gain a critical edge.”

Tweet this: .@Aunalytics to Showcase Daybreak for Financial Services at August Industry Events Attended by Illinois, Indiana, Ohio, and Tennessee Bankers #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

How to Identify Which of Your Banking Customers are at Risk for Crypto Scams

The allure of investing early in the “next big thing” has led to interest in investing in cryptocurrency. Cryptocurrency is a type of digital or virtual money that exists in electronic form (no printed dollars or coins). As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big loss.

Crypto Buyer Profile

Crypto investors tend to be younger adults. They decide to put money into a crypto currency investment with the idea that the currency will gain value over time. When compared to current low and no interest checking and savings accounts rates, where money will not grow in a conventional banking account, crypto provides the promise of potential growth.

People use cryptocurrency for quick payments, to avoid transaction fees that regular banks charge, or because it offers some anonymity. It is typically exchanged person to person online (such as over a phone or computer) without an intermediary like a bank. This means that there is often no one to turn to if there is a problem with the exchange.

Crypto Risks

While some crypto investment opportunities may be speculative long term plays, unfortunately unscrupulous scammers have been attracted to the emerging industry. Investors may find their investment to be worth nothing and the value stolen by a scammer. New crypto currency brands emerge often and many consumers do not know which are legitimate. Because crypto currency is stored in a digital wallet, it is at risk from hackers stealing it. Because there is no banking intermediary, there is no one to turn to if there is fraud.

Crypto currencies are not backed by the government. So, if you store your crypto with a third party company that disappears or is hacked and your money is stolen, there is little to no recourse and the government has no obligation to help you get your money back.

Unlike with credit card purchases, returns and refunds are often not possible for purchases made with crypto because the unregulated industry does not offer these protections as standard.

Crypto currency values change rapidly and constantly. Value is based upon supply and demand. Unlike many investments that may fall in value but typically regain value over time, crypto is less stable. A purchase of $1000 could fall to a value of $100 in minutes. Conversely, it could rise to a value of $10,000 in minutes. But then it could change again – even while you are trying to cash out on your gain while up, it could result in a loss due to the value changing again before the transaction is complete.

How can you protect your banking customers from crypto fraud?

DaybreakTM for Financial Institutions was built specifically for mid-market banks and credit unions to get business outcomes using analytics. Daybreak can mine your transactional data to determine which of your customers has money leaving or entering your bank from a crypto currency company. This will give you an actionable list of customers for outreach and education on risks. If enriched with a listing of crypto companies known to be fraudulent, targeted outreach may be done by you to save your customers from fraud. Further, after explaining the risks of crypto and educating your customers, you may be able to offer an alternative investment opportunity to keep your customers safe and their dollars in your bank.

2021 Missouri Bankers Association Annual Convention

Missouri Bankers Association Annual Convention & Trade Show

Chateau on the Lake Resort Spa & Convention Center, Branson, MO

Aunalytics is attending the 2021 MBA Annual Convention as a Gold Sponsor

Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will join the upcoming Missouri Bankers Association Annual Convention as a Gold Sponsor, July 13-16 in Branson, MO. Aunalytics will feature its Daybreak™ for Financial Services solution with advanced analytics that enable bankers to more effectively identify and deliver new services and solutions for their customers for greater competitive advantage.

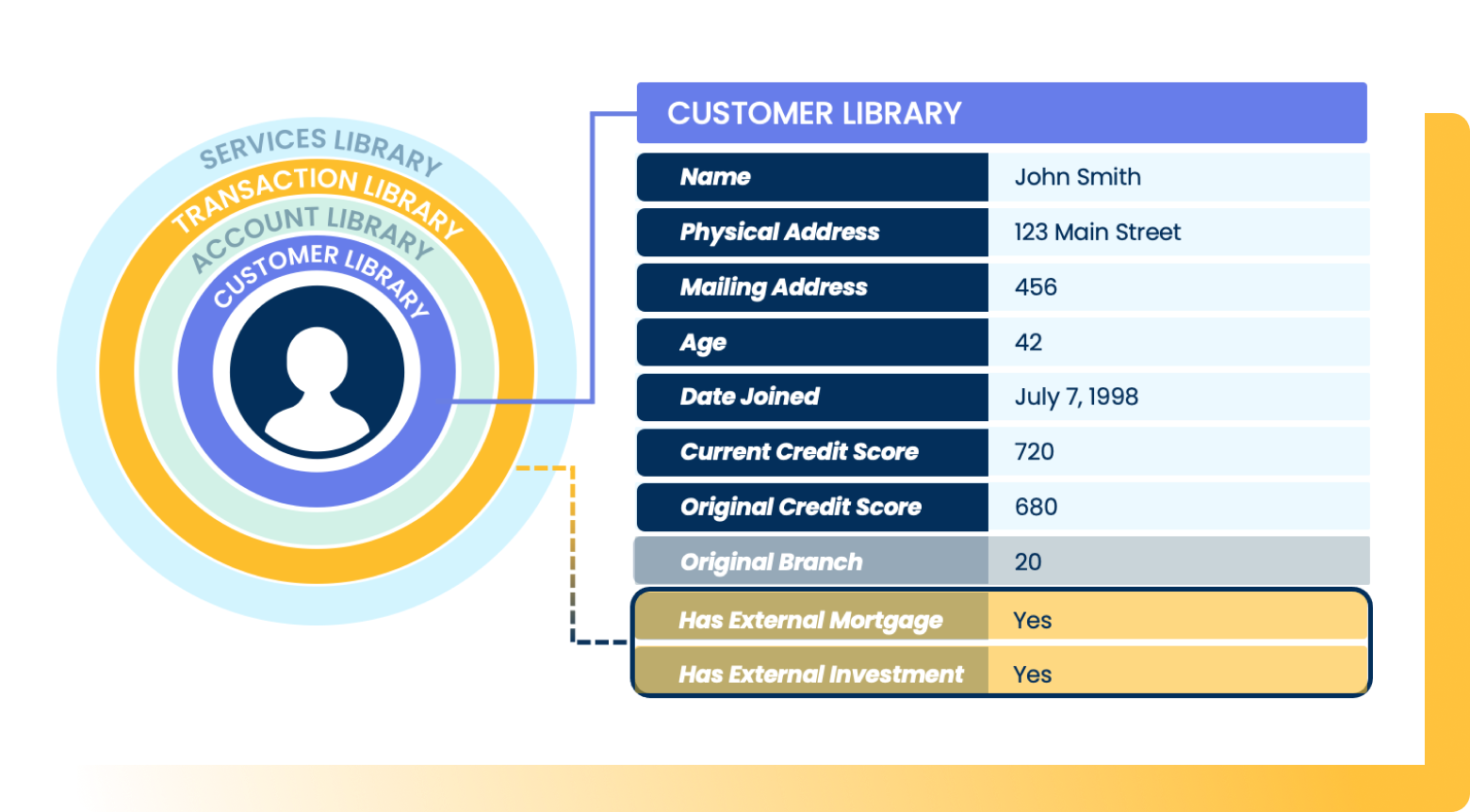

What are Smart Features?

Machine learning is a leading component of today’s business landscape, but even many forward-looking business leaders in the mid-market have difficulty developing a strategy to leverage these cutting edge techniques for their business. At Aunalytics, our mission is to improve the lives and businesses of others through technology, and we believe that what many organizations need to succeed in today’s climate is access to machine learning technology to enhance the ability to make data driven-decisions from complex data sources.

Imagine having the ability to look at a particular customer and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our products is this customer most likely to choose next?

- How likely is this customer to default or become past due on an invoice?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics’ Innovation Lab data scientists have combed through data from our clients in industries like financial services, healthcare, retail, and manufacturing and have developed proprietary machine learning techniques based on a solid understanding of the data commonly collected by businesses in these sectors.

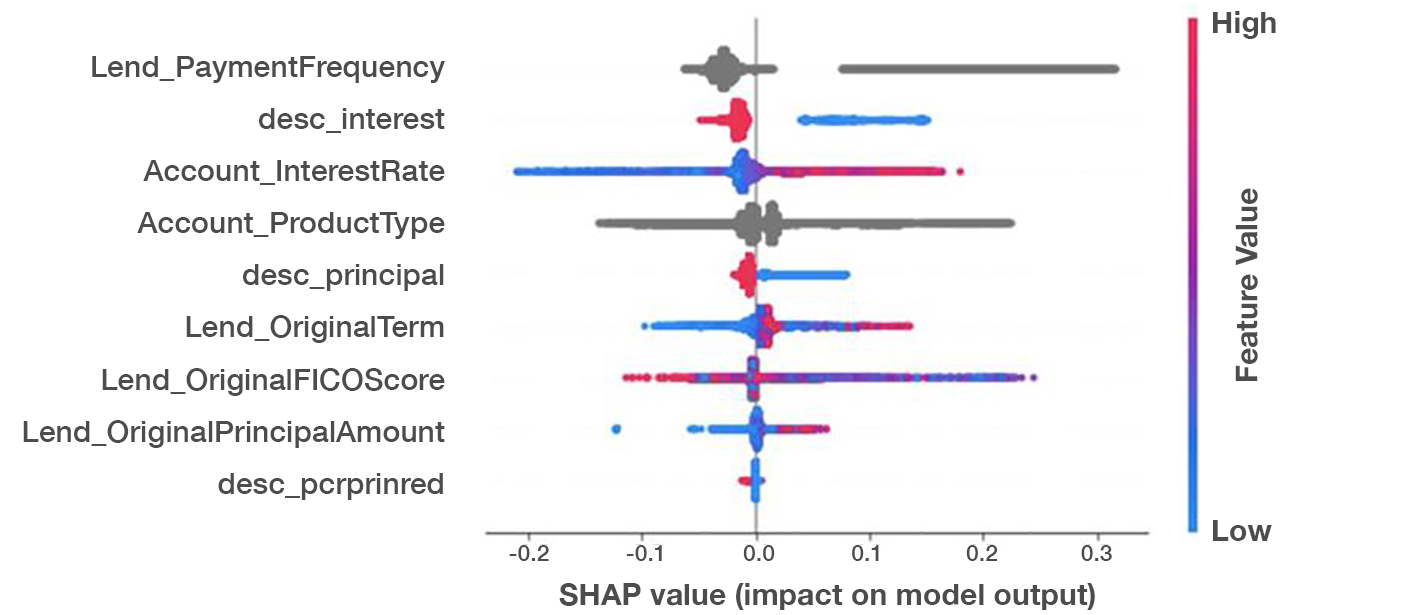

A SHAP (Shapley Additive Explanations) value chart for a remarkably accurate loan default risk model we developed shows which features have the highest impact on risk prediction.

From this, we append insights gleaned from machine learning to data models. We add high value fields to customer records to reveal insights about a customer learned from our algorithms. Smart Features provide answers to pressing business questions to recommend next steps to take with a particular customer to deepen relationships, provide targeted land and expand sales strategies, provide targeted marketing campaigns for better customer experiences, and yield business outcomes.

Machine learning techniques enable more accurate models of risk, propensity, and customer churn because they represent a more complex model of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Smart Features are one way that Aunalytics provides value to our clients by lending our extensive data science expertise to client-specific questions. Through these machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with businesses in your industry.