Aunalytics Executive to Present Session on Mobile Offices & Working Remotely at the Michigan Municipal Treasurers Association’s 2022 Basic Institute Conference

Vice President of Sales - Cloud, Steve Burdick, Will Discuss Strategies to Improve Consistent Data Access While Protecting the Security Perimeter, How to Mitigate Risks and Create Better Remote Work Scenarios

South Bend, IN (April 20, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that Steve Burdick, Vice President of Sales - Cloud for Aunalytics, will present a session titled Mobile Offices & Working Remotely at the Michigan Municipal Treasurers Association’s 2022 Basic Institute conference on April 28. The conference will be held at the Comfort Inn & Suites in Mt. Pleasant, Michigan.

With remote work more prevalent than ever, most businesses now hold some form of sensitive data in the cloud and workers access company data from remote locations. Zero trust security principles based on a user’s credentials instead of a user’s location within a firewalled company facility, are the new norm.

Cybersecurity attacks have increased to higher than ever levels. It has been reported that ransomware attacks, which are reaching new levels of sophistication, increased more than 90 percent in 2021 with demands for payment skyrocketing into tens of millions of dollars.

Burdick's Mobile Offices & Working Remotely session will address how today’s modern work settings demand more mobility than ever, but the consequences of working remotely create cyber security challenges for all organizations. With distributed workforces becoming a critical part of the new reality, the security perimeter can span hundreds, and even thousands, of networks that are potentially exposed to risk at every point.

Session attendees will learn strategies to improve consistent access to data while protecting the security perimeter, how to mitigate risks, and create better remote work scenarios.

Tweet this: .@Aunalytics Aunalytics Executive to Present Session on Mobile Offices & Working Remotely at the Michigan Municipal Treasurers Association’s 2022 Basic Institute Conference #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

2022 NJBankers Spring Golf Outing

NJBankers Spring Golf Outing

Glen Ridge Country Club, Glen Ridge, NJ

Aunalytics to attend NJBankers Spring Golf Outing

Aunalytics is excited to sponsor a foursome at the 2022 NJBankers Spring Golf Outing at Glen Ridge Country Club. Aunalytics’ Daybreak™ solution enables banks to use transactional data to more effectively identify and deliver new services and solutions for their customers.

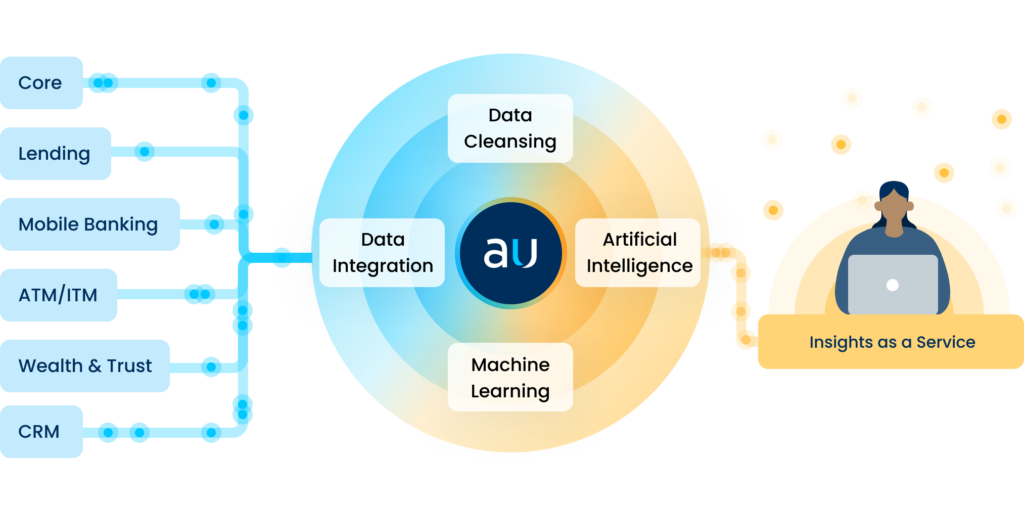

Analytics Database Platform Powers Customer Insights and Positive Outcomes for Community Bank

Data experts at Aunalytics took a three-pronged approach to solve Horizon Bank’s business challenges using the Daybreak for Financial Services analytics database platform. The first move was to get the data right by converging disparate repositories, and organizing the information for ingestion in the proper application area. Horizon Bank leverages Daybreak’s robust, cloud-native platform to convert data into answers in support of a wide range of business intelligence applications. Daybreak allows Horizon’s executives to view system-wide data from all business units, cleansing and verifying records to provide enriched data for accurate, data-driven decision making. The aggregated data delivers a 360-degree view of customer information including behavioral data, from which the platform’s proprietary AI technology and deep learning models developed by Aunalytics data scientists glean actionable customer intelligence insights.

Deploying the Daybreak analytics platform has taken Horizon Bank and its 74 locations to the next level of services and support for customers, making it the preferred financial partner with compelling advantages over larger, competitive establishments. Learn more about the challenges Horizon faced to implement a data analytics platform, and how Daybreak helped them overcome those challenges by downloading the full case study.

MMTA 2022 Basic Institute

2022 Basic Institute

Michigan Municipal Treasurers Association

Mt. Pleasant, MI

Steve Burdick presenting "Mobile Offices & Working Remotely" at the MMTA 2022 Basic Institute

Steve Burdick, Vice President of Sales – Cloud, will be presenting “Mobile Offices & Working Remotely” at the 2022 Basic Institute event presented by the Michigan Municipal Treasurers Association. Steve will be giving tips on how organizations can keep their mobile workforce both comfortable and secure.

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The allure of investing early in the “next big thing” has led to increased interest in crypto investment. As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big loss. As a bank or credit union, here’s what you need to know to protect your institution.

Fill out the form below to receive the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions - PDF

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The allure of investing early in the “next big thing” has led to increased interest in crypto investment. As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big lose. As a bank or credit union, here’s what you need to know to protect your institution.

Related Content

Nothing found.

Aunalytics Innovation Lab Accelerates Midsize Financial Institution Business Outcomes with AI Intelligence Services

Powerful Analytics/Intelligence Services and Experienced Data Science Team Provides Affordable Alternative to HyperCloud-based Solutions

South Bend, IN (April 12, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, today highlighted AI-powered Business Intelligence use cases built by the organization’s Innovation Lab. Established to provide deep insights to midsize financial services organizations lacking large AI budgets, the Aunalytics® Innovation Lab’s team of data scientists create and deploy Smart FeaturesTM (data-driven analytic insights) for companies seeking specific predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

Moving from reactive to proactive, predictive and prescriptive IT solutions are one of the key benefits of integrating a properly architected intelligence service enabled by machine learning, deep learning and artificial intelligence. For example, when a properly orchestrated AI/ML solution is in place, a bank can identify a customer purchase from the Home Depot (for example) and deliver predictive insights suggesting the customer may need a HELOC loan (Home Equity Line of Credit). Bank marketing is then able to take advantage of that information through predictive or proactive sales or marketing outreach. Because of the bottom-line impact this technology can have on midsize financial institutions competing against the Fortune 500, there is rapidly increasing demand for the technology nationwide.

The development of AI powered Smart Features for Aunalytics financial services customers is a top Innovation Lab priority. Smart Features are customized to leverage insights obtained from data-driven machine learning models. The Aunalytics service model includes a private analytics cloud as part of the end to end solution, so that customers can manage compute and storage costs associated with data analytics. Part of the customization is data mining transactional banking data and enriching it with the inclusion of algorithm-powered high value fields appended to customer records that reveal insights about a customer. Smart Features provide answers to pressing business questions in order to recommend next steps to take with a particular customer to deepen or extend the relationship, provide targeted sales strategies and marketing campaigns for better customer experiences that yield more profitable business outcomes.

By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments. Other Smart Features are aimed at providing actionable insights for operational efficiency, risk of loan default at time of application, customers at risk for crypto fraud, where to open or close bank branches, ways to minimize customer impact from new federal regulations regarding overdraft protection, and much more.

“Demand for intelligence services by financial services organizations is starting off strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “New functionality will support evolving compliance and security requirements and find opportunities in a financial institution’s own data. Instead of using national averages, we provide insights based on what is actually happening in a financial institution and enrich the data for predictive analytics. Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

Tweet this: .@Aunalytics AI Innovation Lab Supporting Small to Midsize Financial Service Providers with Advanced AI Intelligence Services

#Manufacturing #Recreationalvehicles #RV #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform members’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com